When you swipe your plastic overseas those currency conversion charges, usually 1-3%, can really add up. So here’s some cards that have no foreign exchange fees at all. [More]

fees

Wells Fargo Hits Girl With Secret Fee Trifecta

Christina is broke as a joke. Wells Fargo doesn’t think this is funny and decides to shut down her account for having no money in it and no activity on it. No big whoop, she’ll just open another account. She does this twice. Then, whups! Those accounts were never closed! And we’re charging you fees because they were actually fee-based savings accounts! And you’re in collections! Good times, let them roll: [More]

When Target's '2-Day Shipping' Really Means 5 or 6 Days

Shipping estimates for many online sellers come from realms in which the customary rules of math do not apply. Not only do ends of business days and weekends tack on time to shipping estimates, but additional bonus days tend to pop in as well. [More]

Pick A Bank That Won't Screw You

Shopping for a bank but don’t want to get dinged with fees or unfair practices, but not totally sure you know what they all are? Those banks can be darn creative, after all. Here’s a great online guide that takes you step by step through all the practices you should watch out for. Complete the worksheet and you’ll have a good idea of whether you should stash your cash there or not. [More]

Verizon To Charge You $3.50 To Pay Your Bill

Starting October 16, all Verizon Communications landline, FiOS, and DSL customers will have to pay a $3.50 fee if they pay their bills by credit or debit card. (Currently there are no plans to apply to same to wireless customers). The only way to get around it is to sign up for auto-billing. Verizon says the new fee is because they have a new vendor for processing credit and debit transactions, and they’re passing on the lack of savings to you. [More]

When Automatic Payments Won't Stop

Here’s what you need to do when a vendor won’t stop billing your bank account automatically after you ask them to quit it. [More]

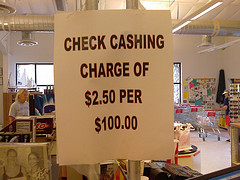

Reporter Lives For Month Without A Bank, Fee Orgy Ensues

As an experiment, an AP reporter tried to live for a month without using a bank so she could get a taste of how people who can’t get an account, or choose not to, live. She discovered fees and confusion galore, and found that it would end up costing her $1,100 a year just to spend her own money. That’s not even counting the cost of standing in “Soviet-style” lines in grungy check-cashing places to cash her paycheck alongside the great unwashed, and unbanked. Overall, depressing, anxious, and time-consuming experience [More]

Cleveland Looking Into $5 Pedestrian Fee At Browns Tailgating Lot

Yesterday, we brought you the story of Cleveland Browns fans being charged a $5 pedestrian fee just for walking into a parking lot used for pre-game tailgating. Unfortunately for the company that owns and operates that lot, one of the pedestrians they hit up for the fee also happens to be a city council member. [More]

Carnival Cruise Line Now Charging Fee For Good Steak

There once was a time where the price of a ticket on a cruise ship included on-board food. Eventually, cruise operators began adding specialty restaurants, where passengers paid more for foods not on the menu in the main restaurant. And then in 2008 we brought you the story about Royal Caribbean charging passengers a $14.95 surcharge for an “organic” NY strip steak that may not have been organic after all. Now comes a report that Carnival Cruise Line thinks its best steak and lobster dishes merit an $18 fee. [More]

Consumer Reports Finds The Absolute Worst Credit Card

Think your credit card is bad? Check out this specimen that our sister-publication, Consumer Reports, says is the absolute “worst credit card.” [More]

Cleveland Browns Fans Charged $5 Each To Stand In Parking Lot

Given the team’s 1-3 start to the season, Cleveland Browns fans probably need a drink or two before settling in for a game at Browns Stadium. But that proposition just got a little pricier for those cheapskates who thought they could save a little money (and gas) by walking to the tailgate lot. [More]

U.S. Airways Gives Employees Misinformation About 'Mad As Hell' Petition

In September, a combination of advocacy groups banded together to launch the Mad As Hell petition in an effort to alert regulators about consumers’ dissatisfaction with the trend of charging fees for just about everything that used to be included in the price of an airline ticket. But if you ask U.S. Airways, they’ll say it’s the people that they hint may be behind the petition who are really the greedy ones. [More]

Bar Charges Me Twice For A Drink, I Get $126 In Overdraft Fees

Freddy watches his balances like a hawk, so he was surprised when TD Bank hit him for $126 in overdraft fees. Turns out the bar he had gone to had accidentally charged his debit card twice for one of his drinks, and though he was careful to stay within his low balance, it set the stage for a cascade of fees. [More]

Priceline Promised No "Young Renter Fee," But Avis Says Pay Up

When Lauren reserved a car rental through Priceline last week, she checked out the fine print to see if she’d have to pay any age-related extra fees, and according to Priceline what she bid would be the total price. Now Avis is telling her Priceline is wrong and she’ll have to come up with more money at the rental counter. [More]

Chase Approves Transaction Anyway After Customer Declines Overdraft Protection

Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

How Do Airlines Compare On Fees?

It’s hard to keep track of all the extra fees airlines have invented to pad a ticket purchase, especially since they keep introducing new ones; USA TODAY says revenue from added fees have jumped nearly 16% from a year ago. The newspaper reviewed fees from 13 airlines in the U.S. and compiled this handy reference chart of current fee schedules, to make comparison shopping a little bit easier. As expected, Southwest continues to be one of the best values. [More]