If you’ve ever bought a house, you’re more than familiar with the mountain of paperwork you have to deal with at closing, not all of which are easy to understand. But a study claims that homeowners who utilize a newer electronic method for reviewing closing documents may better comprehend what they’re signing. [More]

home buying

Electronic Mortgage Documents Easier To Understand, Provide More Benefits For Consumers

Many Homebuyers Spend More Time Shopping For A TV Than Looking For The Right Mortgage

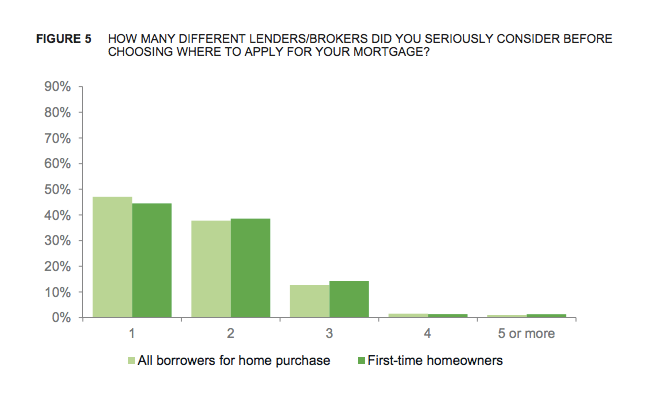

Potential homeowners might spend months nitpicking and fretting over the features of a seemingly endless series of houses they could buy, but a new report from the Consumer Financial Protection Bureau claims that half of American homebuyers aren’t taking the same care when it comes to shopping around for the right mortgage, often putting themselves in precarious lending situations and missing out on savings. [More]

4 Things Home Buyers Do That Annoy Sellers

By this point, most of us have been unwitting sucked into House Hunters marathon and screamed at the nitpicky buyers about their inability to look past the paint color, but that is a minor annoyance compared to some of the other ways in which home buyers get under the skin of sellers. [More]

Could Consumers’ Frustration With Mortgage Closings Be Solved By eClosing System?

After months of searching for a home, going through the process of applying for a mortgage, providing support for every speck of dust in your piggy bank (often multiple times), you finally get to closing day, where you’re often rushed through hundreds of papers of documents you’ve never seen before, hoping that you’re not inadvertently signing away your firstborn. Isn’t there something that can be done to make the closing process less daunting and more transparent? [More]

Expenses That Mortgage Calculators Don't Tell You About

When you’re shopping for houses, you can get giddy when you plug your numbers into a mortgage calculator and discover your dream home has a surprisingly low monthly payment. It’s lying to you. Mortgage payments are only part of the myriad costs home ownership heaps upon you. [More]

3 Steps To Start Saving Up For A Down Payment

Amassing a giant chunk of change is the best way to nail down a lower payment for a vehicle or home, but the process can be so long and arduous that it prevents you from proceeding. The key to following through with your goal is to set a reasonable plan in place and stick to it. The tough part is to find a way to get the ball rolling. [More]

3 Reasons You Shouldn't Think Of Your Home As An Investment

Homeowners tend to see their property as passive investments that will hopefully pay off at some point in the future. The housing market collapse has corrected much of that thought process, but there are still those who figure that buying in when prices are low will work out well decades from now. [More]

How To Make A Lowball Offer With A Straight Face

In a tortured housing market filled with sellers desperate to unload their homes, today’s lowball offers are next month’s listing prices. If you’re in the market for a house, you have nothing to lose by disregarding the sticker price and putting in a comically low bid for the property. Doing so as a way to start negotiations is probably the best way to see just how low the owner is willing to go. [More]

What You Need To Know If You're Looking For Your First House

First-time home buyers are at a disadvantage. They typically lack experience with the real estate market and are eager to seal the deal and get into a house — any house — just to achieve the milestone. But behaving more like a someone who has already screwed up and learned from his mistakes will pay dividends. [More]

How To Save Money For A House

If you want to scrape together as much money as possible for a down payment on a home, you’ll have to cut your usual expenses. The trick is deciding exactly what you can and can’t do without. [More]

Top 10 States With Highest Closing Costs

In terms of closing costs, these little transactional costs needed to process the signing of your new home, how does your state stack up? Bankrate did a survey to find out. [More]

Know Your Closing Costs Or Else A Shark Will Eat You

Homebuyers looking to save money will try to buy without an agent and deal directly with the seller’s broker, but beware, they feed on your weaknesses, ignorance, fear, and money.

DIY Title Search

The cost of acquiring a home can be ratcheted up significantly if the buyer doesn’t pick their own title-insurance company.