Isn’t that one huge billboard for that hedge fund just so incredibly annoying? No, it isn’t, because until just about now, hedge funds and other firms that rely on private investments haven’t been able to advertise for investors publicly. That’s all about to change, as the Securities and Exchange Commission adopted a new rule yesterday that ditches an 80-year ban on ad restrictions. [More]

hedge funds

FBI Raids 3 Hedge Funds In Massive Insider Trading Probe

The FBI showed up with search warrants at the office of three different hedge funds today as part of a huge insider trading probe. Sources say it’s a prelude to the biggest insider trading bust of all time. [More]

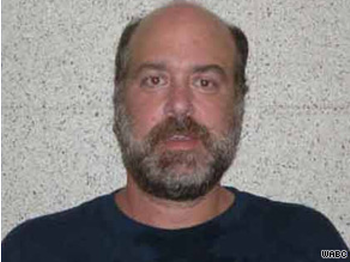

Fraud-Spinning Hedge Fund Manager Fakes Own Death, Gets Two More Years In The Clink

Sam Israel III was busted for managing the Bayou Hedge Fund Group, which defrauded investors out of $450 million. He received 20 years in prison.

Craigslist: Fall Guy For Your Hedge Fund (Financial District)

Is your hedge fund in dire financial straits? Are you totally screwed and now realizing that someone has to take the fall? Has your ponzi scheme enveloped numerous celebrity-endorsed charities benefiting Laotian children with AIDS and been discovered by the SEC?

Suicide: Hedge Fund Manager Who Invested $1.4 Billion In Madoff Scheme Found Dead

A hedge fund manager, Rene-Thierry Magon de la Villehuchet, who invested $1.4 billion in Madoff’s $50billion Ponzi scheme was found dead by apparent, movie-style, suicide.

$50 Billion Ponzi Scheme Could Just Be For Starters

Madoff’s $50 billion scam came unwound when too many investors tried to pull their money at the same time, which means we’re likely to more big swindles get exposed in the coming months…

$50 Billion Ponzi Scheme Busted

Famous broker Bernard Madoff was arrested yesterday for running what was really a $50 billion pyramid scheme. Slate’s The Big Money has insight on how investors can spot an operator like Madoff:

../..//2008/04/17/what-recession-hedge-fund-managers/

What recession? Hedge fund managers are still making billions a year. [Reuters]

Bear Stearns CEO Forced Out By Angry Shareholders, Common Sense

Bear Stearns CEO James Cayne is expected to step down as CEO due to pressure by pissed off shareholders , reports the Wall Street Journal.

Subprime Meets Wall Street, Investor Forced To Sell Yacht

Meet the subprime mortgage meltdown’s other victim, a millionaire mortgage investor who has been forced to put his yacht up for sale—for $23.5 million.

Hedge Fund Notes Disconnect Between Bank Strategy and Execution. Duh.

Second Curve Capital is a hedge fund, managing hogsheads of cash in long-term investments on the stocks of banks and financial services. Most of the year is spent over ponderous goblets of brandies, smoking fine cigars at financiers’ gentlemen’s clubs, absorbing the exuberance and doldrums of bank CEOs and presidents.

Gordon Gekko to Blame for High Gas Prices

Looking for someone to blame for high gas prices? An editorial on the Arizona Republic claims it isn’t fat-cat oil barons taking enemas of sweet crude whilst squatting over solid gold bidets in their fancy European palaces that are jacking up the price of oil: it’s Michael Douglas from Wall Street, trading in hedge funds over his torso-sized army field phone.