Piggybacking is back in, baby. FICO was all set to terminate the credit-score boosting technique of adding another authorized user to an account held by someone with good credit, but they demurred. Piggbyack away, little money pigs. Here’s how it went down…

loans

Will The New Homeowner Rescue Bill Help Rescue You?

A new bill that will help 1-2 million homeowners escape their unaffordable mortgages by refinancing into new low-cost fixed-rate loans insured by the Federal Housing Administration (FHA) has passed the House and will now move on to the Senate. If it is eventually passed by the Senate and signed by the President (who is no longer threatening to veto it), will it help you?

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

Cattleprod Loan Servicers To Answer Your Loan Modification Requests

If you’re trying to get your mortgage modified or just a question answered but find yourself stymied by your loan servicer’s slow or lack or response, you can write what is termed a qualified written request (QWR) under section 6 of Respa, The Real Estate Settlement Procedures Act. Under federal law, they have to acknowledge the letter within 20 working days and respond in 60. Inside, a template to follow for drafting a QWR…

Succeed Through Self-Undermining!

Our post on freezing your credit cards in a block of ice got me thinking. Anything that slows, stops, or impedes making transactions can be used as a technique for limiting your spending. Whatever it may be, cutting up your credit cards, locking up most of your money in an account it takes 3 days to transfer from, giving yourself an allowance, it will be a variation on a single principle: It’s easier to put a hard limit on the future then to make the right decision in the impulsive moment. Installing some kind of an automatic hiccup can help break you out of your desire-driven action and give you the breathing room to step back and make the right choice. So if you have trouble with overspending (or overeating or any kind of bad habit) and your sheer willpower is sometimes lacking, aka, you’re human, try brainstorming ways you can trip yourself up. The world is full of obstacles, it shouldn’t be too hard to find one.

Countrywide CEO: "Countrywide Has Made A Positive Impact On The Country"

Countywide CEO Angelo Mozilo thinks his company being treated unfairly by the media according to a article in BusinessWeek. At the Countrywide annual shareholders meeting, Mr. Mozilo said:

M&T Bank Makes An Offer You Can Definitely Refuse

Here’s a novel way for a bank to increase revenue: offer your customers a “perk” where they can skip a payment on their loan for a neat $25 fee! Of course, interest still accrues, your total repayment amount increases slightly, and one month is added to your repayment period. No thanks. You can see the actual letter and details below.

../../../..//2008/06/25/in-an-effort-to-spur/

In an effort to spur sales, General Motors is offering no-interest, six-year loans on new vehicle purchases through June 30th. Unfortunately, only the slow-selling models (i.e., not very fuel efficient) are included in the sale. Oh, also they’re raising prices on 2009 models. [New York Times]

Shaq Wants To Save Orlando From The Mortgage Meltdown

Shaq has a plan to save Orlando from the mortgage meltdown. Sort of. The Orlando Sentinel says that word leaked out that Shaq was working on a plan to buy the troubled mortgages of Orlando homeowners and refinance them so that families could stay in their homes — and hopefully turn a small profit by doing so. The trouble is, the demand is overwhelming and Shaq doesn’t have anything set up yet. That’s not stopping him, though.

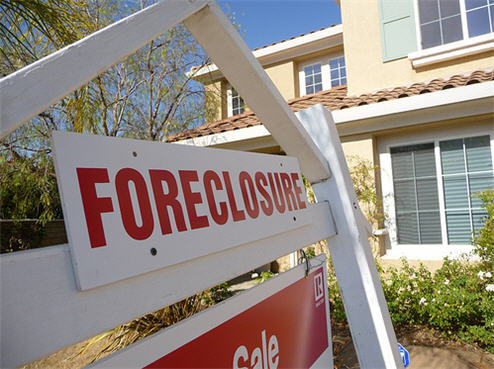

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

8 Rules For Smart Borrowing

Even people who are financially well off can be at risk of slipping into debt, especially in a staggering economy. There are plenty of doctors, lawyers and stock brokers who are currently on debt-management plans, according to David Jones, president of the Association of Independent Consumer Credit Counseling Agencies. Some of the warning signs of excess debt include: relying on home-equity credit lines or credit cards for everyday purchases, making only minimum payments on extended lines of credit and taking cash advances from one source of credit to pay another. To help save you from a downward-spiral into debt, Consumer Reports has put together a handy list of rules for smart borrowing. Here’s one of our favorites…

If Wells Fargo Calls To Offer You An Equity Loan On Your Car… Say No.

Over on the Credit Slips blog, Elizabeth Warren posted an email from a bankruptcy lawyer who was stunned at the horrible deal one of her clients got from Wells Fargo on an equity loan on a car.

Ohio Punches Payday Lending Industry In The Face, Breaks Its Nose, And Laughs

Gov. Ted Strickland, of the great state of Ohio, has signed a bill that punches the rapidly growing payday lending industry in the face. As we’ve mentioned before, the bill will cap interest rates at 28% and limits consumers to 4 payday loans per year. A typical payday loan charges around $15 per $100 borrowed on a 2 week loan, which works out to an interest rate of 391%.

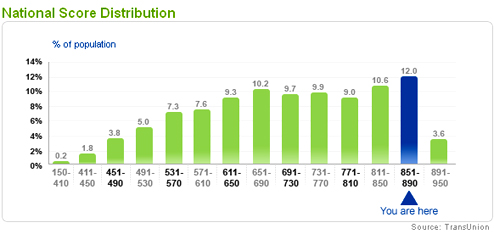

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

../../../..//2008/05/12/mortgage-meltdown-isnt-just-for/

Mortgage meltdown isn’t just for people with bad credit, 2.3% of prime loans were 60 days past due in February, up from 1.4% a year ago and the highest in a decade. [USATODAY]

Miss A Payment And Gadget Disables Car

Auto loan lenders are using an annoying beeping box to make sure sub-prime borrowers pay on time. Cars are fitted with a device such as the “On Time” gadget. When the monthly payment gets near due, it starts blinking. On the due date, it starts beeping. If the payment isn’t made, then the device prevents the car from starting. After the borrower makes a payment, the lender gives them a code that resets the box and stops the blinking and beeping. Lenders love the device and say it’s reduced default rates by 30%. Maybe they should invent something like these for houses.

Ohio Passes Legislation That Will Punch Payday Lending Industry In The Face

Ohio’s House of Representatives passed the…