../../../..//2008/10/15/the-dow-fell-500-points/

The Dow fell 500 points after Fed Chairman Ben Bernanke gave a speech about the state of the economy. If you’re interested, the text of the speech can be found here. [CNBC]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/10/15/the-dow-fell-500-points/

The Dow fell 500 points after Fed Chairman Ben Bernanke gave a speech about the state of the economy. If you’re interested, the text of the speech can be found here. [CNBC]

The Times of London says that a mere three days before Lehman Brothers went bankrupt, the firm approved $100 million in payouts to departing executives.

The Back-To-School season is usually the best season for retailers aside from the holidays, but not this year. Retail spending was down for the third consecutive month as shoppers stayed away from stores and ignored bargains.

../../../..//2008/10/14/hdtv-sales-could-be-down/

HDTV sales could be down this holiday season, report analysts. You don’t say? [Engadget]

In Elkhart Indiana, a new law limits residents to holding only one garage sale per month. The garage sales had grown ever-present as people struggle to make ends meet during tough times, and, apparently, bothered some people. [NYT] (Photo: Todd Kravos)

Antarctic explorers trudge across the icy wastelands, heavily laden with rucksacks, bound together with rope. This is a good metaphor for understanding the credit crisis, and Paddy Hirsch from American Public Media is going to lay it down on you. Oh no! There’s a crevasses. Yay! Here comes Henry Paulson to come save the banks in his helicopter. The money meltdown is definitely much more digestible, and fun, in stick-figure and whiteboard form. Full video inside.

The Treasury Department is expected to announce that it will be pumping $250 billion into banks both large and small tomorrow… and the FDIC is expected to offer an unlimited guarantee on bank deposits in accounts that do not bear interest.

../../../..//2008/10/14/dow-ended-the-day-by/

Dow ended the day by shooting up 936.42 points, 11%, ending at 9387.61, it’s largest one-day point gain in history. [Newsday]

The debate on the BBC news right now is who is cooler, America or Europe. Europe is getting props for acting speedily and decisively in contrast to Paulson’s pace, which is getting characterized as dawdling and indecisive. Some of the very policies Treasury derided, they’re now considering since Europe enacted them. The ex-Reagan economic adviser talking head says it’s nationalizing risk, a backdoor way of calling them socialists. However, it wasn’t until Europe’s “socialistic” actions did the markets rebound. Who is right? Only time will tell; we’ll see if the rally sustains or is just another fitful shiver in this economic fever dream. The key here is confidence, and it seems to be the most precious and rare commodity on the face of the earth right now.

../../../..//2008/10/13/stock-markets-finally-rose-with/

Stock markets finally rose with investors heartened by coordinated global intervention into the financial crisis and amid signs that the credit freeze was beginning to thaw a bit. [WSJ]

Great news for renters facing eviction due to foreclosure: any mortgage owner seeking assistance under Congress’ mammoth bailout bill is required to let paying renters stay in their homes.

The global economy is crashing, credit markets are playing ice age, and you consumers have a simple choice: buy things now or prepare to be stabbed next year.

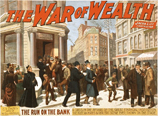

In order to stem the tide of panic-stricken morons taking out all their cash from banks and further destabilizing the financial system, the US is considering a proposal to completely back ALL deposits. This would mean that there would be no deposit insurance ceiling. So even if you had more than $100,000 in the bank, even if you had $1,000,000 in the bank, the government would give you back ALL of that money if your bank failed. The proposal is only in discussions right now, and several different agencies would have to agree that there was “systemic risk” in order to enact it. Europe has already guaranteed all deposits, however, and in order to keep large corporate accounts from emigrating overseas, the US may be forced to follow suit within a few weeks.

Wells Fargo is the winner in the battle for Wachovia, says the New York Times. Apparently, Citibank became nervous about splitting the bank when they saw the size of the “bad assets” it would have to take on, and quietly walked away. The bank will continue to seek $60 billion in damages, however.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..

The balls of the famous Wall Street bull got painted blue today. Before they were cleaned, a Gothamist reader snapped this pic. In terms of the creative comic output it’s sparked, this may be the funniest economic meltdown ever. [More]

Cook County Sheriff Tom Dart said he understood he was flouting the law in refusing to have deputies carry out the rising number of eviction requests, but mortgage holders must be accountable.

With the Dow currently below 8600, stocks are continuing their downward spiral this week, the but the WSJ tells us 3 ways why it’s totally different from 1929:

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.