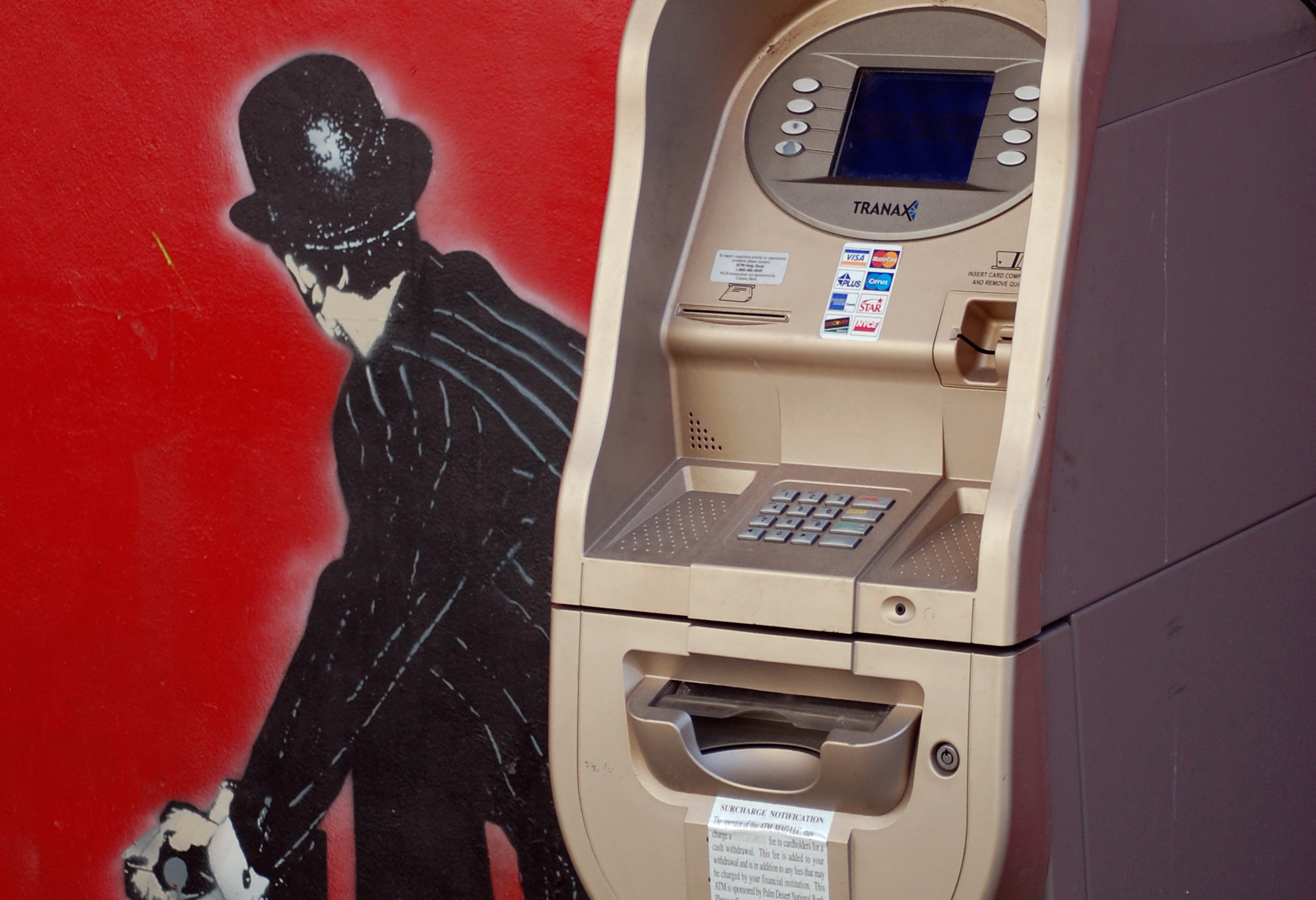

A high-ranking member of the largest card-skimming operation in the U.S. will spend the next seven years in prison for his part in a scheme that used ATMs at several national banks to steal $5 million from credit card accounts.

jail time

Did Paulson Violate The Fair Credit Reporting Act?

When the SEC announced its fraud complaint against Goldman Sachs, people noted that the penalties involved would involve money, not jail time. But an attorney writing for seekingalpha.com argued over the weekend that John Paulson, the hedge fund manager who worked with GS to create “synthetic derivatives,” accessed FICO scores to create his financial product and therefore violated the Fair Credit Reporting Act (FCRA)–which could mean a penalty as high as $1 billion, and even jail time if the FTC or Justice Department decides to go after him. [More]