CNN asks some money experts for tips on how to teach kids about personal finance. Laura Levine, the executive director of Jump$tart Coalition for Personal Financial Literacy, says she uses a special piggy bank for her 3-year-old son—it has four chambers, “one for saving, one for spending, one for donating and one for investing,” and helps teach him that money is not just for “one thing.”

education

Sallie Mae Stops Student Loan Consolidation, Will No Longer Pay Origination Fees On Stafford Loans

Consolidation loans are no longer profitable for Sallie Mae, so it’s saying goodbye to them. SmartMoney points out that ultimately this shouldn’t matter for students taking out new loans, since the original point of consolidation—converting lots of variable rate loans into a nice predictable fixed rate loan—is no longer relevant (all federal student loans are now disbursed with fixed interest rates.) SmartMoney says if you still have variable rate loans you need/want to consolidate, check out the government’s consolidation offering—”You’re likely to pay the same consolidation rates you’d pay if you did so with Sallie Mae,” they write.

AT&T Says It Can't Find Enough Skilled US Workers To Fill 5,000 Jobs

Here’s some depressing news. AT&T’s CEO says his company is having trouble finding enough skilled workers in the United States to fill the 5,000 jobs he promised to bring back to this country.

../../../..//2008/03/13/wondering-where-the-tax-money/

Wondering where the tax money you pay into the NYC public school system is going? Well, part of it goes to pay the salaries of about 700 teachers who are forced to sit in special rooms that are located all over the city. All day. And do nothing. Sometimes for years at a time. [Rubber Room via BuzzFeed]

Student Stripped Of Title, Suspended Over Contraband Candy Purchase

As some schools districts whore themselves out to corporate sponsors in a desperate attempt to raise funds (hey, we sympathize with them, but it’s still whoring), others are enforcing a zero-tolerance policy against unwelcome intrusions. In New Haven, Connecticut, the school district banned candy sales in 2003 “as part of a districtwide school wellness policy,” and when an 8th grade honors student was caught buying a bag of Skittles from a classmate two weeks ago, he was stripped of his title as class Vice President and suspended for a day.

Hey Kids, It's National Consumer Protection Week!

Uhh, apparently this week is National Consumer Protection Week, which is supposed to “highlight consumer protection and education efforts around the country.” Translation: the government put up a mini-website from, like, 1976, with a page of links and some banners for the taking. That’s fine with us—we’ll just claim the other 51 slots as National Consumerist Weeks.

South Carolina Will Place Ads Inside School Buses

South Carolina will begin selling ad space inside their public school buses—11-inch strips above the windows are now for sale, and “Interested school districts get about $2,100 per month per bus.”

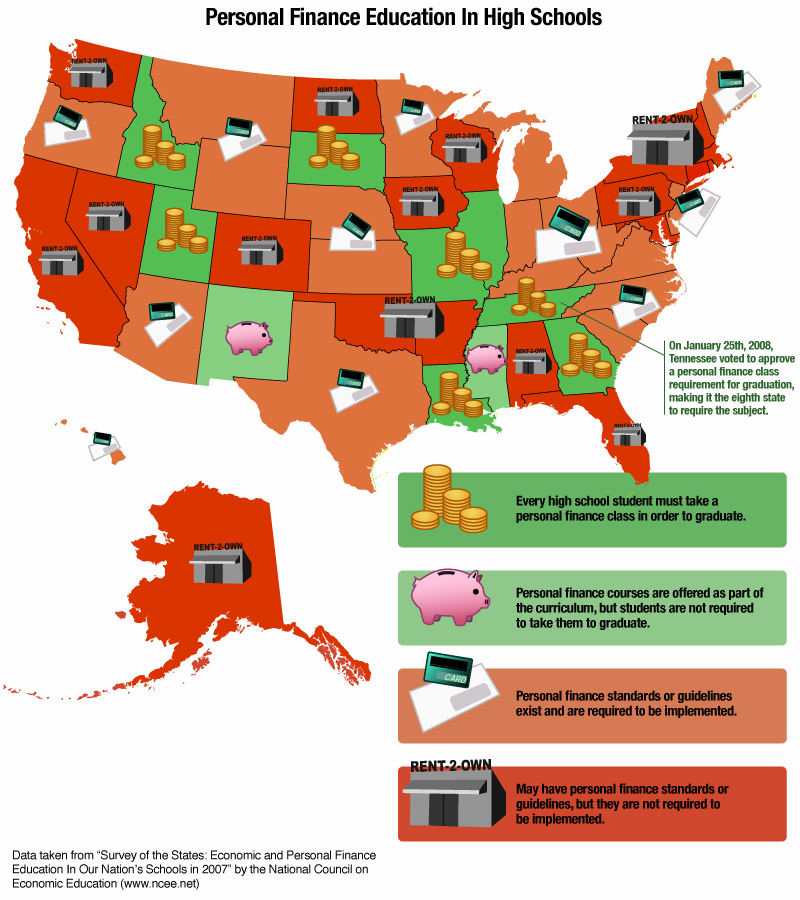

Report Card On Personal Finance Education Nationwide

Less than a week ago, Tennessee voted to require a personal finance class of all graduating high school students, starting with this year’s seventh graders. Unfortunately, less than 20% of states have similar requirements. We’ve made a fancy-schmancy graphic to show which states are teaching tomorrow’s citizens how to manage money, and which states are likely to be great places to set up payday loan shops. Inside, see the chart nice and big.

../../../..//2008/01/18/now-that-salliemae-buy-out-deal/

Now that SallieMae buy-out deal has crumbled and they’re facing much higher borrowing costs due to the subprime fiasco, the unpopular student lender will shed 3% of its workforce, or 350 jobs, mostly CSRs at their call centers.

Tennessee May Soon Require Financial Literacy Classes For High School Students

The Tennessee State Board of Education is expected to pass a bill on January 25th that will make Tennesee the eighth state (after Georgia, Idaho, Illinois, Louisiana, Missouri, South Dakota, and Utah) to require that its high school students take a personal finance class before graduation.

Don't Forget To Claim Your Student Loan Deduction

If you paid on student loans last year, don’t forget that you can deduct the interest paid up to $2,500 as long as your parents don’t claim you as a dependent, writes Kiplinger. “You can deduct up to $2,500 in student-loan interest paid in 2007 if your income for the year was $55,000 or less if single, or $110,000 or less if married filing jointly.” If you make under $70k single or $140k married, you can still take a partial deduction.

Sallie Mae Will Make Fewer Student Loans In 2008

Student loan lender Sallie Mae said today it plans on making fewer loans in the future “in the wake of federal legislation last year to reduce subsidies for student lenders,” reports Reuters.

Freddie Mac's Fraud Video Warns Borrowers

Freddie Mac produced this video to educate borrowers who face foreclosure about a fraud scheme where “a con artist will seek out a public notice of foreclosure and approach the potential victim with documents and the promise of sorting out the debt,” thereby tricking the homeowner into signing over the deed to the house.

Ohio Study Provides Snapshot Of State Of High School Finance Education

Now that Ohio has made personal finance basics a mandatory requirement to graduate from high school, people are starting to look at the problem of who teaches it and what it consists of (just look at the comment threads in the two related posts below to see the wide spectrum of opinions and personal experience anecdotes). A new Ohio State University study has found that the current level of teaching is all over the place—and the people teaching it have widely varying levels of knowledge about the subject matter.

"Checkbook Math" Being Phased Out Of High Schools

We may indeed have a nation of financially illiterate youths, but despite cries for increased financial education in public high schools, the one program that’s historically addressed this—“checkbook math”—has never enjoyed a reputation as a “real” math class because the actual math skills involved are so basic, and it’s being phased out as most students avoid it because, as one student says, it “doesn’t look good for colleges.”

How To Go To College For Free

Want a college education but don’t want to go into debt over it? If your interests happen to coincide with the specific curricula at certain “tuition-free” schools, you might actually be able to get away with it. “There are only a handful of such schools in the U.S., which is one reason they are often overlooked by students, parents, and high school guidance counselors during the college search,” says a senior policy analyst at the College Board.

../../../..//2007/11/13/starting-in-2010-high/

Starting in 2010, high school students in Ohio will be required to take a personal finance class before graduating. [WTOL11]