Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

minimum payments

"Chase Hiked My Minimum Payment To 5 Percent!"

Chase just notified Greg that they’re more than doubling his minimum payment requirement. Because he and his wife are carrying such a large balance due to a promotional balance transfer offer a few years ago, this pushes their monthly payment to nearly $1,000.

Chase Invites Customers To Skip A Payment, Accrue Finance Charges Instead

Chase is being awfully nice to their customers in tough economic times. Many of their customers received statements this month with a minimum payment of $0, even though they have balances. How nice! Customers take a month off, Chase will just let finance charges accrue for them.

Chase Replaces Automatic Payments With Monthly Minimum On All WaMu Credit Cards

Is your Washington Mutual credit card set to receive automatic payments? If it is, and you pay anything less than the full balance, then come March 6, you’ll be paying only the monthly minimum. Why? Because it’s an easy way for Chase, WaMu’s new corporate overlord, to make money off unsuspecting cardholders…

Chase Invents $120 Annual Fee For Balance Transfer Customers

Some customers who transferred their balances to Chase were hit with a new fee this month: a $10 monthly surcharge just for having the account in the first place. This $120 annual fee is pure profit for Chase and doesn’t get applied to the balance. Oh, and they’re doubling the minimum payment as well, although the sooner you pay off your Chase credit card and close it, the happier you’ll be.

Beware: Credit Card Minimum Payments Are Messing With Your Mind

Credit Card minimum payments are supposed to help keep the accumulation of interest on credit card debt from getting out of control — but a new study reported in the Economist suggests that minimum payments do more harm than good.

Capital One Will Ruin This Guy's Credit One Way Or Another

Joseph is having problems paying his Capital One card, mainly because Capital One keeps making it hard for him to pay it, and then reports his payments past due after they’ve cleared the bank. Now he wants to know what he can do to remedy the situation.

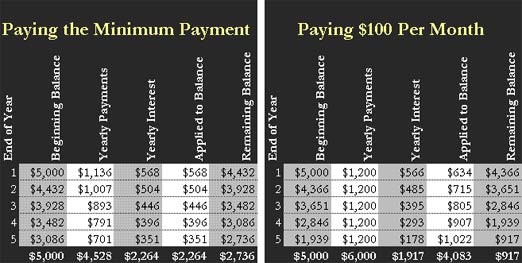

Pay More Than The Minimum Credit Card Payment, Or You’re A Sucker

The minimum payment on your credit card bill may save you from overheating your brain by actually thinking about what you’re doing, but it’s no way to reduce your debt. AllFinancialMatters lays out the math.

Credit Cards Are Vampires

Blind Item: Which credit card company was seen feasting upon the necks of foolish debtors while holding a Jesus mask in front of its face?