In a move that will please banks and annoy retailers, a federal appeals court has overruled a lower court decision on swipe fees — the amount banks charge retailers for each debit card transaction — and revived the previous controversial standards put in place by the Federal Reserve in 2011. [More]

Interchange Fees

Walmart Comes Out Against Credit Card Swipe Fee Settlement

Earlier this month, when the Visa and MasterCard announced a massive settlement in the legal battle over credit card swipe fees, it looked like the seven-year-old dispute had finally come to an end — and that we’d all soon be seeing credit card surcharges at retailers. But in just the last few days, the nation’s largest retailers have come out in opposition of the settlement. [More]

VISA And Mastercard Plan To Hike Debit Card Fees On Small Items For Merchants

VISA and Mastercard are planning to sharply raise the debit card transaction fees for small purchases for merchants, according to an analyst note. A $2 cup of coffee incurs about an 8 cent fee currently, but under the new policy, the fee will hike to 23 cents. [More]

Senator Durbin To Chase CEO: You're Already Gouging The Consumer, So Stop Complaining

The main reason that JPMorgan Chase and other big banks have given for things like $5 ATM fees and prohibitive caps on debit card purchases is a soon-to-be-enacted bit of legislation known as the Durbin Amendment, which limits the amount of money banks can make off of interchange fees, the amount they charge retailers for each debit card transaction. Chase CEO Jamie Dimon has called the laws “price fixing at its worst” and “downright idiotic.” Now Dick Durbin, the Illinois senator whose name graces the legislation, has come out swinging at Dimon, telling the bank exec to quit whining and enjoy being profitable. [More]

Chase Will Reinstate Debit Card Rewards If Fee Overhaul Is Delayed

Chase has pledged to reinstate debit card rewards programs if the cap on fees it collects from merchants per debit transaction, scheduled to go into effect July 21st, is delayed. [More]

Wells Fargo & SunTrust Cancel Debit Rewards Programs

Last week, we wrote about JPMorgan Chase’s decision to get rid of rewards programs for debit card users in response to a new law that will slash the amount of money banks receive per debit card transaction. Now comes news that at least two other banks — Wells Fargo and SunTrust — have followed suit. [More]

Chase Killing Debit Card Rewards In July

With new regulations coming that will limit interchange fees, the amount of money banks charge retailers for debit card transactions, Chase has already begun testing $5 ATM fees and is considering putting a $50-$100 cap on debit card purchases. Now comes the news that the bank is going to pull the plug on most debit card rewards programs starting in July. [More]

Why Don't I Get The Cash Discount For Gas When I Pay With My Debit Card?

David writes that he recently had a confusing experience at a gas station, and he wanted some clarification. He’s used to receiving a cash discount when he pays with his debit card at gas stations, but came across a gas station owner who wouldn’t give a cash discount for anything but actual greenbacks. Are this gas station’s policies illegal, David wonders? [More]

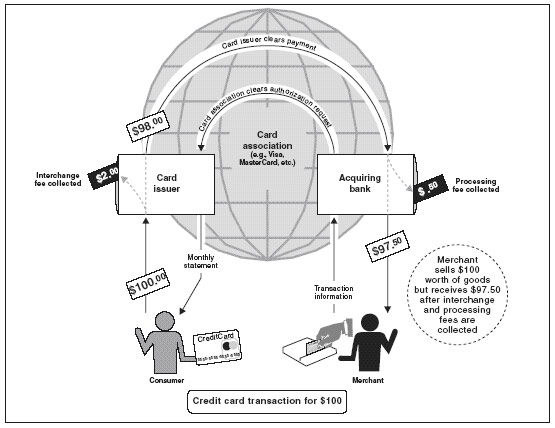

The Hidden Fee That Happens Every Time You Swipe Your Credit Card

It’s invisible to you but each time you swipe your credit card, a fee fairy gets its wings. An interchange fee fairy, to be exact. How does it work? This chart from the Government Accountability Office attempts to shed some light on the murky world of merchant processing fees. Did you know that over the past 10 years, while the technological costs of processing transactions has gone down, interchange fees have more than doubled? A cost that then gets passed on to you in the form of higher prices. [More]

Merchants Demand Credit Card Fee Relief

Merchants are pushing for more credit card fee reform, for the fees they have to pay. Every time you swipe at checkout, whether it’s a credit or debit card, the merchant has to pay two fees. One is a flat per transaction fee, the other is a percentage of the total sale, called the interchange fee. Those rewards cards you’re so fond of? They have the higest interchange fees. Those rewards and cashbacks don’t come from a magical reward tree, they’re paid for by the interchange fees. In other words, the Quickie Mart is paying for your “free” airline miles. [More]

7-Eleven Asks Consumers To Help Fight Credit Card Companies

7-Eleven plans to serve up your next Slurpee with a petition to Congress protesting unfair credit card fees. No, the fees aren’t unfair to you, they’re unfair to 7-Eleven. The vendor of last resort is mad about interchange fees, the fees banks charge merchants for accepting a credit card payment. The recent credit card legislation signed into law protected consumers from rate increases, but stayed silent with regards to interchange fees.