Navy Federal Credit Union offers customers — current and former military servicemembers and their families — a wide range of financial products and services, including loans that must be repaid. But when those customers fell behind on those payments, federal regulators allege that NFCU illegally threatened borrowers and restricted access to their accounts. To resolve these allegations, the company must now pay $28.5 million in refunds and penalties. [More]

legal action

Federal Inquiry Probes TCF Bank’s Overdraft Practices

Overdraft fees cost consumers an average of $32 billion each year. The hefty fees and their often less-than-transparent policies, which vary greatly between banks and financial products, have long garnered the ire of consumer advocates and federal regulators. Case in point: a Minnesota-based bank is now under investigation for possibly unfair and deceptive practices related to its overdraft program. [More]

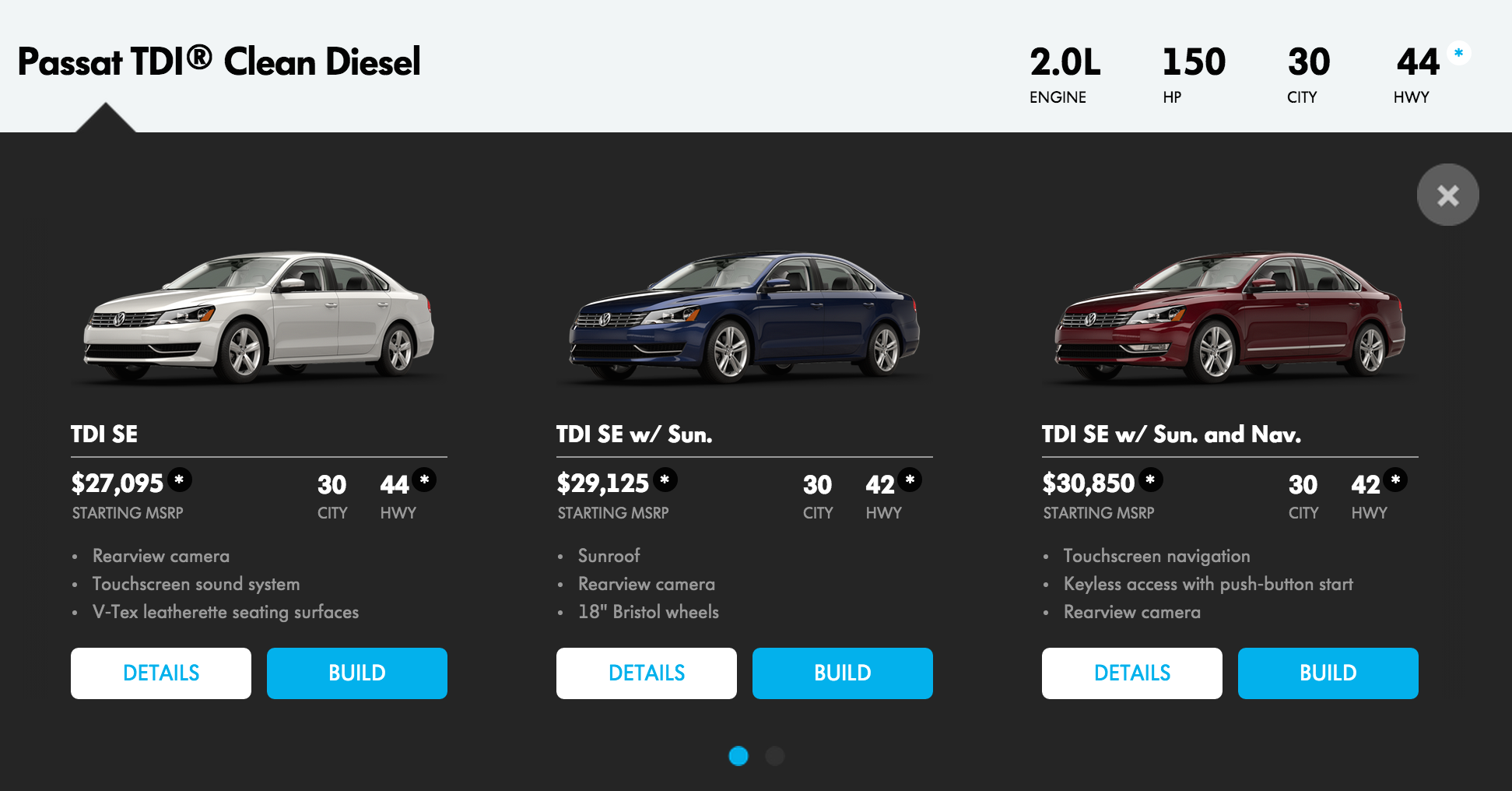

West Virginia Sues VW Over Deceptive Advertising For Vehicles Equipped With “Defeat Devices”

Since the Environmental Protection Agency revealed that Volkswagen had rigged its “clean diesel” to cheat on emissions tests, a number of consumers and cities have sued the carmaker. Now West Virginia becomes the first state to join the list of those alleging the company tricked car-buyers into paying thousands of dollars more for supposedly environmentally-friendly vehicles. [More]

Health Group Challenges E-Cig Makers After Tests Find High Levels Of Toxic Chemicals In Most Products

A health watchdog group took legal action against some of the country’s largest e-cigarette manufacturers for failing to properly warn consumers about the risk of such products after tests show that most produce high levels of toxic chemicals. [More]