No longer will consumer credit scores be able to get a free ride on another’s credit report; FICO has removed “authorized user” accounts from their calculations.

fico

Capitol One Stops Harming Customers' Credit Scores, Starts Reporting Credit Limits

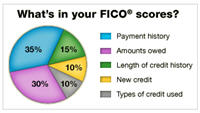

Capital One will start reporting cardholder credit limits to the three credit bureaus, a common practice from which most cardholders had no idea their creditor abstained. Credit limits help TransUnion, Experian and Equifax determine credit utilization, which accounts for 30% of a credit score. Capital One’s decision, which will take effect by the end of the year, will likely boost its cardholders’ credit scores. From the Washington Post:

Your Credit Score Demystified!

Bankrate has an interview with Craig Watts, public affairs manager at Fair Isaac Corp., the creator of the popular FICO credit score. Craig talks about credit myths and strategies for people who are looking to raise their credit scores. Nothing terribly ground-breaking, but we know our readers tend to obsess over their credit scores, so it’s good to get some info straight from the horse’s mouth.

Ask The Consumerists: What Do I Do About Credit Cards I Never Requested?

I’ve gotten two of these unwanted cards in the last 12 months after signing up with two different financial institutions for two different reasons. The first was a mortgage I signed, the second for a business checking account where I was the primary account user. I’ve worked hard all my life to maintain good credit, and I don’t want these things to affect my excellent rating. What should I do now?

Read Beau’s letter and our advice, inside.

Piggybacking On A Stranger's Good Credit To Raise Your FICO Score?

Brian Kinney, 44, a retired Army officer in Glendale, Calif., pulls in more than $2,500 a month by lending out 19 credit card spots on two old Citibank cards with strong payment histories. Kinney, whose FICO score is above 800 on the scale of 300 to 850,

$2,500 a month? What? It’s a good deal for the “renters” too. Just ask this guy:

Estruch paid $1,800 in December for three credit card spots, and by January, his FICO score jumped from 550 to 715. In mid-March, he closed on his four-bedroom beige stucco house after obtaining a 30-year fixed-rate mortgage from a unit of American Home Mortgage Investment Corp. It carried a 7.5 percent interest rate and required no down payment.

Guess what he does for a living? He’s a mortgage broker. Ha! Of course too much of this behavior could cause creditors to take action and change the effect that authorized user accounts have on FICO scores, essentially making them useless to those for whom they were designed. —MEGHANN MARCO

Proper Care And Feeding Of Your Credit Score

The topic of what helps or hurts your credit is a hot one around these parts, but Get Rich Slowly is stepping into the fire with some info about what makes up a credit score and how to properly take care of it.

Upgraded FICO Score To Debut In September

Fair Isaac says that, in addition to better predicting the behavior of subprime borrowers, the new FICO score will do a better job in assessing new accounts and borrowers who have little or no credit histories, such as young people and immigrants.

Most people can expect their score to rise or fall slightly. — CAREY GREENBERG-BERGER

Improved Your Credit Score? Tell Your Car Insurance Company

Since them I received an updated bill and it was $67.50 cheaper (for 6 months)–just based on a new credit check! Obviously if readers credit history worsens, wouldn’t recommend an updated credit check, but for most people, if you don’t ask for the current credit check, you could be losing dollars.

Good tip, Jeff. Insurers compare your credit score to the scores of their other clients and use it as a way to predict how likely you are to have an accident. Apparently, people with similar credit scores have similar driving habits. For more info on how Progressive uses this information, click here. —MEGHANN MARCO

Estimate Your FICO Score For Free

To creditors, you are a walking, talking, three digit number. Creditors use that number, your FICO score, to judge your credit worthiness. A good FICO score can lead to favorable terms, but unless you pay a fee or sign up for a free trial, your score is cloaked in a shroud of secrecy. Until now.

Get Your FICO Score Without Breaking The Bank

Money, Matter, and More Musings has a roundup of stratagems for seeing your FICO score without subscribing to costly services. In case you don’t know, a FICO score is a 3-digit number lenders used to determine your credit worthiness. It’s based on your credit report info.

Intro to Credit Scores And How They Secretly Control You

The info doesn’t really start until 2:00. Ignore the local morning news malarkey. If you find their hijinks hard to stomach, try this two minute bit by Bob Walters of Quicken Loans.

Morning News Roundup: Pigs O’er Manhattan Edition

Verizon Sells Bill Pay Histories To Creditors

New incentive to pay your phone bill on time, Verizon will now provide your bill payment histories to credit report agencies. The practice is becoming common among companies that issue monthly bills.