Because of there being no data on where the money was going and a general attitude of pumping as much money into the banks as quickly as possible, billions of US bailout money wound up in the coffers of foreign financial firms, a watchdog panel chaired by Elizabeth Warren – Warren for CFPA head! – found. 43 of the 87 banks that benefited as a result of the of the AIG bailout were foreign. [More]

economy

Turns Out Walmart Is Quietly Raising Prices

Everyday low prices just got a little higher. A JPMorgan Chase study of a Virginia Walmart (hey, it’s a big store, you gotta just pick one to do a decent survey of its inventory) found that in the past six weeks the retailer raised prices on overage of 6%, but on some products, as high as 60%. [More]

48% Of Those Planning To Quit Once The Economy Improves Say It's Because They No Longer Trust Their Bosses

1/3 of working Americans say they’re going to try to find a new job once the recession is over, and 48% of that group cited losing trust in their employer as being the primary factory, according to a new study. [More]

Fed Votes To Buy Up Treasuries, Keep Mortgage Rates Low

The Fed voted Tuesday to reinvest expiring mortgage-backed securities by putting the money into longer-term Treasuries. That, and the decision to keep rates at 0 to 1/4 percent, should keep mortgage rates low. Here’s the full statement following their coffee klatsch: [More]

Before I Strategically Default, Can I Get A New House? Pwease?

Old news: homeowners strategically defaulting on their loans. New news: They first want to get financing for a new house. [More]

Stocks Rise, Betting Feds Will Vote To Buy More Mortgages And Treasuries

Markets edged upwards Monday, betting that the Federal Reserve will vote tomorrow to inject more money into the system by buying up more mortgage-backed securities and Treasuries. [More]

After 99 Weeks Of Unemployment, Still No Job

The NYT has a profile of a woman who has passed the 99 weeks of unemployment benefits and is now essentially homeless, living in a motel paid for with charity from friends. In 2008 she had a good job and was going to business school. Now she’s on food stamps and making ramen in a motel ice bucket. [More]

Oops, You Didn't Buy A House, You Bought Its Worthless 2nd Mortgage, And Now It's In Foreclosure

A couple thought they were snagging a $97,606 foreclosure fixer upper at a courthouse sale, only to find out months later they had actually bought its worthless second mortgage. The original was in arrears, and now the house would be sold at another courthouse auction. [More]

You Have Nine Years To Build A House In Tampa

Want to build the home of your dreams and can’t find enough land for it? Try moving to Tampa. The area has 27,923 building lots, enough to keep homebuilders busy for nine years. That’s assuming anyone actually wants to build something, of course. [More]

More Than 40 Experts Issue Call For More Government Stimulus And Tax Credits

Online news site The Daily Beast is apparently tired of this whole “floundering economy” thing, so it got more than a dozen economists and historians to come together and issue a manifesto yesterday calling on the U.S. government to “reboot America.” By the end of the day, the number of experts supporting the manifesto increased to more than 40. They argue that the government has to help return lost purchasing power to the unemployed and must use tax cuts and stimulus to boost overall demand, or we’ll never make it out of this slump. [More]

Rich People: More Likely To Default On Mortgages Than You Are

Are you a fancy person? Then you have a 1 in 7 chance of defaulting on your mortgage, says a new study of data compiled for the New York Times. Those of you with mortgages of less than a million dollars only have a 1 in 12 chance of defaulting, the paper says. [More]

30-Year Mortgage Rates Drop To Record Low 4.57%

Rates on 30-year mortgages fell to 4.57% this week amid falling new home sales and increasing joblessness. It’s the third straight week that mortgage rates have dropped, and they’re the lowest since Freddie Mac started keeping track in the 70’s. [More]

Jobs Report Out: 125,000 Pink Slips, Unemployment Falls To 9.5%

The much-watched Department of Labor’s jobs report came out today, and while it ain’t pretty, it ain’t ugly enough to make you stay home from the dance either. [More]

Filibuster Scuttles Jobless Benefits Restoration For Third Time

Happy Fourth of July weekend! To help you celebrate Independence Day, which includes independence from the government dole, a Senate filibuster has successfully prevented unemployment benefits from being extended for 1.3 million out of work citizens. [More]

HOA Board Member Says They're Not All Money Grubbing Scumbags

Yesterday we wrote about how in Texas, there’s been a bit of a spree of homeowner’s associations (HOAs) foreclosing on people’s houses over just a few hundred in late dues, then selling the house to themselves and turning it around for a juicy profit. And now, the other side of the story. Robert is an HOA board member in Texas and while his association does sometimes foreclose in order to collect, there’s more to the situation than meets the eye. Here’s his take: [More]

HOAs Foreclose On Homes Over $500 In Late Dues Then Flip For Personal Profit

In Texas, Homeowner’s Associations (HOAs) are on a foreclosing spree, selling members’ homes on the courthouse steps for just a few thousand dollars simply because they are a few hundred dollars behind on their homeowner’s dues. Sometimes they’re even selling it to HOA board members, who turn around and sell the house for half of what it’s worth, netting a tidy profit. [More]

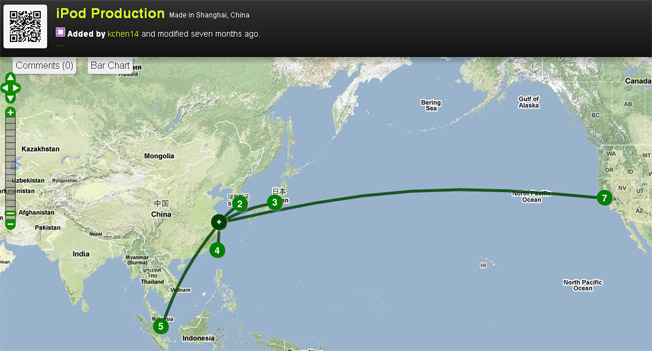

Who Made The Lead In My Kid's Bed?

What happens when you want to trace down which manufacturer is responsible for the lead on your kid’s Thomas the Tank Engine, and make sure you dispose of and don’t buy any other products associated with that maker? Or the melamine in your dog’s food? Or the antifreeze in your toothpaste? It can be hard to find out. Global supply chains are vast and sometimes impenetrable. For instance, your IKEA Sultan Alsarp bed is made in China (not Sweden) and contains parts from Africa, Germany, and Russia. Enter Sourcemap, a open-source MIT project that aims to find out “Where does all the stuff inside your stuff come from?” [More]

Savings Rate Goes Up, But Spending Doesn't

As a nation, we saved more of our paychecks last month than any time since last September–nearly 4% of income went unspent. That worries economists, because it means we’re not spending at a high enough rate to support an economic recovery. But as the Washington Post notes, since unemployment remains high and most of the recent wage growth came from the government, consumers aren’t exactly comfortable with buying something shiny and new just because it’s on sale. [More]