While a decision by the California Employment Development Department only affects one employee and their claim for unemployment benefits, it’s yet another official declaration from a government agency that the people who drive for Uber have an employer-employee relationship with the company, which in theory should entitle them to benefits that employees receive: reimbursement of vehicle costs, having the employer’s portion of their income taxes paid, and receiving unemployment benefits when their employment with the company ends involuntarily, if appropriate. [More]

freelancers

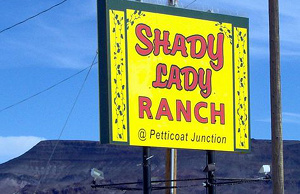

America's First Legal Male Prostitute Quits After Three Months

Markus, the first legal male prostitute in the U.S., hung his shingle at the Shady Lady Ranch in Nevada in January. Since then he’s had “fewer than 10 paying customers” according to the Associated Press (which seems to imply there were some free samples maybe?), so he’s quitting and going back into porn. In other words, there’s a new opening at Shady Lady, gentlemen. Wait, that totally didn’t sound right. [More]

Uninsured Resort To Setting Own Broken Bones

Think you could set your own broken bone? That’s what some of the millions of uninsured people in America end up doing when they need medical care.

10 Tax Deductions For Freelancers

Freelance Switch has 10 deductions freelancers can take. For instance, if you have a cellphone as a second line and primarily use it for business, deduct it. Work from home? There’s the complex but worth it home-office deduction. The “research” category is very useful, especially for journalists and writers. Just about any piece of entertainment can go in there. Hey, you got to keep in touch with the zeitgeist, right?’

Don't Be Fooled By "Limited Benefit" Insurance Plans

If you’re a freelancer, temp worker, or hourly worker, you may have already been exposed to the “limited benefit plan,” a rotten insurance scheme which is designed to rake in more profits for insurance companies by offering low cost plans that provide almost no worthwhile coverage for the consumer.

Claim The Home Office Deduction

If you work from home and/or are self-employed, you’ll likely want to claim the home office deduction on your taxes this year.

How To File Taxes If You're Self-Employed

This moderately difficult tutorial walks the self-employed through the steps of filing taxes.