Shortly after the Consumer Financial Protection Bureau reported that it secured $480 million in student loan relief for current and former students of embattled Corinthian Colleges Inc., Education Credit Management Corporation – the company seeking to purchase more than 50 campuses from the for-profit giant – announced it had completed the controversial $24 million transaction. [More]

kaz

Deal Provides $480 Million In Debt Relief To Current & Former Corinthian Colleges Students

When student-loan servicing company Educational Credit Management Corporation revealed it would purchase 56 campuses belonging to embattled for-profit college chain Corinthian Colleges, regulators and consumer advocates began working to ensure that students affected by CCI’s collapse would be protected under the deal. Today, the Consumer Financial Protection Bureau and the U.S. Department of Education announced some students would receive the help they deserve in the way of $480 million in debt relief. [More]

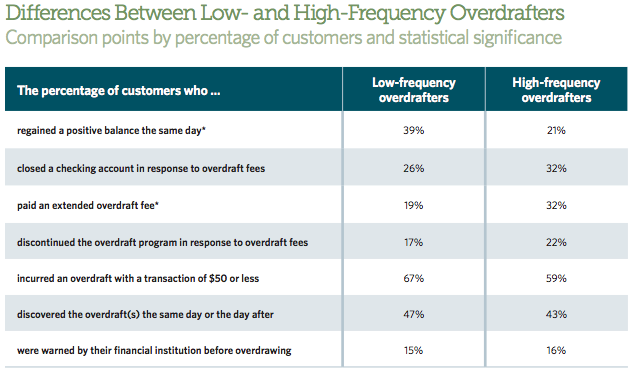

Report: Overdrafting Just A Little Or A Lot Has The Same Negative Consequences For Consumers’ Accounts

For most consumers, overdrawing their checking account results in a hefty fee. While it’s safe to argue that consumer who have more overdrafts will pay more in fees, a new report from The Pew Charitable Trusts finds that both high-frequency and low-frequency overdrafters often face the same devastating financial ramifications from banks’ overdraft penalties. [More]

Report: CFPB To Release Rules Governing Payday Loan Industry Soon

Last March, the Consumer Financial Protection Bureau said it was in the “late stages” of crafting rules to rein in the often predatory payday lending industry. Nearly a year, later the agency is reportedly on the cusp of announcing said rules. [More]

Report Spotlights Impact Of Payday Lenders On Most Vulnerable Communities

It’s no secret that payday loan storefronts often pop up in lower-income communities where consumers are more likely to need a quick infusion of cash to get to the next paycheck. A new report from the Howard University Center on Race and Wealth shines a light on the frequency with which the small-dollar, high-cost loans are opened in susceptible communities in the southern United States. [More]

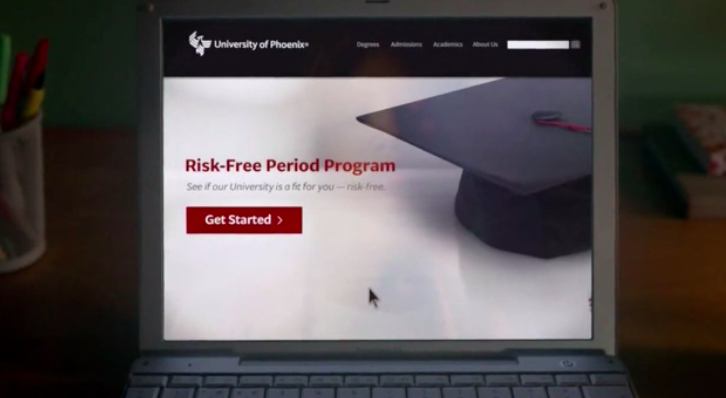

University Of Phoenix’s Risk-Free Trial Might Not Cost You, But Is It An Accurate Taste Of College?

From diet pills to dating websites, it’s not hard to find someone offering a “risk-free” trial membership, and thanks to the University of Phoenix, that “try before you buy” model now applies to college courses. But while one might admire the idea of giving potential students a taste of the school before committing to an expensive education at the for-profit online university, consumer advocates are concerned about the program’s benefits. [More]

Fifth Third Bank Has 100 Million Reasons To Want To Keep Offering Payday-Like Loans

When the four banks still offering customers payday loan-like services announced they would discontinue their often under-fire products, they likely knew their bottom-line would take a hit. One of those institutions, First Third Bank announced this week that changes to its program resulted in the loss of millions of dollars in revenue, providing an example of why it can be difficult to persuade lenders to ditch the profit-making, but financially devastating programs. [More]

Banks Are Cutting Off The Payday Lending Industry’s Access To Customer Data To Avoid Illegal Activity

Banks across the United States are distancing themselves from the unscrupulous payday lending industry by cutting off lenders’ access to a database of customer account information used to assess potential borrowers. [More]

Will New Owner Of Everest University, WyoTech Continue With Old Owner’s Sketchy Practice?

When students apply to one of the for-profit schools owned by Corinthian Colleges Inc., they sign away their right to seek any legal action against the company if they’re wronged. Now that CCI is selling off 56 of its Everest and WyoTech campuses, the new owners have a chance to end this anti-consumer practice, but will they? [More]

Online Payday Lending Companies To Pay $21 Million To Settle Deception Charges, Must Waive $285M In Loans

It’s no secret that payday lending companies charge high interest rates and a butt-load of fees for their small dollar, short-term loans. Payday lending companies break federal laws by not being upfront about the often highly inflated fees they charge. The FTC today jumped in to block two online payday lending companies from preying on consumers with the highest fine ever levied against a payday lender. [More]

Founder Of Consolidated Credit Counseling Services Reportedly Tied To Payday Lenders

If you’re in dire financial straits because you thought you could take out a 275% APR payday loan only to find yourself unable to repay, do you want credit counseling advice from someone with a financial interest in the success of payday lenders? Probably not, but the founder of Consolidated Credit Counseling Services, Inc. says that his investments in the payday loan business had no bearing on his work. [More]

Can Churches Provide A Meaningful Alternative To Payday Lending?

With one-in-four Americans turning to questionable financial products like payday and auto-title loans, an unlikely group is stepping in to provide consumers with a less-costly alternative. Churches across the country are helping members escape the trap of revolving debt by aiding them in obtaining safer loans. [More]

Ohio Senator Proposes Payday Loan Alternative That Allows Consumers To Access Early Tax Credits

For years, lawmakers have tossed around the idea of meaningful payday loan reform, from banning loans with annual percentage rates higher than 36% or looking to close loopholes that allow predatory lenders to claim tribal affiliation. This week, as Congress began its latest session, one lawmaker suggested a payday alternative that doesn’t involve another type of loan at all. [More]

Protecting Military Servicemembers From Predatory Loans Is A National Security Issue

In recent years, we’ve written a number of stories about laws aimed at protecting active-duty servicemembers and their families from predatory loans and the businesses that try to take advantage of loopholes in these rules. Some readers have asked why members of our armed forces merit protections not available to civilians. But this isn’t about just doing something nice for our soldiers; it’s about removing a threat to national security. [More]

White House Proposes Free Community College For Dedicated Students

The cost of a college education has outpaced inflation for the last few decades, making school less affordable for millions of Americans and driving student loan debt past the $1 trillion mark. And in the last decade, the for-profit education industry has taken in many billions of dollars in federal student aid for schools with high dropout rates. Today, President Obama offered a suggestion: Free community college educations for those willing to stick to it. [More]

CFPB Urges DoD To Close Loopholes That Cost Military Personnel Millions Of Dollars

Nearly three months ago the Obama administration and the Department of Defense announced a proposed overhaul of the Military Lending Act that would aim to close loopholes regularly exploited by predatory lenders in order to sink their hooks into military borrowers. Now, a new report from the Consumer Financial Protection Bureau highlights just how devastating – and costly – those loopholes can be for servicemembers. [More]

22 States Ask Defense Dept. To Do More To Protect Servicemembers From Predatory Lenders

When the Military Lending Act was introduced in 2007, it aimed to prevent predatory lenders from gouging military personnel with exorbitant interest rates and mountains of fees. While those protections have proven to be successful in many ways, lenders have since learned how to work around specific limits of the law. Now, attorneys general from 22 states are asking the Department of Defense to do more to shield servicemembers from unscrupulous lenders. [More]