This story isn’t just about possible malfeasance by MetLife insurance in Massachusetts. It’s also a good example for why screwed-over consumers should file complaints with regulatory agencies. [More]

insurance

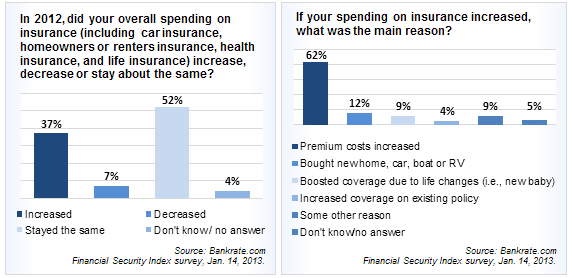

More Than 1/3 Of Americans Paid More For Insurance In 2012

If the amount of money you paid for insurance last year went up, you are not alone. According to a new survey, 37% of Americans paid more for home, health, auto, or life insurance in 2012, while only 7% of people saw their insurance bill shrink. [More]

Former Asurion Staffer Shares Insider Tips On Making Cellphone Insurance Claims

Anyone who has seen our numerous stories about readers dealing with Asurion, the insurance provider for an awful lot of wireless companies, knows that it might not always be the most pleasant experience. Now, a former front-line customer service rep at Asurion has written in to shed some light on what CSRs can and can’t do, and the best (and worst) ways to file your claim. [More]

Illness Forces Woman To Cancel Cruise, But She’s Not Ill Enough To Make Travel Insurance Claim

UPDATE: TripMate has provided Consumerist with a statement, which has been added to the bottom of the post. [More]

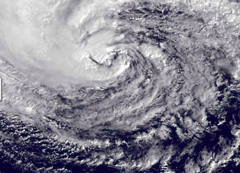

To Save Homeowners On Insurance Deductibles Governors Insist Sandy Wasn’t A Hurricane

Hurricane? What hurricane? Oh, Sandy? She was just a superstorm, say governors in states impacted by Sandy earlier this week. See, if she was a hurricane, homeowners would have to pay out anywhere from 1% to 5% of their homes’ values before insurance coverage would kick in. But if she wasn’t, as the governors of New York, New Jersey and Connecticut are saying, that deductible doesn’t have to be met. That will likely result in huge savings for homeowners. Nice. [More]

Man’s Insurance Won’t Pay For Prosthetic Legs, He Turns To Selling Doughnuts To Raise Funds

What do you do if you need new legs and your insurance company won’t cover the cost? One man’s solution to such a quandary has led him to try and raise a whopping $120,000 for prosthetic legs by selling Krispe Kreme doughnuts in front of local stores in his South Carolina neighborhood. That’s a lot of doughnuts. [More]

Will Hurricane Sandy Leave Higher Insurance Rates In Its Path?

People from the DC area to New England woke up this morning and began to check around their homes and property to see if they made it through Hurricane Sandy without being pummeled. But even if you’re not one of the ones wondering how your patio grill ended up in your attic, you might still be paying the price in higher insurance premiums. [More]

Pharmacists Confirm Pressure From Management To Refill Prescriptions Automatically

Since we began following the stories of CVS pharmacists who appear to have been pressured into automatically refilling customers’ prescriptions, regardless of whether or not a refill has been requested, we’ve received enough e-mails from from both customers and pharmacists at a number of companies who say these are not isolated incidents. [More]

Verizon Uses Warranty-Voiding Photo To Sell Protection Plan

The Verizon/Asurion Total Equipment Coverage Plan looks neat sitting there on the shelf, with its pretty photo of a smartphone making a splash in a cool bin of water. As tipster and photo-taker Eric points out, though, why are they showing the phone plunging into a bin of water when the protection plan doesn’t cover water damage? We’ve heard from some people who know the plan well and who have pointed out that the plan has separate components: the Verizon part doesn’t cover liquid damage, but the insurance component from Asurion does. . However, intentionally throwing your phone in water in order to take a picture is still a bad idea. [More]

I Hate Progressive Insurance For Waking Me Up Over And Over

Tegan is mad at Flo from Progressive. Arguably, it’s her own fault: she leaves the TV on overnight as a sort of background noise. This leaves her and her fiancé at the mercy of whatever commercials run while they’re dozing. A new spot for Progressive insurance that advertises their mobile app features the loud, prominent sound of a vibrating phone. Most TV watchers might glance at their own phones in confusion, but Tegan was asleep, and was on call for work, so when she heard the vibrating sound, she woke up to check her phone. [More]

Citi Has A Very Loose Definition Of “Expedited” When It Comes To Fixing Huge Holes In Roof

When a bank approves a short sale, you would think that it would do everything it can to not put that sale at risk, lest it lose even more money on the deal. But one pending short sale property in New Jersey has had holes in its roof for months because Citi thinks that not approving repairs to the roof is somehow a good idea. [More]

Allstate Won’t Cover My Stolen Instrument Because Sometimes I Get Paid To Play Music

Jonathan is an amateur musician, but not so amateur that he doesn’t play the occasional gig for pay. He didn’t think that this should matter if anything happened to his instrument, and Allstate didn’t say anything when he took out an additional rider on it as part of his renter’s insurance, with theft protection. When his car was stolen, he recovered the car but not the instrument. In theory, it should have been covered. Jonathan says that they refuse to pay because he does play for compensation on occasion, and the company refuses to budge. [More]

State Farm Pulls My Homeowner’s Policy Because I Was Robbed As A Renter

Just a few weeks ago, Consumerist reader Ben went to close on his new home, complete with documentation from State Farm saying he had a homeowner’s insurance policy for the property. Then the other day, he gets a call from the insurer telling him, sorry, he’s not actually covered because his previous apartment had been robbed a couple years earlier while he had a State Farm renter’s policy. [More]

When Hospital Systems Acquire Private Practices, We All Pay More For Health Care

A growing number of private health care practices are being purchased by hospitals. And even if that practice remains changed in all other ways, you can expect that the costs for procedures and visits will increase dramatically. [More]

Why Would The Victim's Insurance Company Defend The Other Driver In A Fatal Car Accident?

After Woman Dies In Car Crash, Brother Says Her Insurance Company Defended Other Driver In Court

A Mobile Phone Warranty Isn’t The Same Thing As Insurance

S. went to buy an iPhone from Best Buy, and let the salesperson talk her into Best Buy’s warranty rather than AppleCare. That more expensive warranty covers accidental damage, but it’s not an insurance plan, which would cover lost or stolen phones. The salesman didn’t make this clear to S. And that’s really too bad, because as she left the store with her new phone, she was robbed. The warranty, of course, didn’t cover the theft. [More]