In an unprecedented move, the SEC warned S&P that it might be suing it over its rating of a mortgage-backed bond. It’s the first warning a credit rating firm has gotten over its behavior leading up to the financial crisis. [More]

legal

Berliner Suckered Into Paying $680 For Free Government Forms

A woman from Berlin Googled for US citizenship application info and thought the site she landed on was an all-in-one place for taking care of all her forms. She forked over $680, and what she got back were forms she could have gotten from the government for free. [More]

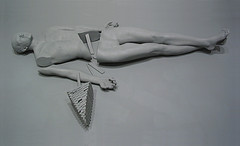

Despite Their Protests, Airlines Are Indeed Liable For Lost Luggage

Many airlines have inserted “checked baggage limitations of liability” into their contracts which try to act like it’s not their fault if jewelry or gadgets somehow go missing during transit from your luggage. They’re bunkum. [More]

Landlord Refuses To Rent To Single Mother Because There's No Man "To Shovel The Snow"

A Wisconsin landlord has been sued by the US Department of Housing and Urban Development after refusing to rent a property to a single mother. The landlord, who is a woman, said it was because the renter didn’t have a man “to shovel the snow.” [More]

Get $500 Each Time Sprint Called You After You Said Stop

If Sprint telemarketed you after you told them not to call you again, you could get $500 for each time they rang you up, thanks to a recent class action settlement. [More]

How A Wall Street Lobbyist Is "Reforming The Reform"

Banks are none too happy about how the passage of Dodd-Frank has been crimping their style. So they hired a Wall Street lobbyist, former Congressman Steve Bartlett, to lead the well-funded rearguard action by the ” Financial Services Roundtable” to neuter the laws. And darned if those cocktail parties aren’t working. [More]

Bank Of America Paying Out $410 Million For Reordering Your Transactions To Maximize Overdraft Fees

What makes this Bank of America $410 million class action settlement special is that it’s over a basic consumer banking business practice. For years, banks have been processing your daily transactions in order from highest to lowest, rather than real-time. They say they’re doing us a favor so that if we have a check bounce, it’s the one for the babysitter and not the mortgage payment. But this class action suit claims that Bank of America did this to unjustly enrich itself. It’s one of over 60 lawsuits against various banks for similar practices, and it could reshape the entire industry. [More]

Convicted Bank Fraudster Could Get 385-Year Sentence

Prosecutors in the case against Lee Farkas, who was convicted of leading a $2.9 billion scheme that wrecked Taylor, Bean & Whitaker Mortgage Corp., have asked the judge in the case to sentence Farkas to at least 50-years in prison, adding that the maximum sentence for his crime is 385 years. [More]

Mom Sues Four Loko For Teen's Death

The parents of a teen who died after drinking two Four Lokos and running onto a highway have sued the beverage maker, reports the Chicago Tribune. The lawsuit claims the manufacturer was “careless and negligent” in making a caffeinated alcoholic drink that “desensitizes users to the symptoms of intoxication and increases the potential for alcohol-related harm.” [More]

College Kid Is Pro At Taking Companies To Small Claims Court

Most of us have trouble scratching a simple customer service call off our to-do list, but The Red Tape Chronicles profiles a college kid who has turned taking companies to small claims court into a bit of a hobby. And he’s won 10 out of 12 times. [More]

Telemarketer Won't Show "Do Not Call" Policy? You Can Sue For $500

If you can’t get rid of annoying telemarketers, you can at least make a profit off them. Under Federal law, they have to give you a written copy of their “Do Not Call” policy for free if you ask them to. If they don’t, you can take them to court and sue them for a cool statutory $500. Here’s a sample script for doing this from a guy who has sued several telemarketers over this violation and won. [More]

Jehovah's Witness's Suit Over Being Fired For Refusing To Wear Santa Hat Reaches $55,000 Settlement

A woman who says the Belk department store fired her after she refused to wear a Santa hat during Christmas has won a in a $55,000 suit against the company, reports the News & Observer. The worker was a Jehovah’s Witness, and said her religious beliefs prevented her from wearing such a cap. However, she had no problem with fulfilling her job, which was to wrap presents. For Belk to have won, they would have had to have proved that letting her not wear the cap would cause them “undue hardship.” Apparently, they were not able to meet this requirement. [More]

Bill Introduced To Delay Swipe Fee Reform

Bills were introduced in both the House and Senate to delay “swipe fee reform” by at least a year and they call for a study of its potential effects. The new rules, scheduled to take effect July 21, would cap the fee banks can charge merchants for processing debit card fees at 12 cents per transaction. [More]

Disabled Janitor's $311,000 Victory Against Abusive Firm Trying To Collect $3,800 Debt

They just wouldn’t stop calling, and now they have to pay. The 9th U.S. Circuit Court of Appeals has upheld a ruling that a debt collection firm will have to pay a former janitor suffering from a head injury $311,000. Quite a turn of events, considering the debt they were hounding him on was only about $3,800. [More]

Is The 30-Year Mortgage On Death Row?

Plans are in the works to dismantle Fannie Mae and Freddie Mac, and that could mean that what many Americans had assumed came fourth after “life, liberty and the pursuit of happiness,” the 30-year mortgage, could be on the outs. [More]

Fed Might Rethink Capping Debit Card Swipe Fees

The Fed told Congress yesterday that it might rethink the plan to cap debit card swipe fees at 12 cents per swipe. One of the hopes is that merchants would be able to pass on the reduced costs to consumers in the form of lower prices. Lawmakers piled on in the hearing, saying that it would “batter banks still reeling from the 2008 financial crisis.” How banks can both be posting soaring profits and still be “battered” and reeling is an accounting trick way over my head. [More]

Understand Common Contract Terms So You Don't Get Screwed

There’s a bunch of terms and provisions that keep showing up in the contracts you sign throughout life, but do you know what they mean? Who exactly are these “Heirs, Successors, and Assigns” coming over for the contract party? Do they have dietary restrictions? What is “separability?” Will it hurt? Well, we’ll tell ya! [More]

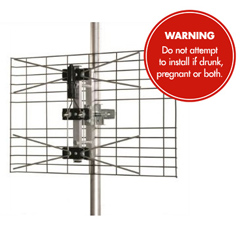

Collection Of Ridiculous Warning Labels

Woman’s Day has rounded up some of the more silly of the fine-print warnings appearing on products. You know, those one’s like on the kid’s Batman cape where it says, “Warning: Cape does not enable wearer to fly.” I think my favorites are the “Terrestrial Digital Outdoor Antenna which warns “Do not attempt to install if drunk, pregnant, or both.” And of course there’s the iPod shuffles’, “Do not eat iPod shuffle.” Gotta love lawyers. [More]