Apple just swung the banhammer pretty hard at Molinker, a development company, after a customer named Patrick Timney pointed out that the majority of reviews on Molinker apps were fake. Until yesterday, the company had 1,011 apps on the App Store, mostly easy-to-knock-out travel guides for 99 cents each. Now they’re all gone, and Apple’s VP Phil Schiller told iPhoneography, “Yes, this developer’s apps have been removed from the App Store and their ratings no longer appear either.” [More]

dishonest

Teavana Salesperson Throws Involuntary Tea Party

When you think of “boutique tea,” you probably don’t associate it with obnoxious upsells and sneaky add-ons. If you do, perhaps you’ve visited the same Teavana outlet as one of our readers. Michael was so annoyed with his recent visit to the Willow Grove, Penn. store that when he realized what had happened, he had to share it with Consumerist over a nice cup of white needle tea.

Brookstone Clerk Tries To Sneak Warranty Into Sale

Clearly Brookstone doesn’t spend enough time training its employees to be dishonest, because this airport Brookstone clerk did a terrible job at trying to sneak a $4 warranty onto Nadav’s father’s purchase. She even admitted to the act when confronted.

Dish Network Adds 22 Channels, Issues Bragging Press Release, Then Yanks 15

Want to convince people you offer as much HD as DirecTV without, you know, having to actually do it? Add 22 HD channels, issue a press release bragging about it, then yank 15 of your older channels while the press isn’t looking. That’s what Dish Network did according to TVPredictions.com:

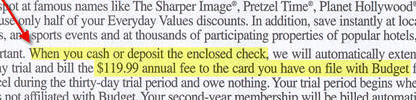

Budget: Cash This Check And You'll Be Enrolled In A Service You Don't Want

Reader Larry writes in with a complaint about a commonly used “scam.” We call it a “scam” because we believe it’s misleading and designed to take advantage of people who do not read things carefully, but you judge for yourself. Here’s how it works:

Capital One’s Credit Trap

Way back when we were 19 years old and getting our first credit card, Capital One sent us a pre-approved card with a $500 limit. Yippie! We soon found out that no matter how early we sent our payment in, we always got a late fee. Every. Single. Month. After writing letters and causing a fuss, we cancelled the card. Imagine our suprise when, so many years later, reader Tim sends us a Business Week article explaining how and why Capital One uses various tactics to increase fees. In this case, it’s over limit fees, but the whole deal sounds very similiar to the problems we had with Capital One back in ’99.