Wells Fargo is meeting today at noon with the Philadelphia homeowner who “foreclosed” on them, The Consumerist has exclusively learned. Patrick says he “received a call from upon high” late yesterday and that he now has an appointment, “with a very senior Wells Fargo person.” It will be interesting to see how this plays out. But how did Patrick go from embattled and ignored homeowner to seated across the negotiating table with leverage? I spoke with him to find out more about both how and why he did what he did. His story is an inspiration to anyone who’s dreamed of going toe-to-toe with the big banks and winning. Turns out that armed with persistence, and a little legal know-how, Davids can take down Goliaths. [More]

fees

Wells Fargo Meeting Today With Philly Homeowner Who "Foreclosed" On Them (Here's How He Did It)

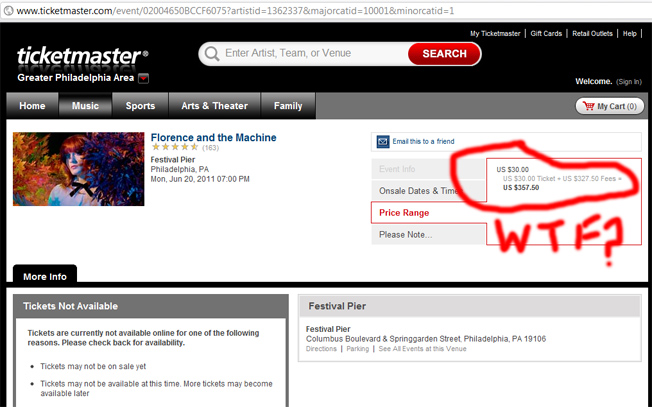

Ticketmaster Charges $327.50 In Fees For One Florence And The Machine Ticket?

Ticketmaster is known for getting away with charging high service fees for its tickets thanks to its effective monopoly over the concert business, but reader Mark noticed a fee that really takes the cake — and smashes it! Right now a ticket for a Florence and the Machine show is showing up as having $327.50 in fees. Talk about a kiss with a fist! [More]

Watch Out For Bank Of America's 'Check Image Service Fee'

Joseph is a longtime customer of Bank of America who has always had a fee-free banking experience. Then he noticed an unfamiliar $3 fee on his account called a “Check Image Service Fee.” He hadn’t heard anything about this, so he signed on customer service chat to find out what it was all about. It turns out to be a fee for having printed images of your canceled checks on a paper statement. Really, the fee is intended to encourage customers to stop receiving paper statements in the mail. [More]

Philly Homeowner Declares He's 'Foreclosed' on Wells Fargo

Frustrated with Wells Fargo Home Mortgage, a Philadelphia homeowner took the bank to court under the Real Estate Settlement Procedures Act and won a $1,000 default judgment because it wouldn’t answer his formal questions about a dispute. The bank blew him off, so the man got the sheriff to schedule a sale of contents of a Wells Fargo Home Mortgage location to pay for the judgment and $200 in court and sheriff’s fees. [More]

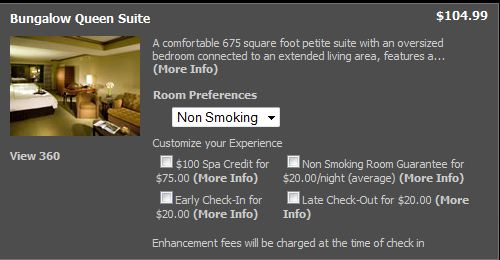

Would You Pay $20/Night To Guarantee A Non-Smoking Room?

You can almost imagine the moment when some executive at the MGM Grand in Las Vegas was walking by the check-in counter and heard an employee ask a guest, “Will that be smoking or non-smoking?” And in that moment, yet another idea for a tack-on fee was born. [More]

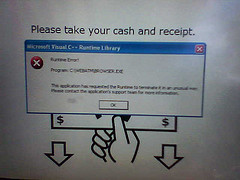

Wells Fargo ATMs Crash Across The Country

Most of Wells Fargo’s 12,000 ATMs crashed starting Monday afternoon and lasting several hours, reports the Star Tribune, and no one knows why. [More]

100 Students Removed From Ryanair Flight Over Baggage Fee Fracas

The scene of student revolt on a Ryanair plane was like something out of Berkeley in the ’60s… Except it wasn’t about the Vietnam war, it was about baggage fees. So okay, it wasn’t exactly like Berkeley, but there were a bunch of pissed-off college students. [More]

Updated: Buy Gas From Shell Last Weekend? Check Your Card For Double Billing

If you filled up with gas from Shell on Saturday, January 29 2011, (update: readers report double-billing throughout the whole weekend and Shell says they’re looking to expand the affected time period) and paid with plastic, you should check your card statement to see if you got double-billed. StorefrontBacktalk got hold of a confidential memo which said that a telco outage resulted in 401,120 double-billed transactions having to be reversed for a total of $12,135,608.19 in refunds. While the reversals should be automatic, some people with low balances did get charged overdraft and other fees because of the mistake, fees they should not have to pay [More]

Get Your Airline Ticket Changed For Free Because Of Massive Midwest Storm

The Superbowl of storms is headed for the Midwest with 20″ snow and 45 mph winds predicted for Chicago. Thankfully, a lot of airlines are waiving their usual ticket change fees for travelers who could be affected. 3,000 flights have already been canceled in advance of the potentially deadly weather. Don’t go to the airport to see if you can make your flight, don’t get stuck in an airport, stay home, stay over at your friend’s house an extra day or two, and take advantage of this leniency. Here are links to the various airlines and their waiver and winter update pages and policies: [More]

The 8 Least Evil Banks In America

Banks that aren’t evil? Really? CNN Money rounded up eight American banks that might not be consumer paradises, but offer free checking, no ATM fees, and comparatively high interest rates for savings accounts. [More]

Bank Of America To Charge Fee To Some For Making Mortgage Payment Within Grace Period

Bank of America is making an 11th-hour push for inclusion in the upcoming Worst Company In America tournament. Starting in February, folks with BofA mortgages who don’t have BofA bank accounts will see their current 15-day grace period for making payments cut by 40%. [More]

What New Airline Fees Could Be On The Horizon?

Parents of young children: Have your wee ones been getting a free ride on domestic flights by sitting on your lap? Well that luxury is just one of several things the airline industry is considering slapping a fee on in the near future. [More]

BofA Tests New Checking Accounts With New Fees

Bank of America is trying out a new system of checking accounts with new rules—and new fees for breaking them. [More]

More New Debit Card Fees Loom

Banks are making less money when you swipe your credit and debit cards because of new caps on interchange rates, the fee that they charge to process each of these transactions, that go into effect on July 1st. They have to make the money up somehow! We’ve seen new fee-incurring tripwires on checking accounts, and now they’re dreaming up even more fees for debit cards. Here’s what’s on their wishlist: [More]

The Time Warner Cable Tech Will Show Up On Time… If You Pay $190/Month

Tired of waiting for the cable guy (or gal) to not show up during the vague four-hour block you’d been given when you made the appointment? Thankfully Time Warner Cable is about to start a premium service that will let the cable tech blow off a more specific appointment for just $189.95 a month. [More]

Man Lets House Go Into Foreclosure Over $25 Fee

I think this qualifies as cutting off your face to spite your nose.

UPDATE: It seems our reader may have the last laugh, letting the house go into foreclosure, then buying it back at a discount.