Don’t lend your debit card to friends or family to pay their DirecTV bill if you don’t want to be on the hook if they fail to pay their bill. As we learned during the debacle where the satellite provider drained the bank account of a dead customer’s friend, any debit or credit card that has ever been used for a given account stays on file…pretty much forever. Reader Laura learned this the hard way when the company drained her bank account to pay her sister’s bill. [More]

debit cards

Even With New Fees, Most Checking Accounts Beat Prepaid Debit Cards

Pushers of prepaid debit cards say the fees they charge are comparable to a checking account, but a new study by Consumers Union, publishers of Consumer Reports and this blog, finds that by and large, checking accounts are still a better deal. [More]

Wells Fargo & SunTrust Cancel Debit Rewards Programs

Last week, we wrote about JPMorgan Chase’s decision to get rid of rewards programs for debit card users in response to a new law that will slash the amount of money banks receive per debit card transaction. Now comes news that at least two other banks — Wells Fargo and SunTrust — have followed suit. [More]

Prepaid Debit Cards Rack Up Fees As Soon As You Even Think About Getting One

Using TurboTax to file his taxes last month, Sam chose an interesting new option for his refund: a TurboTax-branded Greendot prepaid debit card. He doesn’t have a bank account at the moment, and wasn’t receiving a huge refund, so this seemed like a good option. He tried to use up the card soon after receiving it in order to avoid the monthly “maintenance fees” that come with prepaid debit cards. What he didn’t know was his account really began on the day that he requested it online, so he was paying monthly fees when he had the card for barely a week. [More]

Chase Punishes You For Not Earning Enough Money

Since they can’t extract money from our pockets with cascading overdrafts anymore, banks have to get creative. Bradley learned that these indignities add up when the bank deems you insufficiently profitable, and charges a fee on your no-longer-free checking account. Never mind that Bradley is a college student. He doesn’t have a lot of money on hand, and from Chase’s point of view, not nibbling away at his patience and his money now could lead to another 60 years of business from him. Theoretically. [More]

Chase Killing Debit Card Rewards In July

With new regulations coming that will limit interchange fees, the amount of money banks charge retailers for debit card transactions, Chase has already begun testing $5 ATM fees and is considering putting a $50-$100 cap on debit card purchases. Now comes the news that the bank is going to pull the plug on most debit card rewards programs starting in July. [More]

Debit Cards Might Bounce Like Checks

Could a future where your debit card can “bounce” be that far off? That’s what this WSJ article suggests. If so, it would be the result of another creative bit of backlash the banks are mulling in response to the 12 cent debit card fee cap scheduled to go into effect in April. Here’s how it would go down. [More]

JPMorgan Chase Also Considering $50 Cap On Debit Card Purchases

As we’ve previously reported, Bank of America has proposed a cap on debit card purchases. And if some folks at JPMorgan Chase have their way, account holders at that bank will also be very limited on the purchases they can make with their debit cards. [More]

Why Banks Threatening To Limit Debit Card Swipes To $50 Is Horrible, And Hooey

As I mentioned on Friday, because the banks are pissed off, pretty soon you might not be able to pay for a restaurant meal or pay for groceries on your debit card. The banks are considering putting a $50-$100 cap on how much you can buy per transaction with a debit card. First, I think they’re bluffing. But, if they really followed through on it, this would seriously disrupt commerce across America. Let me paint you a picture of hypothetical supermarket checkout line. [More]

Banks Might Limit Amount You Can Buy On Debit Card

Grumbling over proposed limits to debit card swipe fees, banks are hinting they’re considering putting a cap on how much you can buy with a debit card. It could even be something like $50 or $100, forcing consumers to either pay with credit card or cash. [More]

Fed Might Rethink Capping Debit Card Swipe Fees

The Fed told Congress yesterday that it might rethink the plan to cap debit card swipe fees at 12 cents per swipe. One of the hopes is that merchants would be able to pass on the reduced costs to consumers in the form of lower prices. Lawmakers piled on in the hearing, saying that it would “batter banks still reeling from the 2008 financial crisis.” How banks can both be posting soaring profits and still be “battered” and reeling is an accounting trick way over my head. [More]

Chase Chokes Off Enrollment In Debit Rewards

After February 8th, Chase isn’t letting any more people into the debit rewards program. Citing shrinking margins due to recent legislation, Chase is closing off all new enrollment. [More]

Buy A Stolen Debit Card For $80

Security firm Pandalabs investigated the online underworld’s menu of services and has surveyed the going rates for various kinds of fraud. Stolen credit card numbers can be had for as little as $2, but these are like buying a mystery bag. Crooks don’t know the cardholder’s info and there’s no assurance that it will actually work. So for $80 thieves will sell a debit card with a guaranteed (small) balance. To get access to a big balance of $82,000, that will run ya $700. [More]

Treasury Dept. To Offer Tax Refunds On Pre-Paid Debit Cards

We’ve been warning readers for years against “refund anticipation loans,” where tax preparers like H&R Block and Jackson Hewitt give you a pre-paid debit card now loaded with your expected return (minus fees and interest). And yet, these cards have continued to appeal to some lower-income taxpayers who don’t have bank accounts for direct-deposit of their returns. Now the federal government is providing these people with an alternative — a debit card that will accept the direct deposit. [More]

Kardashians Sued For Fee-Drenched Debit Card, By The Card's Makers

The Kardashians have been sued over their Kardashian Card, a pre-loaded debit card they agreed to put their faces and names on and help promote. The card was slammed by critics and an AG almost as soon as it came out for the high hidden fees it hoped to extract from the teen audience it was targeting. But the plaintiff isn’t a government body or members of a class action, it’s the Kardashian’s former business partners. [More]

Apocryphal And Hilarious "Letter A 98-Year Old Woman Wrote To Her Bank" Makes The Rounds Again

An amazing letter that a 98-year old woman wrote to her bank to protest a bounced check is making the rounds. She complains about a check getting bounced from her account because it occurred “three nanoseconds” before her pension got direct-deposited. She then says that going forward the bank will have to appoint a special rep to open her mortgage and loan payments, he has to use a 28-digit PIN to talk to her, and will have to go through a lengthy phone tree. It’s quite clever, but it’s not real. Not exactly. [More]

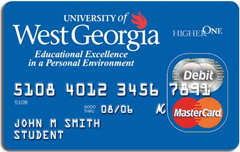

Put That Beer On My Student Loan

A card called “Higher One” lets college kids take their student loan and turn it into a debit card they can use to buy pizza, beer, and other learning essentials with. [More]

New Line Of Prepaid Debit Cards Target Teens With Cartoon Designs

Just days after the Kardashian Kard got cut, a new line of “Myplash” prepaid debit cards targeting teen consumers is here, bedecked with cutesy cartoon characters and Twilight stars. [More]