Reader Ozzie points us to video game developer Ashley Cheng’s blog post about budget gaming. The tips are basic, but it’s good advice nonetheless.

frugality

How To Find Some Extra Cash

A few weeks ago, part of our advice on how to handle these tough financial times was to increase your emergency fund. Obviously this is something that most people would like to do — have more cash in their lives — but how exactly can this be accomplished? MSN has some suggestions on how to find some extra cash:

Could You Survive Spending Only $25 A Week For Food?

The Illinois Food Bank Association issued a challenge to Illinoisans — could they survive by spending only $25 a week for food? $25 a week is the average weekly food stamp benefit that an individual receives in Illinois. Could you make such a small amount last while still eating nutritious meals?

How I Talk Myself Out Of Buying Stuff

If you find yourself in one of those moods where you just “have to have it”, and end up in the store staring at it, talk to yourself about it. List all the reasons you want it (want, not need), and all the reasons you don’t want or need it…

Reader Pays Off $14,330 In 20 Months With Our Tips

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

Personal Finance Roundup

Using Your Health Savings Account as a “Super Roth” Investment Vehicle [Free Money Finance] “If you can afford to delay using your HSA funds and instead leave them invested, your payoff in retirement will be substantial.”

7 Ways Your Public Library Can Help You During A Bad Economy

Reader MG is a fan of the site and a public librarian and has written a list of 7 ways that your library can help you during a bad economy. Libraries are an excellent resource and they’re pretty easy to use. Don’t worry if you’re not a big reader, there’s lots more stuff to do at the library besides just checking out books.

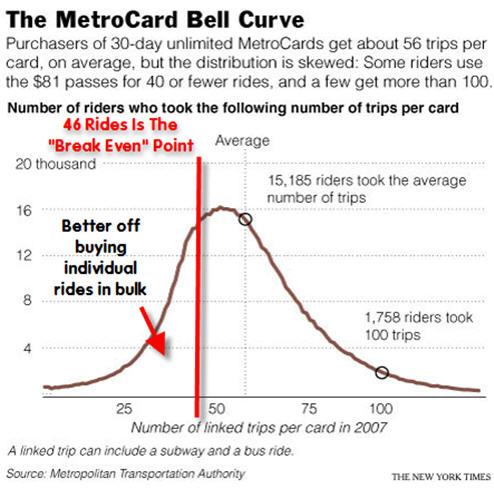

Are Unlimited Ride MetroCards A Good Deal? Not For A Lot Of People Who Use Them

The New York Times had an article today about the 10 year anniversary of the unlimited MetroCard and how it has transformed way people use the subway. They even included a graph that showed how many times people are using their cards in a month. What they didn’t mention is that a lot of people are buying the card and not hitting the “break even” point of 46 rides per month. Hmm.

Save Money On "Foaming" Hand Soap By Watering Down Regular Hand Soap

Reader Isreal has made an exciting discovery. Foaming hand soap is basically just less viscous regular, cheaper hand soap. By watering down cheaper hand soap, you can save money.

Who Is $4 Gas Hurting? Starbucks!

A survey by Kelley Blue Book says that new car shoppers are giving up Starbucks to help offset the cost of $4 gas. Sorry, big green mermaid lady! The KBB study results reveal that 28 percent of new-car shoppers have stopped going to Starbucks or other coffee houses entirely, and 21 percent indicate they are going less often due to skyrocketing gas prices.

When Does It Make Financial Sense To Downsize Your Car?

Over at Consumer Reports they’ve been running the numbers, trying to figure out when it makes financial sense to downsize into a more fuel efficient car.

../../../..//2008/06/11/these-people-have-decided-to/

These people have decided to simplify their lives by limiting themselves to only owning 100 things. Better say bye-bye to that antique button collection. [TIME]

5 Thrifty Lessons From Post-Apocalyptic Novel "The Road"

I’m in the middle of reading The Road, and couldn’t help draw 5 lessons about frugality from Cormac McCarthy’s tale of a father and son scrapping out their survival in the middle of post-Apocalyptic America.

Save Money By Being Your Own Butcher

CheapStingyBargains says that rather than relying on a butcher, it can be cheaper just to buy a whole piece of meat and cut it up yourself:

../../../..//2008/04/25/20-different-ways-to-make/

20 different ways to make good use of carpet remnants. We like the idea of having them in the car for throwing under the tires in case of too much mud or snow. [Frugal For Life]

../../../..//2008/04/23/brita-wants-you-to-keep/

Brita wants you to keep paying $6-$10 for their disposable water filters, but here’s a way to refill your own for $.50. [Instructables]

../../../..//2008/04/21/as-supermarket-prices-rise-people/

As supermarket prices rise, people aren’t just trading down from name brand food to store brands, they’re also trading down from more expensive organic brands. Also, making their own detergent. [CNN Money]

Tightwads vs Spendthrifts

“Frugality is driven by a pleasure of saving, as compared with tightwaddism, which is driven by a pain of paying.”

That’s one of the findings of a new study comparing people’s spending habits. Here’s how the differences between tightwads and spendthrifts break down, according to the survey of 13,327 people: