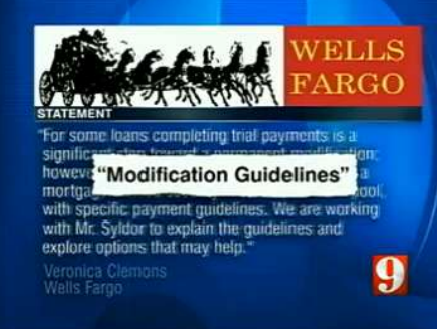

A homeowner in Orlando is confused, and with good reason. He says he not only made his mortgage payments on time to Wells Fargo, but that he sometimes paid early and sometimes paid more than he was supposed to. And yet, the bank decided to foreclose on his home. [More]

foreclosures

New York AG To Sue Bank Of America, Wells Fargo Over Alleged Violations Of National Mortgage Settlement

If the big mortgage servicers thought they’d put a pile of legal troubles behind them when they reached the $25 billion dollar National Mortgage Settlement with almost every state in 2012, they were wrong. Today, New York Attorney General Eric Schneiderman announced his intention to sue Bank of America and Wells Fargo for what he alleges is a ” persistent pattern of non-compliance” by the two banks. [More]

Goldman Sachs, Morgan Stanley Ready To Drop $247 Million In Mail To Victims Of Foreclosure Abuses

Back in January, Goldman Sachs and Morgan Stanley announced a $557 million settlement “for deficient practices in mortgage loan servicing and foreclosure processing.” Later this week, the chunk of that money earmarked for payouts to affected consumers will be going out in the mail. [More]

Some Victims Of Shady Foreclosure Practices Report Trouble Cashing Settlement Checks

As if going through the nightmare of foreclosure proceedings wasn’t bad enough, some of the victims who have been compensated as a result of a settlement between big banks and U.S. regulators can’t even get their darn checks to cash. Most of those borrowers only received between $300 and $500, and have been told their checks were rejected when trying to get their money. [More]

GAO Calls Out Bank Regulators For Mucking Up Foreclosure Reviews

Back in April 2011, in the wake of the robosigning scandal and in light of numerous instances of erroneous seizures, the Office of the Comptroller of the Currency and the Federal Reserve System ordered independent reviews of the foreclosure process at the country’s 14 largest mortgage servicers. Now, two years on, the Govt. Accountability Office is saying these regulators allowed the review process to become inconsistent and overly complex. [More]

Man Buying Foreclosed Homes To Fix Them, Then Sell Or Rent Them Cheap To Save Town

There is no magic solution to the housing crisis that has hit many towns across America, but one man in Carpentersville, Ill. has come up with a very unique way of addressing the situation. In an effort to save his town from becoming a ghost land of empty, foreclosed homes, he’s bought 193 forecolosed home, fixed them up, and either sells or rents them at a discount to locals. [More]

Bank Of America Explains Why It Never Assumed Title To Squatter-Filled Foreclosure

Yesterday, we told you about the California man who said he lost his house to foreclosure but who is being held responsible for the squatters who have moved into his former house because Bank of America has yet to assume the title to the property. Today, we bring you the bank’s side of the story. [More]

Foreclosed-Upon Homeowner On The Hook For Squatters Because BofA Won’t Assume Title To House

Feds Now Letting Big Banks Review Their Own Foreclosures For Errors

Pre-recession banks turned a blind eye to problems with the mortgages they handed out, bundled, sold and securitized. When that bubble burst, these same banks put the foreclosure process on auto-pilot, allowing anyone with a pulse to sign legal documents. So who better to review all those foreclosures for errors than the institutions that didn’t care in the first place? [More]

Eviction Papers Served To Squatter In $2.5 Million Mansion, But He’s Sticking Around For Now

The sheriff finally served an eviction notice to the man who’s been squatting in a Florida mansion worth around $2.5 million. But it looks like the squatter will at least be able to enjoy the Super Bowl and maybe Valentine’s Day in the bank-owned house. [More]

Fannie & Freddie To Let Some Underwater Homeowners Walk Away From Their Mortgages

Since bailed-out mortgage servicers began dealing with the toxic loans made during the housing bubble, the focus has been on people who couldn’t pay their mortgages. Now Fannie Mae and Freddie Mac have an out for people who have continued to pay while their houses have lost value. [More]

Is A Guarantee Really A Guarantee If It’s A “Gurantee”?

The operators of a company that claims, for an up-front fee of $395 and monthly payments of $395, it can keep foreclosed-upon folks in their homes for several more months may be confused about the meaning, and spelling, of the word “guarantee.” [More]

Squatter Takes Over $2.5 Million Bank-Owned Home, Bank Of America Doesn’t Seem To Care

If you’re going to squat, you might as well squat like a rich dude. Just ask the man in Florida who has been enjoying the mortgage-free life in a $2.5 million, 7,200 sq-ft house, all while the owner — Bank of America — appears to be doing nothing to get him out. [More]

CFPB Rules Aim To Protect Homeowners From Inept & Foreclosure-Happy Mortgage Servicers

One week after it announced a new set of rules that require mortgage lenders to prove that borrowers will actually be able to pay back their loans, the Consumer Financial Protection Bureau is unveiling a slew of new rules for mortgage servicers intended to curb some questionable practices and provide more safeguards for all borrowers. [More]

Goldman Sachs, Morgan Stanley Hit With $557 Million Settlement Over Foreclosure Practices

While most of the headlines about abusive or half-baked foreclosure practices have focused on the huge retail banks — Wells Fargo, Bank of America, Citi, Chase, et al. — the big investment banks haven’t exactly been let off the hook. [More]

Deadline For Foreclosed-Upon Homeowners To File Claim In National Mortgage Settlement Is This Friday

It took years to reach the $25 billion settlement between the nation’s largest lenders and 49 states, but affected homeowners were only given months to claim their piece of the pie. [More]

Bank Of America Provided Cheat Sheet To ‘Independent’ Foreclosure Reviewers

Imagine you’re sitting down for an exam and you find that your friend has already filled in the answers with what he believes are the correct answers. Sure, you can change whatever you want but it would also be so much easier to just let your friend’s answers go, so long as you’re generally in agreement. [More]

Homeowner Says He Lost $250K In Equity To Foreclosure

When a property is sold at foreclosure for more than what is owed on the mortgage, the homeowner is supposed to receive that difference. But what happens when the bank sells the home for hundreds of thousands of dollars less than what it is worth? [More]