We were operating under the misunderstanding that Judge Judy was a broadcast of an actual small claims court somewhere, but then our legal beagle intern Alex informed us that it’s really just arbitration dressed up to look like small claims court.

law

RIAA Told To Provide Breakdown Of Expenses Per Each Downloaded Song

Over the Thanksgiving weekend, a Brooklyn judge made a defendant in an RIAA lawsuit very happy when he ordered the RIAA to document the actual expenses incurred per downloaded song.

Blogger Who Wrote About A Business Wins Defamation Lawsuit

Considering the lifeblood of The Consumerist is publicizing stories of bad businesses and bad business practices—including drawing attention to personal stories on other peoples’ blogs—we were happy to read that blogger Philip Smith won the federal defamation and trademark dilution lawsuit brought against him by a company he wrote about on his personal blog. Although it doesn’t guarantee that other angry business owners or their legal teams won’t come after you for writing about your unpleasant experiences with them, it cheers us to know that, at least in this case, a federal judge felt that Smith should be protected from retaliation for telling his side of the story. “It’s not about the title, it’s about the content, said Judge Henry Hurlong, Jr.; a journalist turns out to be anyone who does journalism, and bloggers who do so have the same rights and privileges under federal law as the ‘real’ journalists.”

../../../..//2007/09/07/ohios-legislature-passed-the/

Ohio’s legislature passed the Product Liability Act in 2006, which capped certain court damages at $5,000 and created special protections for companies that once sold paint containing lead. Gov. Ted Strickland vetoed it, but the Ohio Supreme Court overturned the veteo last month on a technicality. Today, a group of consumer advocates in Ohio turned in 1,800 signatures in an attempt to bring the issue to a public vote in November ’08. [Business Week]

Credit Card Late Fees Might Be Unconstitutional?

Over at the Consumer Law & Policy Blog they’ve posted the abstract of a article that considers the constitutionality of credit card late fees. Apparently, there are “constitutional constraints upon the imposition of punitive damages.” Neat. The article by Seana Shiffrin and is called “Are Credit Card Late Fees Unconstitutional?”

State Farm Mutual Automobile Insurance Co. v. Campbell articulated serious and specific constitutional constraints upon the imposition of punitive damages. Justice Kennedy’s majority opinion announced that, apart from exceptional cases, punitive damages should not exceed nine times the amount of the actual losses sustained by the plaintiff and should usually be far lower…

New Texas Law Guarantees Access To Restrooms

Under a new law signed by Texas Governor Rick Perry, retailers can’t deny restroom access to any consumer with a valid medical condition. Stores with less than two employees on duty are exempt, and mistrustful employees can ask to see a doctors note. The Texas Retailers Association had no objection to the law, which for some consumers, is a godsend:

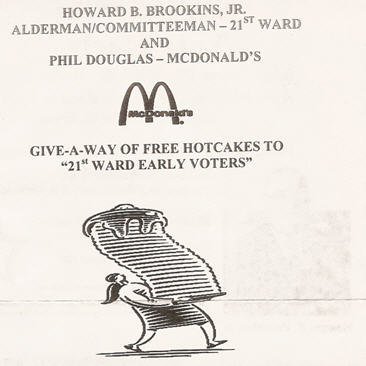

Did McDonald's Commit A Crime By Giving Hotcakes To Voters?

Reader Josh writes us with concerns that a Chicago McDonald’s Franchisee committed a crime by offering free hotcakes to “early voters” in Chicago. He writes:In Chicago, some McDonald’s restaurants are offering free hotcakes to people who early-vote in the local runoff elections!

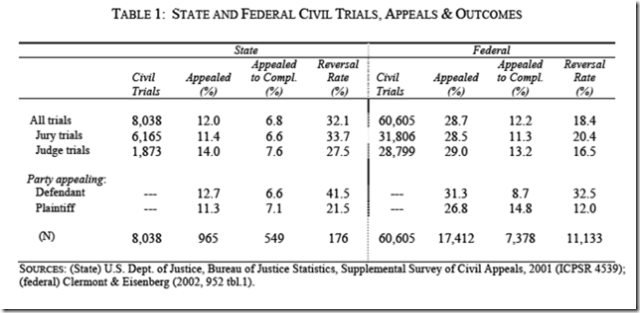

Tort Reform: What It Is, Why You Should Care, and Why It Is Anti-Consumer

Tort reform is a buzzphrase that comes and goes, but nearly always gets tied to things like The Great McDonalds Hot Coffee Incident or the rising cost of medical malpractice insurance for doctors. Many blogs, Tort Deform and Overlawyered prominently among them, devote copious space to arguing tort reform.

Lop-Sided Cell Phone Contracts To Be Decided By Supreme Court

Speaking of crappy cell phone providers, we’ve long been aggrieved by the providers’ one-sided contracts. Sign up for a cellphone and all you are really guaranteeing a company like Verizon, Sprint or T-Mobile is that, over the course of the next year, you will continue to pay them whatever arbitrary monthly fee that they spontaneously dream up, regardless whether or not that is the fee you initially agreed to.

Georgia Bill To Make Cell Carrier Contracts Less Restrictive

A Republican state senator in Georgia has filed a bill that aims to prohibit cell phone service providers from forcing customers to restart their contracts just to move to a new rate plan. The pandering doublespeak from the cellular service providers in this article is sickening.

Kristin Wallace, spokeswoman for Sprint Nextel. “In principle, Sprint Nextel believes the competitive wireless marketplace is serving its consumers well and that regulation of wireless service would be harmful to innovation and costly for consumers.”

Caran Smith, a spokeswoman for Verizon Wireless, said … “By limiting a carrier’s contract options, the state in effect is limiting a consumer’s flexibility to move to rate plans and take advantage of services that meet their wireless needs.”

We understand that to subsidize the cost of phones your carrier wants to lock you into a contract—really, we get it. But there’s no way to justify the inability to switch plans to suit your needs within your contract period. (Not to mention the inability to purchase your own phone independent of the carrier subsidy and use their service on a month-to-month basis without using pre-paid.) (Thanks, Erendira!)