Tea, unless it’s of the “iced” variety, is generally considered a hot drink. Commercial jets, while smoother rides than some planes, are known to be occasionally bumpy. One Southwest Airlines passenger found out the hard way that these two facts could result in her being burned — and she’s suing the carrier for $800,000. [More]

lawsuits

Rent-To-Own Companies Busted Using Tracking Software To Spy On Customers

For years, we’ve been warning consumers about rent-to-own electronics businesses because they usually end up costing customers a heck of a lot more money in the long term. Now there is another reason to avoid them: The Federal Trade Commission has caught seven rent-to-own companies installing tracking software on computers to do everything from tracking their locations to capturing screenshots of confidential info to secretly snapping photos of customers. [More]

Feds Shut Down Debt Relief Companies That Only Relieved Customers Of Their Cash

We occasionally have the TV turned on in the background here at the Consumerist Batcave, so we know that anyone in the market for a sketchy debt-relief firm has many, many options to avoid calling. But now there are a few fewer questionable companies littering the daytime airwaves because the Federal Trade Commission has halted the operations of four services that allegedly made false claims about being lawyers, debited money from people who did not actually order the services — oh, and failed to get any significant debt relief for the customers that actually signed up. [More]

Lawsuit Claims Dollar Rent A Car Charged Customers For Options They Specifically Declined

A doctor from Florida claims that Dollar Rent A Car charged him more than $250 for options he had explicitly told the company he did not want — and he believes he’s not the only one who has been hit with these unasked-for charges. [More]

Customer Sues Walmart Because Cashiers Shouldn't Rip Up Two $100 Bills Without Making Sure They Are Real

Anyone who has paid for a purchase with a $100 bill is probably familiar with the various methods that stores have for validating the authenticity of the note. But one Texas woman says she was publicly humiliated at her local Walmart when a cashier ripped up two of her C-notes — and then detained her on allegations of trying to pass counterfeit bills — without properly checking to see if the money was the real deal. [More]

Judge Requires Strip Club Patrons To Tuck In Shirts, Dancers To Cover Rear-Ends

A Houston-area strip club is set to face trial in December on allegations that all sorts of illicit activities — prostitution, drugs, illegal weapons — were being trafficked within its walls. Yesterday, the judge in the case ruled that the club can remain open, but on some rather strict conditions. [More]

'Your Baby Can Read' Charged With False Advertising Because It Didn't Prove Your Baby Can Actually Read

Since 2008, the makers of the Your Baby Can Read! learning system have made $185 million from parents who hoped that the product could indeed help their infant get a head start on becoming a voracious reader. Now the company has to forfeit all that money (well, sort of) after the FTC filed false advertising charges against it, its former CEO and its creator. [More]

Apple Lists Samsung Products It Wants Banned; Samsung Vows To Fight

As you probably heard, over the weekend, a jury found in favor of Apple in the computer company’s fight against Samsung over allegations that the latter willfully copied Apple’s iPad and iPhone designs to make its own products. Now, Apple has provided the judge with its list of eight Samsung products it says should no longer be sold in the U.S. [More]

Court Tells 82-Year-Old She Wasted 8 Years Fighting For Right To Bury Husband On Her Property

Eight years ago, a woman in Connecticut buried her late husband on their 8-acre property, where previous owners had been interring the dead for generations. But her subsequent attempt to make sure this was all okay with local authorities has led her on a legal wild goose chase all the way to the state Supreme Court — and now all the way back to where she started. [More]

FTC Sues Dish Network Over 'Do Not Call' Violations

Even if a consumer isn’t on the National Do Not Call Registry, when they ask a telemarketer to stop calling them, said telemarketer is legally obliged to honor that request. According to a new lawsuit filed by the Federal Trade Commission, the folks at Dish Network (allegedly) ignored this request from millions of annoyed Americans. [More]

Capital One Admits It Wrongly Tried To Collect On Credit Card, Then Continues Trying To Collect Anyway

Earlier this year, a woman in Chicago won what she likely thought was a small victory. She and her lawyer were able to convince Capital One that she had never had a credit card from the bank, and thus does not owe the $1867.18 Cap One had sued her for. But rather than remedy the situation, the woman says Capital One just made it worse. [More]

Man Sues Firing Range Over "Ladies' Day" Promotion

The notion of a “ladies drink free” night at a bar or club is certainly not unheard of, but a man in Maryland says a local firing range is breaking the law by hosting days where females — and only females — are allowed to shoot without having to pay. [More]

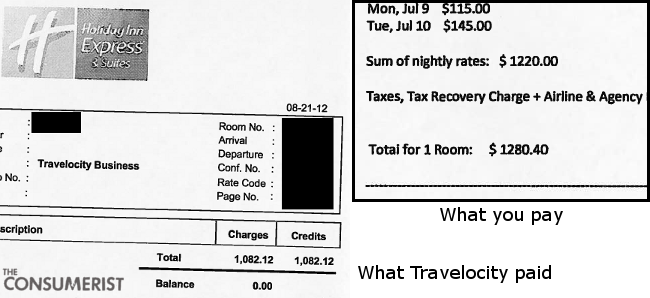

Holiday Inn Sends Me Wrong Receipt, Reveals How Much Of A Discount It Gives To Travelocity

If you’ve ever booked a room through Travelocity or any other online travel site, you might have wondered how much that company is paying the hotel operator for the room. Without even trying to, one Consumerist reader managed to find out what Travelocity actually paid for a recent stay at a Holiday Inn. [More]

Lawsuit Alleges Price-Fixing By Major Hotel Chains And Online Booking Sites

A class-action lawsuit filed yesterday in a U.S. District Court in California alleges that the biggest names in online travel — Priceline, Expedia, Travelocity, Orbitz, Hotels.com — and some of the world’s largest hotel chains — Hilton, Starwood, Marriott, Intercontinental, among others — conspired together so that the “best price guarantee” you often see when booking a room online is in actuality just a number set by the hotel operators. [More]

Progressive Provides More Details On Controversial Lawsuit

Earlier this week, the brother of a woman killed in a car crash made headlines around the world by claiming that his sister’s insurance company, Progressive, had actually come to the legal defense of the driver accused of causing the fatal accident. Since then, the insurance company has stated that it was not defending the other driver, but only defending itself in the lawsuit — a distinction the brother found wanting. Today, the insurer says it has reached a settlement with the family and is attempting to clarify matters further by explaining why its lawyers ended up on the other side of courtroom. [More]

Lawsuits Accuse Bank Of America Of Helping Developer Trick People Into Buying Worthless Land

Fifteen separate lawsuits recently filed in U.S. District Court accuse Bank of America of defrauding homebuyers by allowing an insolvent developer to take their money for properties in a subdivision that were not only never built, but also had no roads, sewers, or other utilities. [More]

Progressive Denies Defending Driver Who Killed Policyholder In Crash

UPDATE: The victim’s brother has issued a rebuttal to Progressive’s statement. It has been added to the bottom of the post.

—

Yesterday, the brother of a woman who died in a car crash made headlines when he wrote that lawyers for his late sister’s insurance company, Progressive, had acted as the defense counsel for the driver accused of causing the accident. At the time, we had asked the insurer to clarify its actual involvement in the case, but it only offered a vague “our hearts go out”-type statement. But now Progressive is flat-out denying it came to the defense of the at-fault driver. [More]