When you sue a debt collector for allegedly violating federal law, that collector can’t just go behind your back, buy the debt on the cheap at auction and get the whole case dismissed, can it? That tactic worked for one collection agency and, depending on how a federal appeals court rules, it could lead to many other debt collectors buying their way out of legal trouble. [More]

Debt Collectors Are The Worst

Debt Collectors Can Sue You, But Court Might Not Let You Sue Debt Collector Back

A new report claims that a growing number of debt collectors are trying to exploit a legal loophole that allows them to bring potentially frivolous lawsuits against alleged debtors, but bars those defendants from bringing their own legal action against the debt collector. [More]

FTC Puts A Stop To Three Debt Collection Operations Using Threatening Text Messages, Robocalls

For the most part, we can’t say many glowing things about the debt collection industry that has, in the past, been known for using a litany of abusive and deceptive practices to pry money from consumers. Three such companies will no longer be bothering people after the Federal Trade Commission temporarily shut down the operations for engaging in nearly all of the hallmarks of shady collectors: threatening lawsuits or arrest, impersonating law enforcement and government officials and illegally contacting supposed debtors. [More]

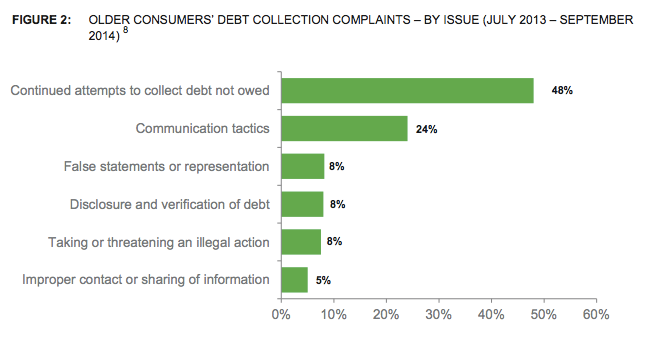

CFPB Finds Older Consumers Face Illegal, Harassing Tactics From Debt Collectors

As if we hadn’t said it enough, but debt collectors are the worst, especially when they use illegal tactics to pry money from older American’s living on fixed incomes. A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. [More]

FTC: Deceptive Debt Collectors Must Pay $3.3 Million In Consumer Refunds

We here at Consumerist are always a little happy when deceptive debt collection businesses get what’s coming to ’em from the Federal Trade Commission. But those feelings grow exponentially when we find out said company will be forking over millions of dollars to refund abused consumers. [More]

Most Debt Collector Complaints Made By Consumers Being Hounded For Money They Don’t Owe

We’re not sure how many times we’ve said it, but it’s worth repeating: Debt collectors are the worst. It’s not just that they’re often rude and occasionally violate the law. What really puts collection agencies at the bottom of the barrel is the fact that they consistently go after debt that consumers simply don’t owe. [More]

FTC Shuts Down Debt Collecting Scheme That Pretended To Be From The Government

Debt collectors have been known to intimidate, deceive and even threaten to take your children away when trying to separate you from your hard-earned cash. Just remember, it’s illegal for the collectors to threaten to arrest you, and it’s definitely illegal for them to pretend to be from the government in order to make you pay up. However, it’s those same tactics that have a New York-based company in hot water. [More]