We’ve received two letters claiming that Hollywood video is signing their customers up for magazine subscriptions without their consent. The scam sounds similar to the ones that Best Buy is accused of in their on-going racketeering lawsuit.

marketing

Sara Lee "Soft & Smooth Made with Whole Grain White Bread" Has More Water Than Whole Grain

The CPSI has announced its intention to sue Sara Lee over its “Soft & Smooth Made with Whole Grain White Bread,” which claims to combine “all the taste and texture of white bread with the goodness of whole grain,” when actually “there is more water in this product than whole grain,” according to the CSPI.

Some Of The Year's Worst Ad Concepts

Suicide—even if it’s performed by a robot, and then only in a robot’s nightmare—just doesn’t move products. People don’t respond to suicide. Or football players acting all grossed out by seeing two straight dudes accidentally touch lips. Or a digitally reanimated zombie Redenbacher with skin so lifeless you’d swear he just climbed out of a casket at the funeral home. These were among the big losers picked by Stuart Elliot at the New York Times this year as he reviewed the advertising world’s more unconventional spots of 2007.

7 Of The Most Controversial Ads In Fashion History

It’s Friday—let’s look at pictures. Debonair Magazine has a rundown of some of the most controversial fashion ads in history. Well, “in history” is a bit overstated, since the oldest is a Jordache spread from 1979, and by today’s standards it looks like something from a brochure for Build-A-Bear. However, a few of the more recent ads are borderline NSFW, especially the pornoriffic Tom Ford For Men. Then again, they all appeared in a fashion mag at one point or another, so if your boss is not so good at debating, you can argue that point and maybe get away with it.

../../../..//2007/12/13/a-private-student-loan-company/

A private student loan company agreed to change its ways after being sued by the NY AG for deceptive marketing practices. The company licensed school colors, logos, team names, and and designed its materials to look like the University itself was making the loans. [NYT]

Tips For Avoiding Medicare Sales Scams

The WSJ Health Blog alerts us to the existence of predatory sales scams involving private fee for service (PFFS) Medicare plans.

Consumer Agency IT Pro Admits To Stealing 8.4 Million Records

A senior database administrator for Fidelity National Information Services, a widely used banking technology and data providor, has admitted that he stole 8.4 million customer records from the company and sold the data to a broker, who in turn sold them to marketers. He could face up to 10 years in prison but will probably get less because he confessed. We think he should have to open, read, and shred every piece of junk mail that his victims receive for the next, oh, say 10 years instead.

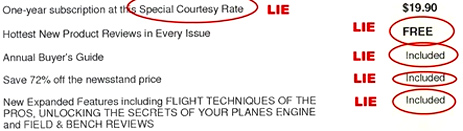

Wired Editor Reveals Magazine Subscription Card Lies

Wired Editor-in-Chief Chris Anderson annotated a typical magazine subscription card to showcase its numerous lies. He asks, “Why do magazine circulation departments treat people like idiots?” Then he answers his own question: “because it works.”

../../../..//2007/11/30/following-the-increasingly-integrated-and/

Following the increasingly integrated and undisclosed use of product placement in TV shows, like a Seventh Heaven episode where a wedding ring was embedded in an Oreo cookie, the busy beavers at the FCC are planning to scrutinize the practice. [Broadcasting and Cable]

Bank Of America Uses Outdated Photo Of Chicago In Ad Touting "Local Commitment"

Now that the LaSalle Bank merger is complete, Bank of America is looking to win over the notoriously neophobic population of America’s 3rd largest city. To that end they’ve taken out a full page ad in Crain’s touting Bank of America’s “local commitment” and ability to provide “global capabilities” to businesses that want “every competitive advantage.”

Capital One Introduces DIY Credit Card Offer

If one of the goals of credit card marketing is to give customers the illusion of choice and control, then Capital One has just outdone itself with its new Card Lab, where you can construct the card offer you desire from a menu of options. Your available options are determined by which general credit score category you pick: Excellent, Above Average, Needs Improvement, or Limited History. When you select certain options, others go away. At the end, you’ve self-selected the “perfect” offer, and possibly saved yourself from the hundreds of thousands of junk mailings* Capital One would otherwise send to you on a daily basis.

Successful Ad Slogans Dissected

Nick Padmore at A List Apart has produced an extraordinarily nerdy and detailed breakdown of the various qualities of 115 of the most successful “copy shots” in advertising history—you know, those short phrases like “Where’s the beef?” (1984) or “Don’t leave home without it” (1974) or “it takes a licking and keeps on ticking” (1956) that you’ll carry with you to your grave, unless you develop some sort of “good” Alzheimer’s that only wipes out the commercial jingles part of your brain. (Somebody assign a stem cell researcher to that!)

Phishing Scams Hurt The Brands They Target

Ars Technica reports that “42 percent of adults in the UK feel that their trust in a brand would be greatly reduced by receiving a phishing e-mail claiming to be from that brand, according to an online survey conducted by research firm YouGov.”

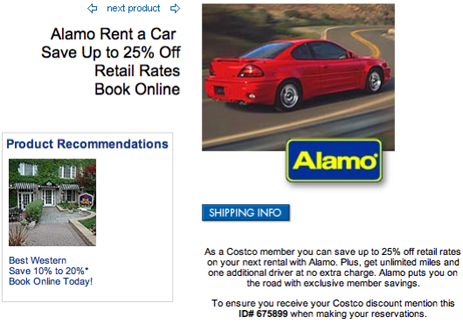

Alamo, Rudely, Doesn't Honor Costco Discount

Due to the Costco membership second driver discount, I suggested that my parents use Alamo on their trip to visit me. When my mother told the rep on the phone and again at airport pickup that she was a Costco member for the free additional driver, they told her there was no such thing and they had never heard of it. I have used this discount, and it was the only reason I recommended Alamo. Rather than contacting someone else who might know of the partnership discount or listening to their customer, they were rude to my mother and she left with no second driver rather than pay the additional $9/day they were asking for.

Always Patronize Loansharks Responsibly

I’m listening to the radio and I hear an ad for “Check-n’-Go” check cashing services. At the very end of the ad, the announcer quickly mutters, “Remember to always use cash advances responsibly.” This is what we’ve come to, they’re borrowing language from liquor ads. Guess that’s the boilerplate you throw up when advertising an item that’s potentially addictive and hard to escape. What’s next? Remember, always gamble responsibly. Remember, always snort responsibly. Remember, always Katamari Damacy responsibly.