The Fair Debt Collection Practices Act prohibits debt collectors from a number of annoying and aggressive practices, like calling late at night to hassle folks about their debt or publicly outing people as debtors. However, this morning — in Justice Neil Gorsuch’s first opinion — the U.S. Supreme Court ruled that this law doesn’t apply to banks that purchase defaulted loans with the intention of collecting on them. [More]

in the midst of life we are in debt

Supreme Court: Protections Against Debt Collectors Don’t Apply To Banks That Purchase Defaulted Loans

Trump Administration Eases Restriction On Student Loan Debt Collectors

The Department of Education has told federal student loan debt collectors that they are to ignore previous guidance that restricted the fees they could charge to borrowers who defaulted on their loans — even if they immediately enter into repayment programs. [More]

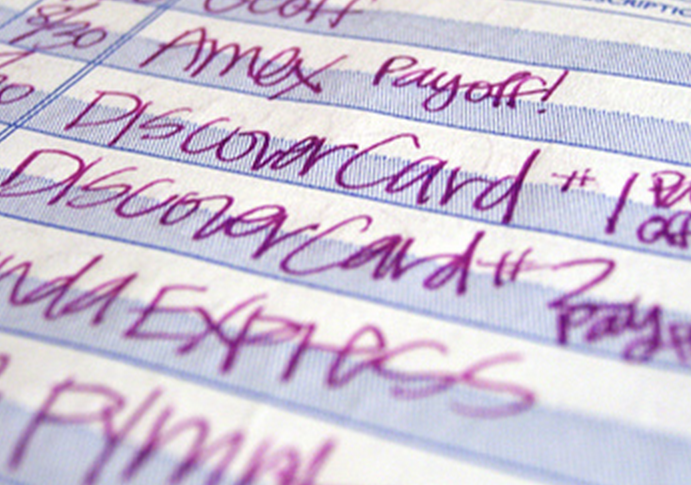

Which Cities Have The Highest/Lowest Credit Card Debt Burden?

The average amount of credit card debt varies quite a bit from city to city, as does the ability of consumers to pay down that debt in a timely manner. A new study claims to show that the cities with the least amount of credit card debt burden aren’t necessarily the cities with the least amount of debt. [More]

The 5 States (Plus D.C.) With The Highest Levels Of Credit Card Debt

If you were asked to guess which states had the highest average credit card debt, you might assume it would be dominated by places with high real estate costs, where consumers need to spread out their other purchases in order to make the rent or mortgage every month. Or you might go the other way and guess that states with low costs of living but high unemployment rates would top that list. But a new analysis of credit card data paints a different picture than either of these assumptions. [More]

Death Is No Excuse For Not Paying Your Car Lease

We’ve written before about people who co-signed a loved one’s loan and were left owing the debt after the borrower passed away before the loan was repaid. But even if you weren’t the co-signer, you might still end up being on the hook for thousands. [More]

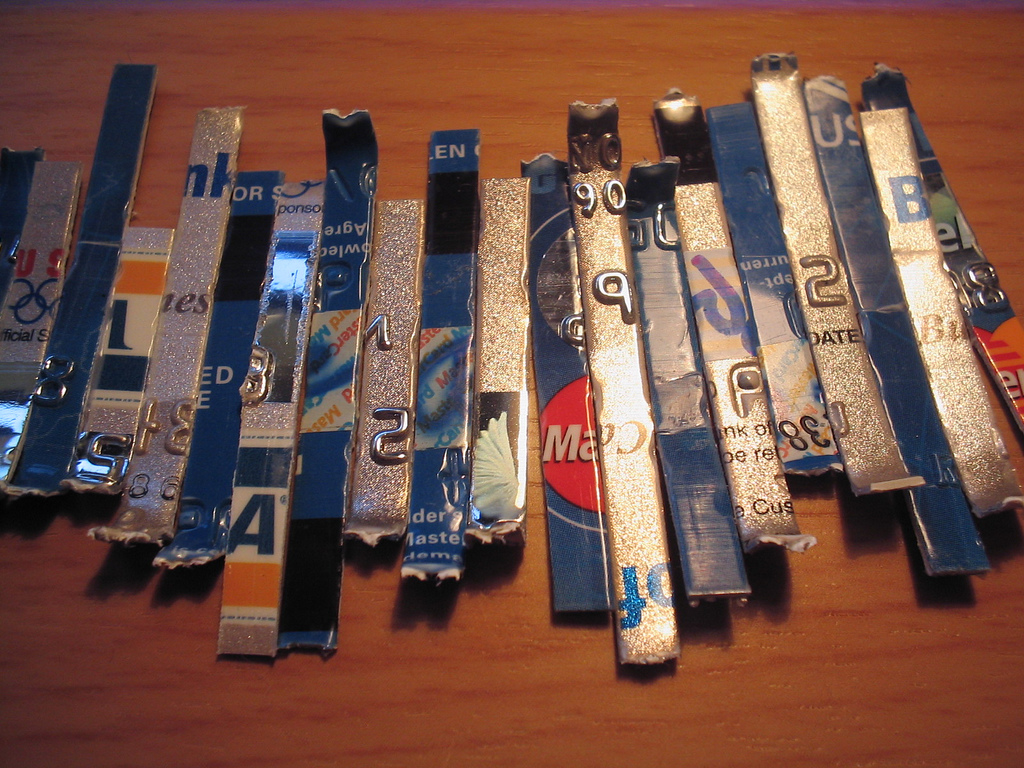

How Does A $1,000 Loan Blow Up Into $40,000 Of Debt?

We’ll never advise that anyone take out a payday or installment loan with an interest rate of 240%, but if you do find yourself taking out one of these ridiculously high-interest loans, know that defaulting on the payments can land you in the courthouse, where you could end up buried beneath a mountain of debt from which you’ll never dig out. [More]

Bank Of America Continues Deducting Fees, Even After Death

Perhaps showing its firm belief in the afterlife, Bank of America has continued to charge fees to the bank account of a man it knows died nearly half a year ago. [More]

Advocates Call On Senate To Remove Paid Medical Debt From Credit Reports

Medical bills can be outrageously high, and usually there’s a direct relationship between the unexpectedness of a procedure and its cost. Sometimes, no financial planning in the world can forestall unforeseen medical expenses. Yet if any medical debt ends up on your credit report, it can remain there for up to seven years — even after you’ve paid it in full. That’s why a large coalition of advocacy groups have written Senate leadership asking them to consider the Medical Debt Relief Act. [More]

Woman Spends 6 Years Trying To Convince Credit Bureaus She's Not Dead

In 2004, a hospital staffer accidentally checked off “deceased” on a heart surgery patient’s discharge papers. That one little tick mark on one document resulted in years of headaches for that woman, as she has attempted time and again to prove to the three credit bureaus that she is not a zombie. [More]

4 Things Debt Collectors Won't Tell You

Of all the industries the Federal Trade Commission receives complaints about, debt collectors are involved in the most, accounting for around 27% of all complaints received in 2010. A big part of the problem is misinformation about the rules regarding what debt collectors can legally say and how nuch authority they actually have. [More]

4 Debt Traps And How To Avoid Them

One of the best ways to keep out of debt is to be mindful of the many pitfalls that are waiting to swallow you up, and how best to avoid them. The problem is, some of these debt traps don’t look so deadly until you consider the consequences. [More]

How Long Should Paid-Off Medical Debt Be Part Of Your Credit Report?

Right now, any medical debt that gets sent to a collections agency can remain on your credit report for up to seven years, even after it’s been paid off. This ding on your credit score can be the difference between qualifying for a loan or being denied. That’s why the House Committee on Financial Services is looking at a bill that would erase some paid medical debts from folks’ credit reports. [More]

Verizon's Excuse For Continuing To Bill Dead Customer: "No One Is Perfect"

Last September, a woman in California contacted Verizon to set up internet access at the home of her ill mother. It won’t surprise some of you that Big Red, despite promises to the contrary, never managed to properly set the service up. In December, the mom passed away and the daughter called Verizon to cancel all service — including phone — to the house. So of course Verizon continued to charge for internet access it was never able to provide in the first place. [More]

GAO: Consumers Only Getting $.21 On The Dollar Out Of Credit Card Debt Protection Fees

In 2009, U.S. consumers spent at least $2.4 billion in fees for credit card debt protection products that provide them with the ability to suspend or cancel a part of their debt obligations as a result of things like disability and involuntary unemployment. However, a new Government Accountability Office report finds that the credit card companies are making a substantial profit from these fees. [More]

Why Won't Rental Car Companies Let Me Use My Debit Card?

We recently gave you a suggestion for how to find a rental car that doesn’t require a major credit card, but we didn’t explain why it is that many car rental companies require the credit card — and why they won’t take your debit card. [More]