The new Trump administration has already made one of its first moves, directing the Department of Housing and Urban Development to suspend a recently announced program that would have reduced mortgage insurance rates for a number of new homeowners. [More]

FHA

Wells Fargo To Pay $1.2 Billion To Settle Govt. Lawsuit Over “Reckless” Mortgages

In Oct. 2012, the U.S. Department of Justice sued Wells Fargo, alleging that the mega-bank had defrauded taxpayers by issuing “reckless” mortgages then misleading the Federal Housing Administration about the quality of those loans. Today, Wells revealed that has agreed to pay $1.2 billion to close the book on this issue. [More]

DOJ Sues Quicken Loans Over Improperly Underwritten Mortgages

If you thought that we were done with lawsuits related to the mortgage meltdown, think again. The U.S. Dept. of Justice is suing Quicken Loans, alleging that the lender improperly underwrote hundreds of FHA-insured home loans before and during the housing market crash, resulting in substantial losses for the federal government. [More]

New Homeowners To Pay Less For FHA Mortgage Insurance

In the wake of the devastating crash of the housing market, the U.S. Dept. of Housing and Urban Development was forced to increase mortgage insurance premiums for borrowers with loans insured by the Federal Housing Administration, effectively stopping hundreds of thousands of potential homeowners from climbing the property ladder. With the market stabilizing, HUD is rolling back most of that rate increase for new homeowners in the hope that it will spur more borrowing. [More]

First-Time Homebuyers May Only Need 3% Down Payment, But It Won’t Be A Cakewalk

In October, the director of the Federal Housing Finance Agency announced that the regulator had reached a deal that would allow bailed-out mortgage-backers Fannie Mae and Freddie Mac to sign off on loans with down payments of less than 5%. Today, Fannie and Freddie revealed more details on what it would take for home buyers to be eligible for the reduced requirement, and getting one of these loans won’t be as easy as filling out a form. [More]

Wells Fargo Sued In Illinois For Allegedly Pushing Mortgages On Borrowers Who Couldn’t Repay

Five years on from the nadir of the housing crisis and the lawsuits against the few remaining big banks continue to be filed. This time, it’s Wells Fargo being sued by prosecutors in Cook County, IL (home to Chicago), alleging that the bank deliberately issued “predatory” high-interest, subprime loans to borrowers — primarily minority — who may not have been able to pay back those loans. [More]

Bank Of America’s Compliance With Federal Mortgage Program Being Investigated

While it’s still settling multibillion-dollar tabs tied to the mortgage meltdown, Bank of America continues to face new legal and regulatory pressure. Yesterday, the bank revealed that it is being investigated by federal authorities to see whether it has complied with a program aimed to ease the mortgage-lending process. [More]

Government Shutdown Could Completely Screw Up Your FHA Mortgage Application

As the real estate market still continues to creep up out of the sinkhole that opened beneath our feet five years ago, home buyers have still been able to rely on loans backed by the Federal Housing Administration. But if lawmakers in Washington can’t figure out a way to keep spending money in the very near future, the federal government would effectively shut down, putting pending FHA mortgages at risk of falling through. [More]

Wells Fargo Fails At Getting Federal Mortgage Lawsuit Dismissed

The same day that trial began in the Justice Dept.’s lawsuit against Bank of America, the DOJ had another victory in a similar suit filed last year against Wells Fargo, as the bank failed this morning in its attempt to have the suit dismissed. [More]

Clearer Mortgage Rules, No-Fee Refinances Key To President’s Plan For Middle-Class Housing Market

On Tuesday, President Obama will visit Arizona, one of the states that took the biggest butt-whooping from the housing boot, and one of five states (along with Nevada, Florida, Michigan, and Georgia) that still account for a full 1/3 of the negative equity in the U.S. In a speech in Phoenix, the President will outline what his administration believes are steps that will help give more middle-class Americans a chance at securing a foothold in the housing market. [More]

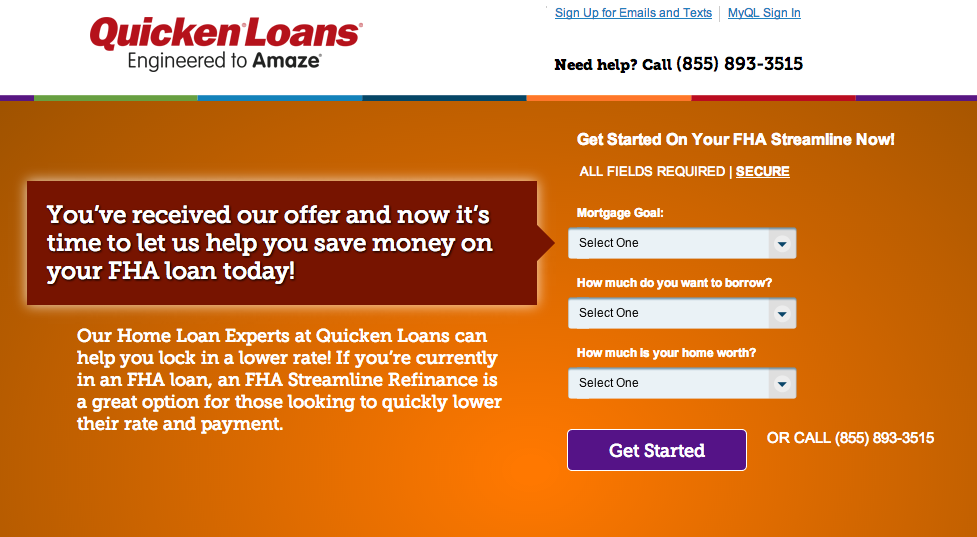

Apply For A Quicken Loans FHA Mortgage: No FHA Products Allowed

The Federal Housing Administration insures mortgages, which makes it easier and more affordable for people to buy homes. That’s good. Quicken Loans happens to be an FHA lender, which is also good. What’s kind of confusing, though, is how the web page where you start your FHA loan application explicitly exempts FHA loans. Sort of. [More]

U.S. Sues Wells Fargo, Accuses It Of Being A Loan Factory Pumping Out Deficient Mortgages

United States prosecutors leveled charges against Wells Fargo yesterday, claiming the bank lied about the quality of mortgages it was working with under a federal housing program. Prosecutors say Wells Fargo defrauded the government for more than a decade, issued mortgages willy nilly and then lied about their condition to the Federal Housing Administration. [More]

Unemployed Homeowners Will Have Longer Before Facing Foreclosure

If you’re unemployed and worried about losing your home, here’s some news that might make your day a little brighter. The White House announced earlier today that all FHA-approved mortgage servicers must extend the forbearance period for unemployed homeowners, currently four months, to one year. [More]

Is The Federal Housing Administration Going To Need A Bailout?

Earlier today a former Fannie Mae exec and the current head of the FHA gave conflicting testimonies to Congress about the health of the mortgage insurer—particularly about whether or not it’s going to require a taxpayer bailout in the next couple of years.

First-Time Home Buyers: Use $8k Tax Credit For Down Payments Or Closing Costs?

BusinessWeek has an interesting article about a little known program that will allow first-time home buyers (technically, those who have not owned a home in three years) to use the 8k tax credit to offset down payments or closing costs.

../..//2009/03/04/looking-for-a-mortgage-you/

Looking for a mortgage? You might want to consider an FHA loan. The New York Times says, “The Federal Housing Administration used to be known as a place for low-income borrowers with tarnished credit histories. But now, it has become a destination for borrowers whose credentials are respectable, but not stellar.” [NYT]

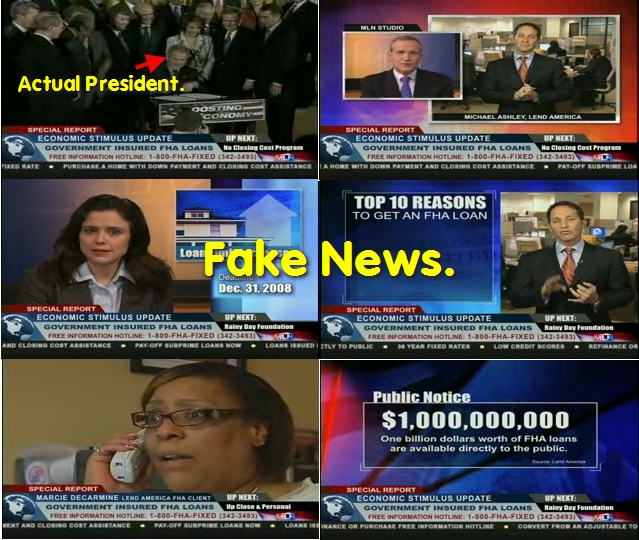

Don't Fall For Mortgage Infomercials Masquerading As "News Networks"

Reader Brian says he saw the above pictured infomercial on CNBC this Sunday, and is wondering how they get away with such a “blatant attempt to take advantage of those same mortgage consumers who where hoodwinked in the first place.”