Under the Fair Credit Reporting Act, companies – and lenders – are allowed to access credit reports only for “permissible purposes,” like determining if a person is creditworthy. But federal regulators say a Florida-based subprime credit reporting company illegally obtained tens of thousands of consumers’ credit reports for use in marketing materials for potential clients, including payday lenders.

disputes

The Country’s Two Largest Debt Buyers Must Refund Consumers $61M Over Illegal Collection Practices

Encore Capital Group and Portfolio Recovery Associates are two of the biggest names in the debt-buying game, and according to federal regulators they have often used deceptive and harmful tactics to collect their newly acquired debts. Now, as a result of these actions, the companies must refund consumers $61 million and pay $18 million in penalties. [More]

Dish, Sinclair End Broadcast Network Blackout… For Now, At Least

Dish’s latest contract fight with the networks it airs has wrapped up much more quickly than usual: less than a day after nearly 130 Sinclair channels went dark on the satellite provider, the local channels are back on in 5 million subscribers’ homes. At least, for now. [More]

Hundreds Of Local Channels Go Dark For Millions Of Dish Subscribers In Latest TV Blackout Fight

Dish Network subscribers may have a hard time getting their local news and weather today along with some of their favorite network programming. A contract dispute between the satellite TV company and one of the biggest network owners in the country has resulted in one of the biggest TV blackouts to date, with 5 million viewers losing access to nearly 130 channels. [More]

Fox News Returns To Dish Network After New Contract Ends Blackout Dispute

Consumers don’t usually see all the ins-and-outs of TV negotiations, except when a contract expires and a channel wants more money than a provider is willing to pay. When the fight gets bad enough, the parties go nuclear and a channel gets blacked out. Fox News viewers who subscribe to Dish have seen — or rather, not seen — that blackout up close and personal for the last three weeks, but the feud between the two is now over. [More]

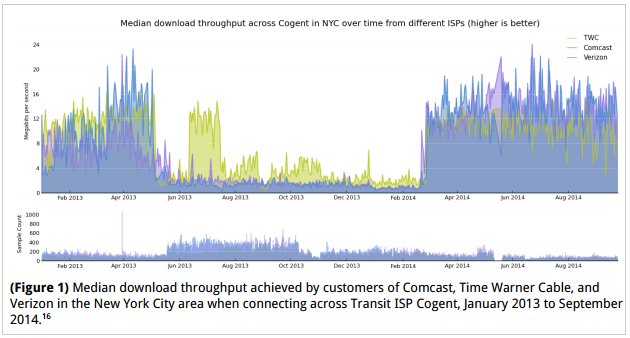

Study Finds Internet Congestion Really Is About Business, Not Technology

Various enormous corporations have this year been at each other’s throats over how well or how poorly internet traffic travels through their systems. A new report indicates that some of the mud-slinging this year is true: interconnection, or peering, between ISPs is why end-users are getting terrible internet traffic. But, they say, it’s business, and not technology, that’s making your Netflix buffer. [More]

If You’re Unhappy About Comcast Charge, Don’t Pull Gun On Service Tech

While we disagree with some who think that Comcast is an admirable company, we certainly don’t advocate using a gun to resolve your disputes with the cable company. Apparently our talk-it-out ways are not shared by a New Mexico woman who is accused of pulling a gun on a Comcast tech following a dispute over unexpected charges for a service call. [More]

After 10 Years Of Selling, Why I Swore Off eBay

After having used eBay for 10 years, Daniel has vowed to never do it again. “If I have something I know I can sell on eBay,” he wrote in a letter to eBay executives, “I’ll give it away before listing it.” Why is Daniel so steamed? [More]

EECB Saves The Day When Scammer Disputes Chargeback And Wins

Lee’s teenage son has a debit card, and he didn’t sign up for any credit monitoring services or ask for mysterious entities to call his cell phone 15-20 times every day. When the mysterious credit monitoring service charge showed up on his bill, his father disputed the charge and thought that was the end. The company disputed the dispute and got their charge reinstated. What now? As a Consumerist reader, Lee knew what to do. [More]

Man Forced To Eat Own Beard In Botched Lawnmower Sale

Two men are being sentenced for cutting off another man’s beard and demanding at knife and gunpoint that he eat it because they thought he was cheating them in a used lawnmower sale. [More]

Hyatt Charges Asthmatic Woman $250 For Smoking, Says It Has Secret Photos

A woman who stayed at a Hyatt in Milwaukee last month was hit with an extra $250 charge for smoking in her room. The problem, she says, is that she has severe asthma–she offered to show Hyatt her prescriptions–and is not a smoker. When she complained to Hyatt, the hotel’s director of operations told her “the Hyatt had photographic evidence of smoking in the room and would absolutely not refund her money.” [More]

PayPal Says Man Owes Nearly $300 For Dispute That He Won

Kentaro already went through a dispute resolution with PayPal for an HTC Droid Eris he sold on eBay. He says the reason for the dispute no longer exists, and anyway, he won and that was supposed to be the end of it. But now he owes $287, according to PayPal. [More]

Help, Expedia Sold My Chargeback To A Collection Agency!

Ed and his wife successfully filed a chargeback against Expedia for a canceled trip earlier this year. Now he’s being dunned by a collection agency for the amount that Amex refunded him. [More]

T-Mobile Changes Mind, Lets Family Off The Hook For Stolen Phone Charges

Yesterday I posted about Zeb, a special needs guy whose phone was stolen shortly before Christmas. Between then and when his family found out about the theft and reported it to T-Mobile, the thief had made $6,000 in international calls and texts–and T-Mobile wanted Zeb’s family to pay $1,500 of that.

Today I received word from Zeb’s dad that T-Mobile has changed its mind and won’t hold Zeb or his family responsible for the bogus charges. His email is below.

Best Buy Bans Visa Contactless Payment Over High Fees

If you buy something with your Visa card at Best Buy, you’ll have to go the old fashioned route, comparatively speaking, and swipe it. Visa demands that contactless payments have to be signed, which is more profitable for Visa but not for Best Buy. Visa refused to change their policy, so Best Buy says it will no longer allow customers to pay that way, reports StorefrontBacktalk. Mastercard doesn’t ban PINs on contactless payments and will continue to be an option. [More]

Police Drop Theft Charges Against Pub Non-Tippers

Police in Bethlehem, Pennsylvania, are withdrawing charges against the two college students who refused to tip at a pub last month, says The Morning Call.

Costco Bans Coca-Cola

A dispute over pricing has led Costco to stop selling a number of Coca-Cola brands, which means all Coke varieties as well as Sprite, Squirt, Dasani water, and Full Throttle energy drinks, reports the Associated Press.

How A Disputed Item On Your Credit Report Can Screw Up Your Home Loan

Thanks to federal regulations, when you dispute an account on your credit report and the dispute is resolved in your favor, the credit reporting agency is required to remove or correct the account. Credit reporting agencies often don’t do this, though, and the Washington Post notes that it can come back and interfere with your next home loan application.