With more than 40 million consumers holding thousands of dollars in student loan debt, it’s no surprise that student loan debt collection is a growing business. Yet, these collectors must follow federal rules when it comes to enticing debtors to repay their obligations. Despite this, federal regulators say one company wasn’t following the rules, and must now pay $700,000. [More]

debt collector

Medical Debt Collection Firms Must Refund $577K For Threatening Consumers

In this latest episode of Debt Collectors Behaving Badly, we bring you the tale of two medical debt collection law firms who must now refund hundreds of thousands of dollars after they were caught falsely claiming that attorneys were involved in collection actions. [More]

Regulators Shut Down Debt Relief Operation That Took Millions From Consumers

The Florida Attorney General’s Office and the Federal Trade Commission make a pretty effective pair when it comes to putting an end to companies and operations taking advantage of consumers. Just a day after the regulator and state’s attorney general teamed up to sue a company behind medical alert robocalls, the two entities announced they shut down a debt relief scheme that took million from consumers with credit card debt. [More]

How A Forgotten Blockbuster Video Caused A 2 1/2 Year Battle With Discover Card And Collection Agencies

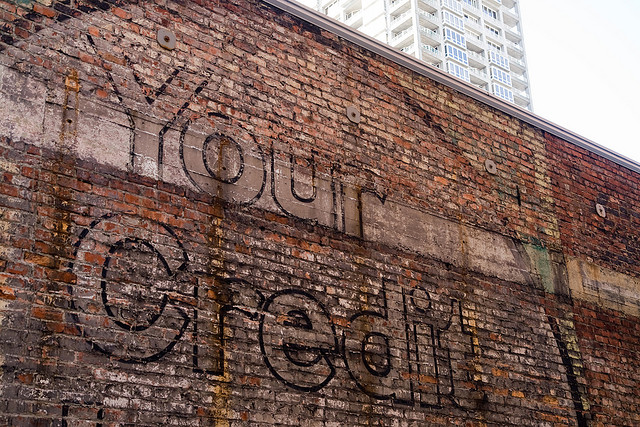

“Universal Default” is when your credit card company adjusts the terms of your loan because you “defaulted” with another company. In reader P.’s case the “default” was a Blockbuster video that his friend forgot to return. Discover Card took this opportunity to double P.’s interest rate. When he tried to fight it by closing his account, it launched him into a 2 1/2 year legal battle with Discover, a collection agency, and now the credit bureaus.