WaMu’s crack fraud department is at it again, according to reader Kristin. Someone broke into her iTunes account and bought a couple hundred dollars worth of iTunes gift cards with her debit card information. She disputed the charge and WaMu told her not to worry — they’d take care of it. Two months later, while on a trip to Chicago, WaMu reversed the credits, causing Kristin to become severely overdrawn. No amount of protesting will convince WaMu that she wasn’t lying about the iTunes break-in. Why? Because she never responded to some mail they sent to her old address.

debit cards

WaMu: You're Lying About Someone Breaking Into Your iTunes Account

../../../..//2008/08/15/as-of-august-5th-alaska/

As of August 5th, Alaska Airlines no longer accepts cash on its flights. In their words, welcome to “the convenience of a cashless cabin. Passengers will no longer need to hunt for cash to pay for on board purchases.” Finally! All that cash flitting around the cabin hurting people is a thing of the past. [Personal Finance Weblog]

Crowne Plaza Hotel Blindsides You With A $235.13 Hold For Incidental Charges

Much like that nasty little gas station problem we talked about awhile back, hotels just love to slap holds on your debit or credit card accounts for “incidental charges.” There’s nothing wrong or uncommon about the practice, but its difficult or impossible to tell exactly how much the hold might be — and for some consumers who aren’t expecting it, the holds can cause big problems. Reader Eric recently got slapped with a $253.13 hold from the Crowne Plaza Hotel in Kansas City, and he’s a little irked because they didn’t disclose the hold when he was checking in, and they only refunded $160 of it when he checked out.

More On Minimum Purchases, Surcharges, And Other Credit Card Merchant Agreement Violations, From The Companies Themselves

We’ve posted a lot of stories of businesses requiring customers who pay with a credit card to make minimum purchases, or pay a surcharge, or show ID. And as we’ve repeatedly said, the businesses’ merchant agreements with the credit card companies forbids these practices. A reader wrote in to argue that this might not be true, as many businesses contract with third-party credit card processors, and are not bound by the merchant agreement. So we did some investigating.

Uno Chicago Grill Charges You $200 When You're Not Even There

Lauren was shocked to find five charges for a total of $200 on her account from a pizza place she hadn’t been to in months. They were all levied from one Uno Chicago Grill during a day she wasn’t even in town. What she found out about why they happened in the first place was even more disturbing, and annoying.

Is This $0.10 Credit/Debit Surcharge On Gasoline Allowed?

Reader Brian wants to know how to tell a “surcharge” applied to a credit/debt card transaction vs a convenience charge?

Lowe's Self Check Out Is Apparently Just A Huge Pain In The Ass

Reader Jason says that the self check out system at his local Lowe’s simply refuses to process his debit card transaction properly. After the third time, he’s finally given up and will be shopping at Home Depot. Aren’t self check out systems supposed to be convenient?

Bank Of America Treats Parking Meter Payments As Cash Advances, Charges $10 Fee

Reader Gary used his Bank of America credit card to pay $2 on a parking meter in Washington, DC. Bank of America treated it as a cash advance and slapped him with a $10 fee, as well as a higher APR. When Gary called to complain, he learned that it wasn’t an error: Bank of America has started treating payments to parking meters as cash advances and may even treat all payments to government entities as cash advances.

Help! The Gas Station Froze $100 For $12 Of Gas And My Rent Check Bounced!

Reader WW is upset because a gas station froze $100 on a debit card transaction for $12 worth of gas. This caused his rent check to bounce. Now he’s got overdraft fees and he’s wondering why gas stations are doing this.

WaMu Doesn't Care You Could Be Stranded In Himalayas With No Money

Lila got her Washington Mutual debit card pickpocketed while traveling in India. Naturally, her account was drained. She filed a fraud report with Washington Mutual and a got a temporary credit issued on the account while the case was investigated. Less than 3 days later, the credit was reversed without warning. It’s not WaMu’s policy to reverse provisional credits in these matters before 30 days have passed to investigate, and not without warning. None of the various reps and fraud personal could explain why this happened, nor could they give her her money back, nor could they connect her with anyone who would or could do anything. Supervisors are mysteriously never around. It’s a good thing she already had some Rupees in hand when the theft occured, or Lila could have been stranded in the Himalayas while WaMu reps were busy playing Snood. Her complaint letter, and our advice on how to be more effective, inside…

WaMu Doesn't Understand The Concept Of Fraud

Reader Todd says that WaMu issued him a provisional credit after he was ripped off by a fake online merchant, but reversed the credit because he didn’t supply the bank with “a product description, cancellation policy, and cancellation number.” He can’t get a cancellation number because the transaction was fraudulent (he never received the item he ordered.) No matter who he talks to, he can’t get WaMu to understand that he’s been ripped off.

Use Your ATM Card Once A Year To Keep It Valid

If you’re the type of person who never uses your ATM card—and we really mean never in this case, you might want to call your bank to find out if there’s a minimum activity threshold to hit to keep it from being deactivated. A reader tried to use her Bank of America ATM card recently and kept getting an “invalid transaction” error at every ATM. She called the number on the back of the card to ask what was going on: “I was told that since I hadn’t used my card in a couple of years it was closed, even though the expiration date is several years in the future, and I hadn’t received any note that suggested I should cut the card up into tiny pieces.”

Microsoft And The $1,632 Copy Of Vista

Microsoft charged Bill $1,632 for a single Windows Vista Ultimate upgrade license. Each time Bill, an IT Manager, tried to his enter his payment details through Windows Live Marketplace he was told that Microsoft could not be contacted, and to “please try again later.” What Microsoft really meant was, “Ha! Got your money! How ’bout some more?!”

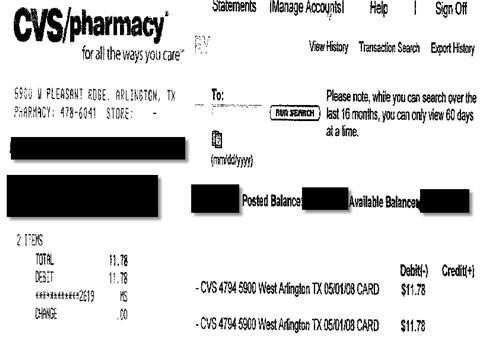

CVS Stole My $11.78, And Refuses To Give It Back!

Reader Julie ran into some trouble at the CVS when a cash register rebooted while processing her transaction and the employee, rather than voiding the messed up transaction, simply charged her twice. Julie writes:

Bad Voodoo: Transforming Student IDs Into Debit Cards

Cash-strapped colleges are partnering with banks to transform student IDs into debit cards. The deals are a windfall for the institutions, but force students to open accounts laden with hefty penalty fees and surcharges.

Don't Want A Debit Card? Key Bank Will Charge You $1 A Month

After hearing about Hannaford’s giant customer data breach yesterday, Brian decided to cancel the debit card he’d used there. That’s when he found out that Key Bank really wants you to have a debit card. In fact, they’ll charge you a small monthly fee to not have one linked to your “free checking” account. We figure that this means Key Bank makes about $12 a year more off of customers who have linked debit cards—and that if you want greater security on your account, it’s going to cost you.