This is good advice any time of the year, but since many of us are about to launch into spending sprees in the oncoming days, it’s as good a time as any to remind shoppers to think long-term about how much they are actually going to pay for an item purchased with a credit card. [More]

interest rates

Would Capping Credit Card Interest Rates Help Or Hurt Consumers?

Many Americans are carrying more than $10,000 in revolving credit card debt, some with an APR of over 20%. But while the idea of putting a more reasonable ceiling on these rates might seem like a way to help get these folks out of debt and back in the black, some say it would likely have no positive effect on the economy at large. [More]

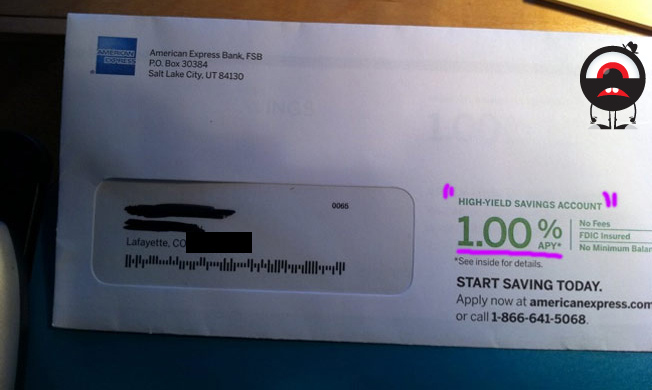

Banks Marketing 1% APR Bank Accounts As "High-Yield"

Considering how “high-yield” savings accounts used to give returns of 4-5%, reader Phil thinks it’s a bit disingenuous for banks to continue marketing them as such when the rates are only 1%. He sent in a picture of a recent piece of junk mail he got from American Express to illustrate. [More]

30-Year Mortgage Rates Now Lowest Ever, People Still Aren't Buying

It’s like that scene in Groundhog Day, where Chris Elliott’s character enters the Punxsutawney bachelor auction and is greeted by dead silence from the women in the crowd…. Once again, mortgage rates have dropped to record lows while potential home buyers continue to hold off on making a purchase. [More]

Federal Reserve Says It Will Keep Interests Rates Low For 2 More Years

In a move meant to ease uncertainty in the markets, the Federal Reserve pledged to keep interest rates low for the next two years. The Fed’s target rates, which banks use to set loan rates, have been close to zero since 2008, and previously said they would stay there for “an extended period.” The two-year designation is a sign that the Fed expects the economy to remain in troubled waters until at least 2013. [More]

If The Debt Ceiling Isn't Raised, You'll Pay For It On Your Credit Card

The game of political brinkmanship over the debt ceiling isn’t just an abstract battle of wills. If it isn’t raised, you can expect that your credit card interest rate surely will be. [More]

Credit Card Interest Rates Hit 9-Year High. Thanks, CARD Act!

Average interest rates have hit a new 9-year high of 14.7%, and we have credit card reform to thank for that. Por-kay? Unable to keep soaking you on the backend with hidden fees, tricks, and traps, issuers now have to push their profit-taking to the fore. [More]

Even Wells Fargo CEO Powerless To Reduce Your Punitive APR

The APR on Kevin’s Wells Fargo credit card got jacked up from 9.6% to almost 23%. He owes $16,000. At 9.6, he could afford to make double the monthly payments, but now he’s paying $300+ a month in finance charges alone. He’s begged up and down the hierarchy, from the CEO to any exec or VP he could reach, to please reduce his APR so he can carry this debt. Nope. The numbers have spoken. The odds are calculated. Your risk has been assessed, and the verdict has been issued: you lose. [More]

Reader Pays Off $14,330 In 20 Months

Stuck in a $14,300 debt hole, reader Trixare4kids was dug herself out using tips she learned about on Consumerist. Let’s learn how she went on a personal finance rampage, learned to live frugally, did it all in 20 months, and how you can do it too! [More]

What Do You Do When Your Credit Card Has Been Armed With An Interest Rate Trap?

Harry’s got a problem: the Bank of America card he’s had for years is paid off, but now it’s been set to explode in Harry’s wallet if he ever uses it again because the variable APR will jump to 29.99 percent. What’s worse, his other card has been canceled. Now Harry doesn’t know if he should start using the BofA card or back away quietly from it. [More]

Low Interest Rate Party To Continue For An Extended Period

Fed Chairman and former South Of The Border employee, Ben Bernanke, says these historically low interest rates will continue… but not forever. [More]

Citi Socked Me With Fee, Rate Increase Because I Lost My Card

Justin says he couldn’t pay his Citibank credit card balance because he lost his card and couldn’t log into the system because he hadn’t yet received his replacement. As a result, he was stuck with an interest rate hike and a missed payment fee. [More]

ING Slashes Mortgage Rate, Jacks Fees, Leaves Me Out Cold

As complaints about mortgage companies go, Chris’s gripe about ING Direct isn’t something that will bring tears to your eye, but it does work as a fair word of warning for those considering refinancing with the e-bank. He says the bank slashed its interest rates but more than tripled the closing costs. He writes: [More]

Watch Out For These Tricks After The CARD Act Kicks In Next Month

The credit card reform bill will go into effect at the end of February, but that doesn’t mean you should stop paying attention to what your credit card company does with your account. There are lots and lots of loopholes, notes WalletPop. For example, your card issuer can still raise rates on future purchases any time and for any reason. In addition, there’s no limit to the number of fees that can be invented and applied to your account. The only way to make sure you don’t get screwed by a profit-hungry card issuer is to read every single thing that’s mailed to you, and closely review your statement for evidence of any changes that you may have missed. [More]

BofA Undoubles Doubled Interest Rate

Responding quickly to Wednesday’s post of Julia’s complaint that Bank of America doubled her credit card interest rate, then refused to reset it despite promising it would, the bank has promised that it will indeed undouble the rate for good. Got all that? [More]

UPDATED: BofA Doubled My Interest Rate, Said They'd Undouble It, Kept It Doubled

Julia said Bank of America hiked her interest rate then placated her for months, promising it would eventually lower it to its previous level, only to turn around and say she was misinformed and would be stuck with the higher interest rate. [More]

This Citibank Balance Transfer Offer Sure Sounds Dangerous

RP was just offered a transfer on his Citi card by a Citibank CSR, but the CSR was kind of vague on the details of the offer and could only repeat the benefits. RP looked online while the CSR pitched the offer, and found that there’s quite a big catch in the fine print–after six months, the interest rate jumps from 3.99% to 29.99%. [More]