Marketplace Money took a look at some folks who are selling their possessions on eBay and Craigslist in order to pay their bills. The main interviewee was a former mortgage broker who used to make six figures but was now selling his collection of cool amps to pay off his $5,000 a month mortgage and $50,000 in credit card debt.

foreclosure

Jose Canseco Makes "Mathematical Decision" To Let Mansion Go Into Foreclosure

Was ex-American League MVP and admitted steroid abuser Jose Canseco too busy counting the money from his Major League Baseball tell-all books to remember to pay his mortgage? Nope. When the California market tanked, Canseco made “a mathematical decision” to walk away from his mortgage, says the Wall Street Journal.

How The Candidates Would Address The Foreclosure Crisis

Mark Ireland, former Minnesota Assistant Attorney General, took a look at what the three remaining presidential candidates are saying about the foreclosure crisis and translated their campaign-speak into good ol’ American English.

No Help For 70% Of Homeowners Facing Foreclosure

A new study shows that despite the best efforts of lawmakers and mortgage-service companies, little is actually being done to help homeowners facing foreclosure, says the Wall Street Journal.

../../../..//2008/04/22/marketplace-money-reminds-you-to/

Marketplace Money reminds you to watch out for “rescue scams” and “phantom counseling” when you’re at risk of foreclosure. [Marketplace]

Real Estate Speculation: From A Trailer Park To Foreclosure On 4 Homes

The Minneapolis Star-Tribune has a fascinating article about real estate speculation in Minnesota. The article focuses on Bradley and Sarah Collin, a couple with three children who were living in a trailer park when they were suckered by a local “property management company” that (illegally) paid the couple $20,000 cash to buy 4 houses in a new subdivision.

Life In A Subprime Ghost Town: Not Paying The Mortgage Feels "Great!"

We’ve been hearing tales of suburban McGhost-Towns that were submerged by a tidal wave of foreclosures at the height of the subprime meltdown and are now just sitting there, the lawns turning brown one by one.

Can't Afford Your Mortgage? Walk Away!

We’ve talked about this issue a few times here on Consumerist and now the New York Times has gotten into the act with an article about people who’ve chosen use the new service “You Walk Away” to let the bank take over their mortgages after their homes turned out to be bad investments.

The Administration's New Subprime Mitigation Plan: Take 30 Days To Pack Your Bags

The compassionate conservatives helming our government have an ingeniously simple new plan for homeowners facing foreclosure: take 30 days, pack your bags, and then get the !@#$ out.

Tax Tip: Mortgage Forgiveness Debt Relief Act of 2007

Tax Cat knows that it’s a hard subject, but if your home has been foreclosed there’s something you should know about changes to the tax laws.

America's 10 Most Miserable Cities

Did you know there was an index to measure misery?

Misery is defined as a state of great unhappiness and emotional distress. The economic indicator most often used to measure misery is the Misery Index. The index, created by economist Arthur Okun, adds the unemployment rate to the inflation rate. It has been in the narrow 7-to-9 range for most of the past decade, but was over 20 during the late 1970s.

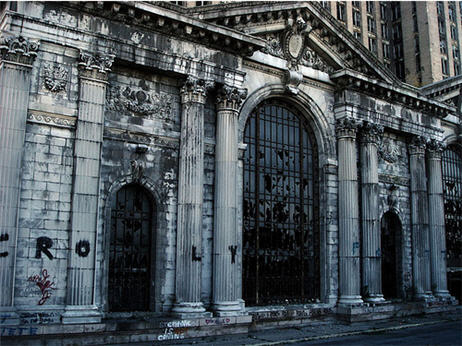

Vacant, Abandoned Housing Is A Blight On Cities

In Cuyahoga County, Ohio there are 17,000 vacant, foreclosed properties. In Baltimore, there are 16,000. These properties sit, unmaintained, with boarded up windows, affecting not just their own value, but the values of homes nearby.

Consumers Are "Unaware" That Lenders Can Help Them Avoid Foreclosure

A new survey from Freddie Mac says that 57% of delinquent homeowners are unaware of so-called “workout” options that could help them avoid foreclosure.

When A House Is A Bad Investment, Is It OK To Just Walk Away?

Here’s one that’s sure to start some intense debate: If you’ve made a bad investment and your house isn’t worth what you thought it was going to be, is it OK to just walk away?

Freddie Mac: Don't Let Fraudsters Steal Your Home

Con artists use publicly available foreclosure notices to find victims for their equity stripping scams.

Another Ohio Judge Halts A Foreclosure

The judge said the foreclosure lawsuit was filed before Wells Fargo owned the mortgage – thus, the suit was premature.

Debt Counselors Feeling The Strain Of Subprime Meltdown

As foreclosures continue to skyrocket, debt counselors have become a last resort—sometimes the only resort—for thousands of panicked homeowners who don’t know how they’re going to keep their homes. “I don’t think people fully appreciate the pressure that’s being put on those counselor organizations today,” says a Housing and Urban Development official. In addition to offering financial advice, the counselors try to help negotiate payment plans with lenders, stave off foreclosure notices, and even offer mental health support for people so distraught that they become depressed or suicidal. The average pay: $30-50,000 a year.