Leverage leverage leverage. Everyone’s talking about it, but what does it mean?

money meltdown

Investors Willing To Pay The Treasury To Borrow Their Money

Here’s a sad bit of news, investors are so shaken that they’re willing to put their money into Treasury bills — even if it means losing money.

I Love The Recession Because Things That Suck Are Dying

The good thing about the recession is that everything that is most bloated and cheesy and garish is imploding. Witness:

- Harrah’s, the McDonald’s of casino chains, is in big trouble. So is Claire’s. They’re owned by the same private equity firm.

- Sharper Image, Circuit City, and Linen’s n’ Things. Suck suck and suck, dead dead and dead.

- Those glass condo towers disrupting your nice bo-ho “sweet spot of gentrification” neighborhoods? Building has stopped because they can’t get any construction loans.

- Gas-gorging SUVs will soon be worth more being turned into the toasters they look like.

What excesses are you glad to see on deathwatch?

../../../..//2008/12/08/the-tribune-company-which-owns/

The Tribune Company, which owns the Chicago Tribune, the LA Times, Wrigley Field and the Chicago Cubs, has filed for bankruptcy. [New York Times]

Illinois Stops Doing Business With BoA Until It Restores Window And Door Company's Credit

The state of Illinois has suspended doing all business with Bank of America until they restore the line of credit to Chicago-based Republic Windows & Doors necessary for paying their workers.

This Year's Best Stocking Stuffer: Stocks

If you have some extra cash right now, there’s a big sale going on right now you should know about. It’s called the stock market.

On Heels of Bailout, Citi Raises Rates on Millions of Cardholders

We know the credit markets remain seized: late on Black Friday when no one was listening, the Federal Reserve issued a statement that its emergency lending to banks had increased over the prior week. Thus, massive amounts of money continue to flow to large financial institutions in an effort to stimulate economic activity, but by all appearances the money is not flowing into the broader economy. Quite the contrary; as the Fed lowers rates and adds record amounts of loaned cash to bank balance sheets, big banks are actually increasing consumers’ cost of borrowing and reducing their lines of credit. Witness Citibank’s recent adverse actions against cardholders.

What Would $40 A Barrel Oil Mean For Travelers?

Oil is now nearing a 4-year low as the world’s economic crisis keeps on truckin’, says the Wall Street Journal. Light, sweet crude (don’t you just love that term?) is now trading at 44.56 a barrel on the New York Mercantile Exchange. “The price was the lowest since January 2005 and more than $100 below oil’s record close July 3,” says the WSJ. So, what does that mean for travelers?

Not Even Money Saves You From Foreclosure

Eric lost his home to foreclosure, but unlike other homeowners, he had actually been trying for the past month-and-a-half to buy it back from the mortgage company for more than the mortgage. The law firm that was handling it, however, wanted an extra $20k in fees to make that happen. He told the realtor that he would buy it for more than it was going to be listed for. The realtor told him that he couldn’t make a bid until it was “active,” which would happen on 11-29. On Sunday he tells the broker he;ll give an offer on Monday. Monday rolls around and they’ve already sold the house to someone else, for less than Eric was willing to pay. They said they “forgot” that he was going to make a bid. Eric is livid. His story, inside…

Labor Department Screwing Unemployed By Not Answering Phones

The waiting area of the New York Department of Labor Office is getting increasingly crowded. It’s not just the economy, more people are showing up because they can’t get anyone on the phone.

Tweeter Turns Over To Liquidators Early, Customers' Pre-Paid Items In Question

Tweeter, a MA mid to high-end electronics retailer, and not a misspelling of a popular microblogging service, decided yesterday to close its doors 6 days ahead of schedule, and send home everyone without paying them. Furthermore, customers who have already paid for the merchandise, expecting to be able to come by and pick it up, will have to deal with the liquidators. [BoingBoing Gadgets] (Thanks to Hawkins!) (Photo: dalvenjah)

Consumers Don't Think Saving The Auto Industry Would Help The Economy

A majority, 61% of Americans are not in favor of bailing out the auto industry, says CNN/Opinion Research Corp. poll. Ford, Chrysler and GM have requested up to $34 billion dollars in emergency loans, but a majority of Americans polled thought that bailing out the automakers wouldn’t help the economy.

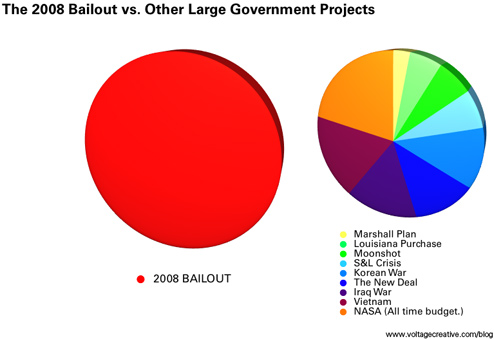

2008 Bailout Costs As Much As Several Large And Famous Government Projects Combined

This graphic demonstrates how the 2008 bailout, so far, costs as much as several large and famous government projects added up together. Yes, these numbers are inflation adjusted.

../../../..//2008/12/03/harvard-universitys-endowment-the-largest/

Harvard University’s endowment, the largest of any university, has lost 22% of its value in the past year — or approximately $8 billion. Ouch. [MarketWatch]

Auto CEOs Promise To Ditch The Private Jets And Drive To Washington

The big three auto CEOs Bob “Big Bob” Nardelli, Alan “Leavin’ On A Jet Plane” Mulally, and our personal favorite Rick “The Station” Wagoner are apparently going to drive to Washington to beg for your money. Previously, they all flew on private jets.

AIG Swaps "Retention Bonuses" For Annual Bonuses

In order to get a giant honking bailout from Congress, AIG pledged it would give up executives annual bonuses, but guess what? They found a way to give them anyway.