Just like one of those action movies where a federal agent gets paired up with a small-town sheriff who knows all the bad guys in the area, the Federal Trade Commission has brought its crackdown on abusive debt collectors to New York and partnered with the Empire State’s attorney general to shut down a pair of unsavory operators. [More]

debt collectors

Debt Collectors Paying To Use Prosecutors’ Letterheads To Get People To Pay

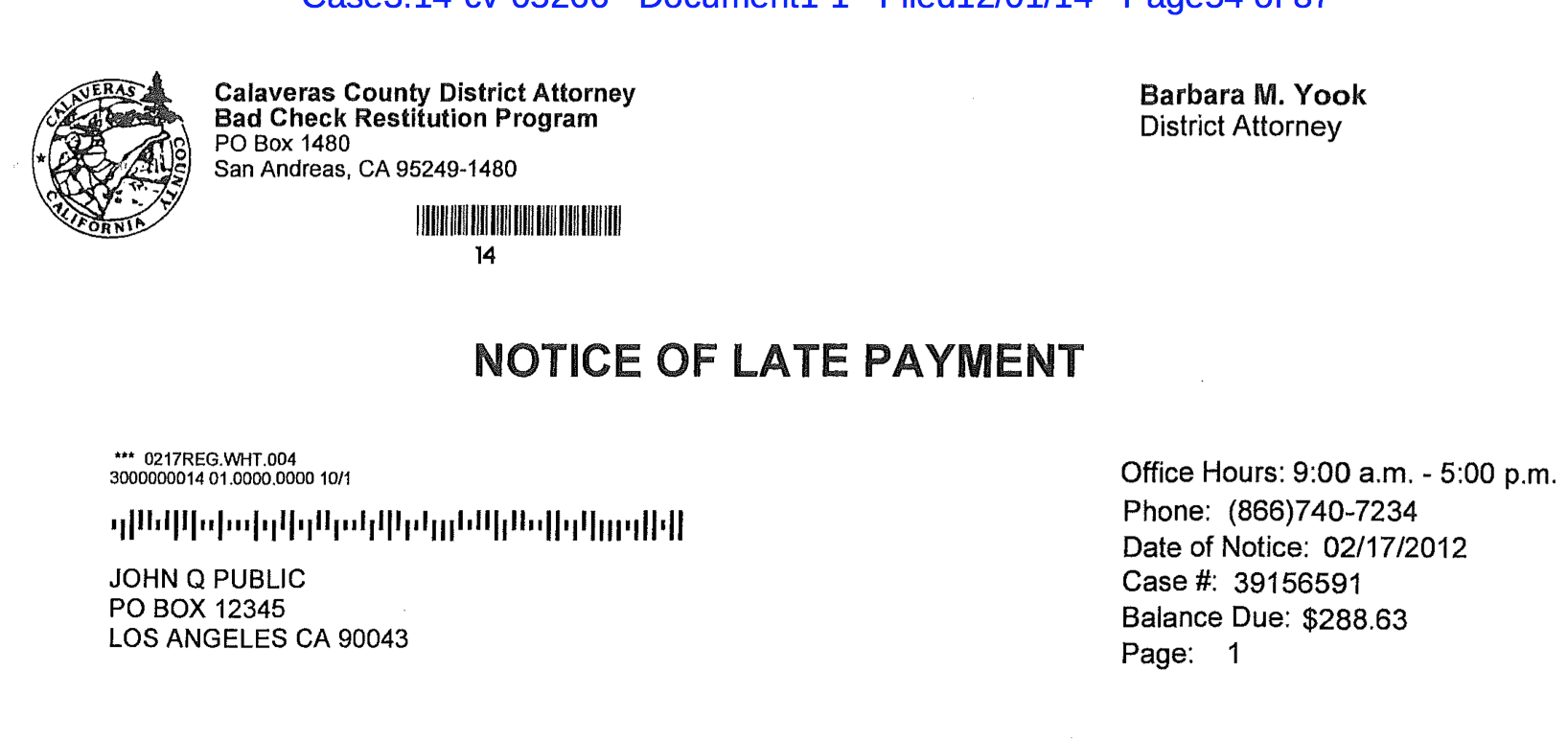

It’s one thing to get a letter from a debt collector that erroneously claims you owe money and have to pay up; it’s another to receive that same notice from your local prosecutor. But what if that latter letter is actually coming from a debt collector who is paying the district attorney’s office for the right to contact certain consumers? [More]

Debt Collection Is A Great Line Of Work For Ex-Cons

When a debt collector calls you, there’s a good chance that he or she might be an ex-convict calling you from a strip mall in Buffalo, New York. Buying and collecting debt is a lucrative business, and some people who had a rough upbringing have a real gift for it. Learn about the “Buffalo Talk-Off” and the Excel Spreadsheets of Doom. [NPR] [Planet Money] [More]

Study: One Third Of Americans Have Debt In Collections

Sometimes debt isn’t so bad, and sometimes it is, but one thing is clear: 80% of Americans owe someone, somewhere, some money. It might be a mortgage or student loan, or a five-year-old fee that got forgotten about, but the vast majority of us have some outstanding debt. And worse: a third of the country may have debt collectors chasing after them for that cash. [More]

Even Scofflaws With $270K In Debt Have The Right To Not Be Cyberstalked By Collectors

We recently told you about the woman who admitted she indeed owed Kohl’s $20, but sued the retailer for being over-eager about collecting on the debt. But does a debt collector have more leeway to be a pest when the debt is 13,500 times that amount? [More]

Houston-Based Debt Collection Company Agrees To Stop Deceiving Consumers

Deceiving consumers is a trademark for some debt collection agencies. Shady collectors have been known to lie about debts, misrepresent themselves as officers of the law, threaten lawsuits, and in the case of a Houston company, charged by the Federal Trade Commission, bully people into paying unnecessary fees. [More]

Dept. Of Education Sued For Access To Info On Private Debt Collectors

After being denied access to what it claims are public documents about financial incentives the U.S. Dept. of Education provides to private debt collectors, a consumer advocacy group has filed suit under the Freedom of Information Act to have those documents released. [More]

FTC Shuts Down Texas Debt Collector Who Threatened To Arrest Consumers

Debt collection is a generally unsavory operation. Thankfully, there’s now one less scummy, lying collector calling consumers. A Houston-based company is out of business and must pay $1.4 million after being charged with unsavory practices. [More]

Advocates: Bill Requiring IRS To Use Private Debt Collectors Would Harm Consumers

It makes sense that the federal government would want to collect owed taxes and a proposed law would require the IRS to push that duty off to private debt collectors. However, a history of abusive practices by debt collectors and the failure of similar programs in the past has consumer advocates warning that the provision will only hurt consumers and the government in the long run. [More]

Report: Debt Collectors Now Using Court System To Unfairly Force Consumers To Pay Up

Debt collection is a big business that doesn’t look to be shrinking anytime soon. But along with the rapid expansion of the industry, there has been an increase in abusive and predatory collection practices. One of those practices, obtaining default judgements against consumers, has led the Center for Responsible Lending to call for stricter regulations over the process of selling debt to collectors. [More]

CFPB Receives Double The Consumer Complaints In 2013, But Sought Fewer Explanations

The Consumer Financial Protection Bureau heard a lot from consumers in 2013. The agency received the most complaints in its history, including those from three new areas – payday loans, money transfers and debt collections. But it appears that fewer complaints were sent to offending companies for review and response. [More]

Most Debt Collector Complaints Made By Consumers Being Hounded For Money They Don’t Owe

We’re not sure how many times we’ve said it, but it’s worth repeating: Debt collectors are the worst. It’s not just that they’re often rude and occasionally violate the law. What really puts collection agencies at the bottom of the barrel is the fact that they consistently go after debt that consumers simply don’t owe. [More]

Debt Collection Company Actually Admits It Did The Wrong Thing After Bad Online Review

Does anyone currently see any pigs fluttering past the window? Or maybe there’s a new ice skating rink in hell? Because a debt collection company has actually admitted it was wrong. Specifically, the company that owned the supposed $3,500 debt a businesses levied against a customer who posted a negative review about an online shopping experience. [More]

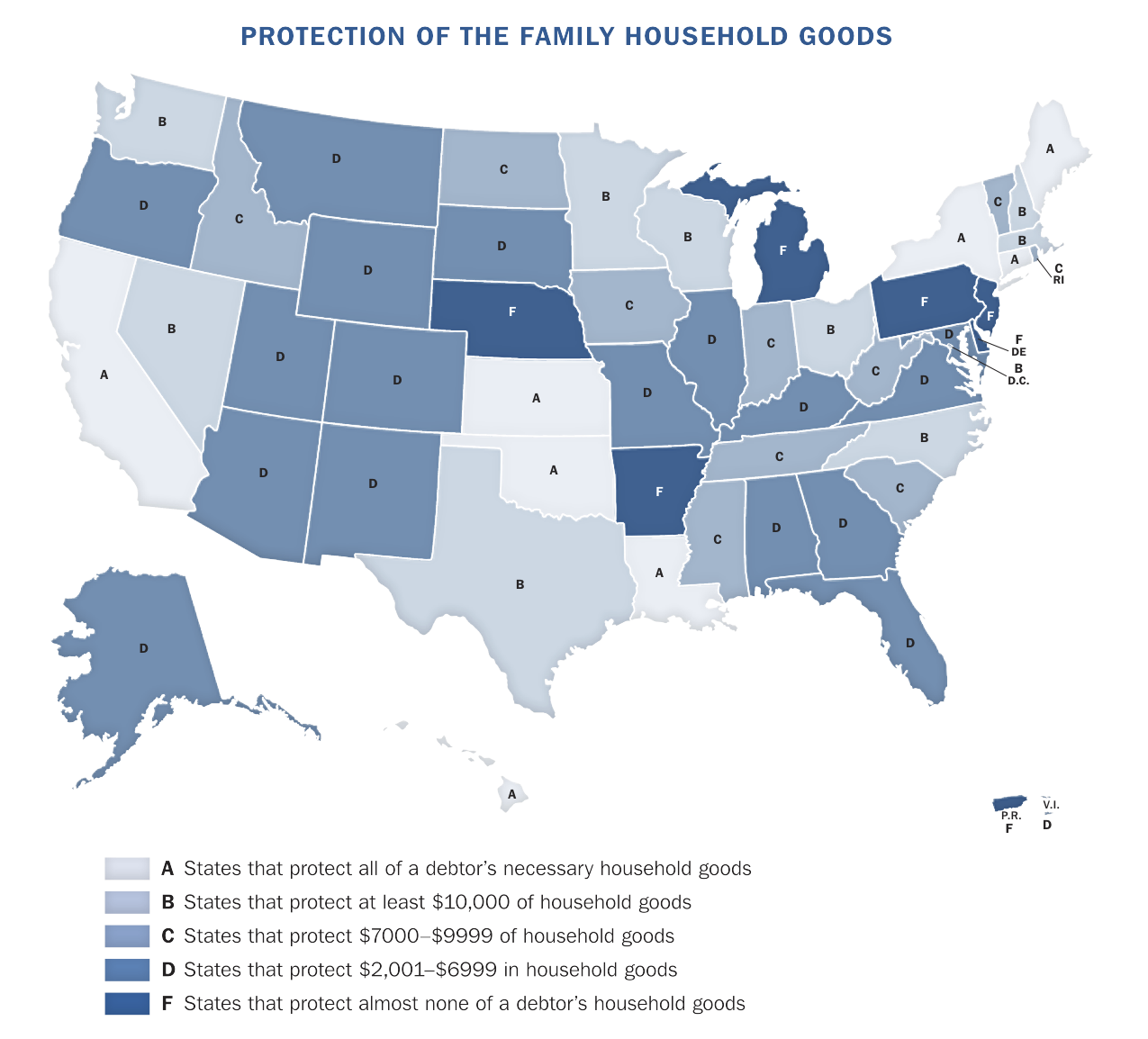

In Vermont, Debt Collectors Can’t Seize Your Goats Or Bees, But Your Car May Be Up For Grabs

Every state has some level of protection for debtors so that they are able to continue living and working while repaying their debts. But the level of protection covers the spectrum from protecting reasonably priced homes, vehicles, and necessary goods, to protections so minimal that the debtors will likely remain in the red, unable to ever climb out of debt. [More]

5 Sample Letters That Get Debt Collectors Out Of Your Face

Calls from debt collectors can make your life miserable when you’re already pretty miserable from being in so much debt. It’s even worse when you already paid the debt, or it wasn’t yours to begin with–what should you do next? That’s why sample letters can be a good starting point, or you can just send them as is. [More]

World’s Largest Debt Collector To Pay $3.2 Million Penalty For Harassing Consumers

It’s highly possible you’ve never heard of Expert Global Solutions, but it’s the largest debt-collection operation in the world. It also is the subject of a recent Federal Trade Commission complaint alleging that the company and its subsidiaries violated federal law by harassing consumers. [More]