Curt says his roommate can’t shake a pushy debt collector who won’t get it through his head that he mixed up his identity with some guy who owes AT&T for DSL service. He contacted AT&T but the company seems unwilling/unable to call off the dogs. [More]

debt collection

My Dental Bill Was Sent To Collections By Mistake – Who Do I Pay Now?

S. writes that in 2008, she owed a lot of money–about $8,000–to her dentist. She worked out a payment plan with the office, and asked them to auto-bill her credit card every month. They frequently forgot to bill her, but she wasn’t too concerned about the situation. At least, until a debt collector called her, saying that the dentist had sold her balance to them. The dentist’s office claims that this is a mistake. Now both entities want S.’s money, and she’s not sure who she should pay. [More]

Bank Of America Won't Stop Calling Looking For "Zoran"

Hey, um, “Zoran,” if you owe money to Bank of America, can you give them a call because they seem to think you live at reader Kimber’s house and they are just not willing to accept that you don’t. Kimber says they call the house at “all hours of the day, during meal times and weekends” looking for you. [More]

Lawsuit: Debt Collector Harassment Contributed To Man's Death

When a Florida man suffered a heart attack, he needed to leave his job. Between everyday expenses and medical bills, he fell behind on his mortgage and other bills, and debt collectors began calling. And calling. And calling. Eventually, a lawsuit alleges, the stress from the harassing and abusive phone calls led to the man’s death. Frivolous lawsuit? Maybe not.

Wave Of Fake Debt Collectors Hints At Possible Data Breach

The Better Business Bureau has released a warning to be aware of scammers calling to threaten people with arrest “within the hour” for defaulting on payday loans. What makes them stand out from normal debt collecting scammers is these callers have huge amounts of personal info on their victims, including Social Security and drivers license numbers; old bank account numbers; names of employers, relatives, and friends; and home addresses.

Debt Collectors Will Stop Calling If You Sue Them

“Litigant Alert” from WebRecon promises to help debt collection companies ferret out “overly-litigious debtors” with “a history of suing collection agencies.” It’s basically a Do Not Call list of troublemakers who had the nerve to fight aggressive collection practices with the law. Debt collectors are apparently willing to pay $1,595 to figure out who they should leave alone.

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

"Empathetic" Debt Collectors Want You To Pay The Debts Of The Dead

Who is responsible when dead people owe money? The New York Times says that the law varies but, “generally survivors are not required to pay a dead relative’s bills from their own assets.” That doesn’t mean they’re going to tell you that when they come calling about an unpaid bill.

Debunking The Debt Collectors' Spin Doctors

The nation’s economic woes make debt collection a topic du jour, but while there are some good bits mixed into the Washington Post’s article, “When Debt Collectors Disrupt Dinner,” it probably should have been titled “What Debt Collectors Would Like You To Say And Do When They Call About The Credit Card.” Read it with a shaker of salt. Read on for the good, the bad, and the lazy reporting, plus what you should actually to protect and exercise your rights as a debtor…

Man Sets Himself On Fire At Rent-A-Center After Receiving Too Many Late Payment Notices

There are lots of good ways to escalate your complaints. Going to the store, dousing yourself with lighter fluid and setting yourself on fire is not one of them. Unfortunately, that’s exactly what one Newark, NJ man did after becoming frustrated with the amount of late payment notices and collection calls he was receiving from Rent-A-Center.

How A Forgotten Blockbuster Video Caused A 2 1/2 Year Battle With Discover Card And Collection Agencies

“Universal Default” is when your credit card company adjusts the terms of your loan because you “defaulted” with another company. In reader P.’s case the “default” was a Blockbuster video that his friend forgot to return. Discover Card took this opportunity to double P.’s interest rate. When he tried to fight it by closing his account, it launched him into a 2 1/2 year legal battle with Discover, a collection agency, and now the credit bureaus.

Tampa Woman Tries To Collect Loan Made By Her Great-Grandfather During Civil War

Some debt collectors are mighty persistent.

Collection Agency's Server Stolen; Had 700,000 Accounts On It

Indiana broke its own record for computer security breaches last month, when a server containing personal data on 700,000 people was stolen from the offices of Central Collection Bureau, a debt collection agency. The stolen data included names, personal billing information, last known addresses, and social security numbers of people who hold delinquent accounts with a variety of companies, including utilities and hospitals. The company said the server was behind “three locked doors” and “was protected by two passwords, but was not encrypted.”

"Why I Never Want Anything To Do With Verizon Ever Ever Again"

Verizon is finally installing FiOS in my area. But I’ll never use it. I’ll never sign up for another Verizon account in my life, and I’m encouraging my parents to change to a different service when their Verizon cell contracts end soon. Over the course of eight months, I’ve become completely appalled at the horrible customer service I’ve gotten from that company.

Zombie Debt: How Credit Card Companies Illegally Reanimate Your Old Debt

In what BusinessWeek calls “financial Night of the Living Dead” credit card companies are refusing to stop reporting legally discharged debt to credit reporting agencies—illegally forcing consumers to pay debts that they no longer owe in order to get approved for mortgages.

The Midlothian Police Department Should Not Collect Private Debts

The Midlothian, IL Chief of Police thinks it’s appropriate for his officers to help local businesses collect private debts. Midlothian’s local mechanic, Merlin’s Muffler and Brake, performed $500 of work for Angela Proctor, who paid back all but $108 before falling into financial trouble. From The Star:

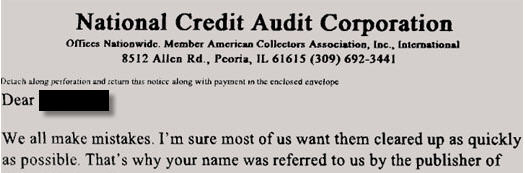

"National Credit Audit Corporation" Tries To Collect Bogus Debt

Brian writes us, enraged at Popular Science for sending him to a debt collector in an attempt to get him to renew his subscription. We were unsurprised to learn that Brian had received a notice from the “National Credit Audit Corporation” of lovely Peoria, IL.