Before you travel through the sky in the belly of a silver tube at hundreds of miles per hour, wouldn’t it be nice to know which extra fees you might be charged for doing so? Kayak has a great chart for doing just that. [More]

fees

Citicorp Deferred Interest Trap Springs Shut On Man Who Underpaid By $11

I suspect some readers will say that Assefa Senbet is to blame for screwing up one of his final payments to Citibank on a deferred interest loan agreement. They’ll be right–it was his responsibility. But he didn’t skip a payment, and he wasn’t late. In fact, he frequently overpaid in order to pay it off early. Near the end of the loan, however, he sent in a check for $70 instead of $81. As a consequence, he’s now paying off $887 in deferred interest fees at a 30% interest rate. [More]

Merchants Demand Credit Card Fee Relief

Merchants are pushing for more credit card fee reform, for the fees they have to pay. Every time you swipe at checkout, whether it’s a credit or debit card, the merchant has to pay two fees. One is a flat per transaction fee, the other is a percentage of the total sale, called the interchange fee. Those rewards cards you’re so fond of? They have the higest interchange fees. Those rewards and cashbacks don’t come from a magical reward tree, they’re paid for by the interchange fees. In other words, the Quickie Mart is paying for your “free” airline miles. [More]

6 Credit Card Fee Traps To Avoid

Despite the passage of the Credit Card Accountability Responsibility and Disclosure Act (“Credit CARD Act”), there are still fee traps out there waiting to snare you. [More]

Citibank Closes Overdraft Protection Due To Lack Of Overdrafts

We all know that banks offer overdraft protection because it makes them money, not because they want to be kind to customers. Still, it seems weird–or maybe just brutally honest–that Citibank would cancel Corrie’s overdraft protection service simply because she’d managed to avoid any overdrafts since she opened her accounts. [More]

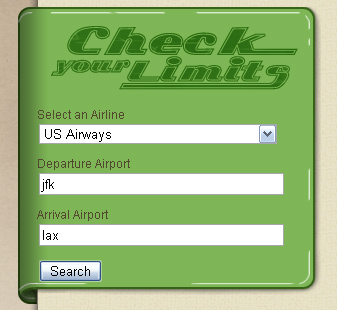

Check Luggage Limits Online And Dodge Baggage Fees

How fat a bag can I bring? The ad-supported LuggageLimits compiles the carry-on and checked baggage rules for 90 airlines. Just enter your airline, ticket type, departure and arrival city and it will tell you if you’re likely to hit any fee turbulence with your luggage. [LuggageLimits via Lifehacker] [More]

Watch Out For Changes To Your Flight Itinerary

Alexandros received an update from Orbitz about his trip and realized that United had changed the time of his flight. For various reasons he couldn’t make the new time, so he was lucky to have caught it—not to mention he could have missed the flight entirely had he not seen the change.

Federal Reserve Proposes Rules On Gift Cards

Here’s your chance to sound off on another consumer protection issue. In accordance with the CARD Act, today the Federal Reserve proposed new rules that would protect consumers from fees and expiration dates on gift cards, and they’ll soon be accepting comments on the rules.

Ally Bank Debits Account Before Customer Verifies That It's Hers

Sometimes a company verifies that a bank account by making a couple of small deposits in it, then asking you to report back the deposit amounts. Don’t rely on that verification process to block any activity in the meantime, though. That’s what Suzette did with Ally bank, and she ended up with a $35 stop payment fee from her own bank.

Congress Investigates Airline Fees In Search Of Tax Revenue

Congress is concerned about the new fees that airlines seem to enjoy piling on their passengers. But not out of any sense of concern for consumers’ wallets. The problem is the lost tax revenue that airports are missing out on when airlines increase their prices through the use of fees instead of by raising fares.

Starting July 1, 2010 Overdraft Fees Will Require Consumer Consent

The Federal Reserve has announced a new rule requiring overdraft fees on one-time debit card transactions and ATM withdrawals to be “opt-in.” The new rule will take effect July 1, 2010. “The final overdraft rules represent an important step forward in consumer protection,” said Federal Reserve Chairman Ben S. Bernanke in a prepared statement. “Both new and existing account holders will be able to make informed decisions about whether to sign up for an overdraft service.”

Don't Let Maintenance Fees Ruin Your Automatic Savings Program

If you participate in an automatic savings program like Bank of America‘s Keep the Change service, where debit card purchases are rounded up and the difference is deposited into your savings account, keep an eye on maintenance fees. James says he was hit with a $5 charge last month because he hadn’t met the minimum monthly deposit requirement of $25: “It turns out that I wasn’t even accruing $5 worth of change per month, so I was losing more money due to the maintenance fee than I was saving via Keep the Change!”

American Airlines And The Tale Of The $100 "Prepaid Baggage Fee"

Reader Jeremy says that his attempts to be polite and have everything taken care of for someone who was doing his organization a big favor were made more difficult by a secret, unpublished “prepaid baggage fee” that American Airlines attempted to charge him.

Is Bank Of America Of Trying To Skirt The CARD Act With New Annual Fees?

In a series of recent posts, WalletBlog has accused Bank of America of breaking the spirit of its “no new fees” promise and of potentially breaking the law next year, after it announced it will introduce annual fees on some existing credit card accounts in 2010.

Citibank To Charge Fees On Checking Accounts

If you’re a Citibank customer who has one of the bank’s two smaller checking account plans—the ones where the monthly fee is waived as long as you use direct deposit or their online bill payment—then maybe it’s time to consider taking your business elsewhere. Starting in February, anyone with an average balance of less than $1500 will be assessed a monthly $7.50 service fee, reports the New York Post.

Expedia Drops Fee For Booking By Phone

This morning, travel service Expedia announced it will abandon its book by phone fee, which it first implemented last May. This makes it the only major online travel agency to not ding customers with a fee for booking flights over the phone, notes consumer travel advocate Christopher Elliott.

Update: Capital One: Waive Your Rights, Get $10 Off Your Next Overlimit Fee!

Here’s the straight scoop on what’s up with the story in that “Capital One: Waive Your Rights, Get $10 Off Your Next Overlimit Fee!” post.