It’s not just brands of beer that Anheuser-Busch InBev and SABMiller have had to discard in order to make their $107 billion merger dreams a reality: it could also cost thousands of people their jobs. [More]

inbev

How America’s Two Signature Beer Companies Became Expats

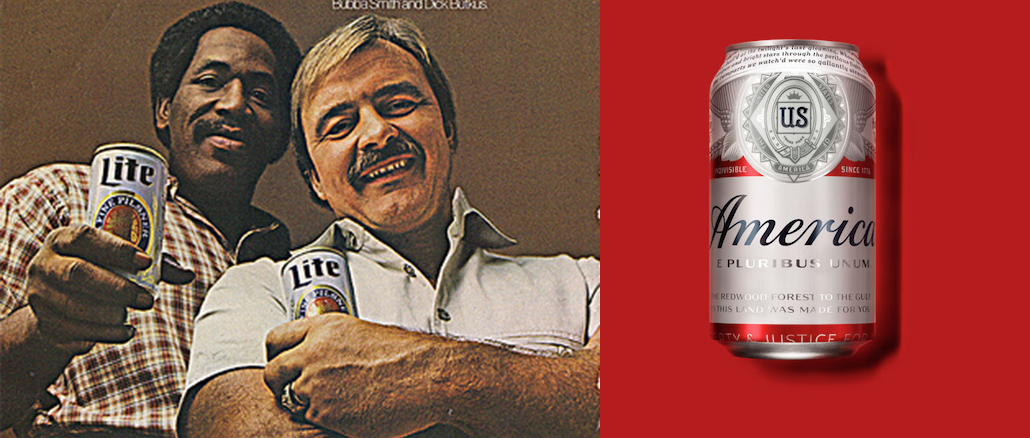

Budweiser and Miller: Even if you don’t like them, you have to admit that they have long been considered the two beers most associated with America. Their ads feature vast fields of wheat, baseball, hard-workin’ and hard-partyin’ men and women — heck, Bud even went so far as to rebrand itself “America” for the summer — even though neither brand has been majority owned by an American company in years. And now that U.S. regulators have signed off on on the marriage of Bud and Miller’s parents, these once-American titans of industry have completed their transition to become worldly expatriates. [More]

Anheuser-Busch CEO Tells Congress That Mega-Beer Merger Is Good For Everyone, Really

Executives involved in the billion-dollar beer merger between Anheuser-Busch and SABMiller tried to paint a rosy picture of its impending marriage — despite a wealth of contradictory testimony — assuring lawmakers that there’s really no downside to the deal: everyone will benefit, even consumers. [More]

Big Beer CEOs To Testify In Front Of Congress On The Awesomeness Of Mega-Merger Tuesday

There are billions of reasons (or rather dollars) for the executives for Anheuser-Busch InBev, SABMiller and Molson Coors Brewing Co. to prove that a mega-beer merger is a brilliant plan, and now it looks like they’ll have their chance to opine on its greatness by testifying in front of Congress tomorrow. [More]

Consumers Sue To Stop $107B Mega-Beer Merger

Anheuser-Busch InBev’s formal $107 billion bid to acquire SABMiller is far from a done deal: federal regulators will likely be combing through the details of the proposal for quite some time to determine how it will affect the global beer markets, and consumers’ wallets. But it looks as if lovers of the sudsy drinks are a bit ahead of the game, filing a lawsuit to stop the mega-merger. [More]

Will Mega Beer Merger Lead To Higher Prices & Fewer Choices For Consumers?

With a $104.2 billion merger agreed to in principle, beer giants Anheuser-Busch InBev and SABMiller could be walking down the aisle soon, creating a company that provides nearly 70% of the beer sold in the U.S. While such a mega-merger might be beneficial to the companies as far as increasing market share and cutting costs, the deal could have some very real consequences for consumers – and other beer producers. [More]

What Do You Mean, This German Beer Was Brewed In Missouri?

You can’t really blame reader Nathan for thinking that Beck’s beer comes from Germany. Until just a few years ago, it was an import. Then InBev, the brand’s owner, acquired Anheuser Busch, and with that lots of breweries in the United States. Breweries where they might as well make InBev-owned brands, since most consumers won’t be able to tell the difference. Or so they thought. [More]

Anybody Wanna Buy Rolling Rock? Again?

Three years ago, the Belgian brewing company that just acquired Anheuser-Busch, InBev, sold Rolling Rock to AB. Now they’ve got it back again… and want to sell it. Anyone looking for a beer brand?

Budweiser Sold To The Maker Of Stella Artois, Becks

It seems that $70 a share was enough for Anheuser-Busch — the brewer agreed to sell itself to Belgian beer giant InBev over the weekend. The new company will be called Anheuser-Busch InBev, and its board will have room for two former A-B executives, including A-B CEO, August A. Busch IV.

Anheuser-Busch Rejects Foreign Takeover Bid

Anheuser-Busch says that is going to fight a takeover bid by Belgian brewer InBev by cutting staff and finding savings of over $1 billion, the St. Louis-based brewer announced today. They also plan to increase profits and repurchase stock.

Should The Proposed Sale Of Anheuser-Busch To A Belgian Brewer Be Stopped?

Missouri governor Matt Blunt has sent a letter to the Federal Trade Commission, “asking for a federal review of the proposed sale of Anheuser-Busch Cos. to Belgian brewer InBev,” says the AP. Blunt is concerned that allowing the maker of Becks and Stella Artois beers to buy the St. Louis-based brewery could create a “near monopoly” in the US beer market, and that it would damage the Missouri economy.