Credit Slips digests a recent article in the Journal of Economic Perspectives on Payday Loans. The article’s answer to why banks don’t offer low-cost, short-term, unsecured loans is that banks find fees, like from bounced checks, more profitable. Bob Lawless disagrees, offering this alternative explanation:

loans

Senate Hearing Attacks Credit Cards' Ridiculous Fees

A Senate hearing today called up executives in the credit card industry to defend their anti-consumer practices, their explanations provoking laughter from the crowd.

New York Takes Deeper Look Into Student Lending

Concerned that guidance offered to students is tainted by conflicts of interests, Cuomo’s office asks schools to disclose if there are financial relationships with lenders and if any favors were offered to individual financial aid officers.

Is Anyone In America NOT Pre-Approved?

Elizabeth Warren over at the intellectually rigorous Credit Slips blog points out the correlation between tightened bankruptcy laws and credit card offers increasingly inundating the American consumer.

How Much Is That Payday Loan In The Window?

If people knew the true cost of a payday loan, perhaps the industry wouldn’t be growing like cancer. AllFinancialMatters breaks down the math.

What To Look For In A Credit Counseling Service

Credit counseling is not for everyone, but may be for you if you are struggling with debt. Credit counselors work by negotiating a reduced payment plan with creditors. In exchange for receiving timely payments, creditors may return a small portion of the amount received to the counseling service. Only consider a counselor if you can reign in your spending and pay off your debt in less than five years.

Avoiding Payday Loans

CreditPro is a new blog written by a non-profit credit counselor, and he has some harsh words about Payday loans and why they are never a good idea:Another common problem that I encounter on a daily basis has to do with payday loans.

Payday Lenders Target Poor New Mexicans

NPR’s got a nice little story on payday loans in New Mexico.

Should You Pay Off Your Credit Cards With Home Equity?

Ah, one of the questions for the ages. Shall you or shall you not pay off your credit cards with home equity? Let’s say you ran up a credit card on a bunch of crap you didn’t need and are now being charged 15%. You’ve seen the error of your ways, and now are interested in paying off your debt. How should you go about it? Should you use Home Equity? Blueprint For Financial Prosperity suggests that, while you may be saving big money by cutting your interest rate, you should think the decision over carefully.

Senate Credit Card Hearing: "Take a Long, Hard Look at How You Treat Your Customers."

CNN has the highlights of the Senate Credit Card Hearing and Senator Dodd issued the smackdown WWF (WWE?) style: “If you currently engage in any business practice that you would be ashamed to discuss before this Committee, I would strongly encourage you to cease and desist that practice.

Protect Yourself From Magically Rocketing Lending Fees At Closing

Thanks to various loopholes, people shopping for a mortgage can find themselves hit at closing time with lending fees changed dramatically from the initial quote.

The Myth Of The Rational Borrower

The academics behind the Credit Slips blog chew economic macrodata t to consider whether…

10 Ways To Avoid Credit Card Pitfalls

•Be aware that the card issuer has a great deal of leeway. They reserve the right to change the terms of your card, including the APR (annual percentage rate), at any time, for any reason–with as little as 15 days notice. So check your monthly statement carefully.

Almost As Many PayDay Loan Centers As There Are McDonalds

There’s almost as many PayDay Loan Centers in America as there are McDonald’s.

Tax Tip: Do Not Put A Refund Anticipation Loan On A Prepaid Credit Card

As we’ve mentioned before, refund anticipation loans are a bad idea. They’re made doubly bad when they are deposited to a prepaid credit card, but that’s just what HR Block suggests that you do. Why is this a bad idea?

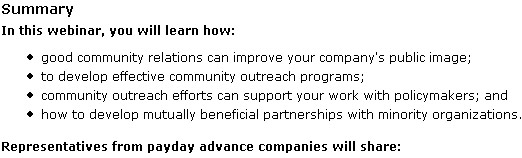

Do PayDay Loan Centers Target Minorities?

Do payday loan centers target minorities? If there’s any doubt in your mind, consider an instructional course offered by the Community Financial Services Association of America (CFSA,) a payday loan trade group. The couse is titled, “Building Community Support: Strategies for Business Survival.”

What to Do With A Vehicle At The End of A Lease

A reader wrote into Bankrate and asked what he should do with his truck now that the lease was up. Should he buy it for the residual price, or simply lease a new truck?