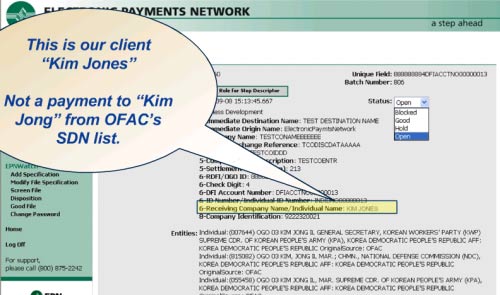

The Electronic Payments Network, a private-sector automated clearing house, has an online demo showing how an institution can scan transactions for possible terrorists based on those free, public, and error-ridden text files.

credit reports

Credit Reports: How Long Different Items Stay

Ask Max has a detailed list of how long different types of credit items stay on your report.

Reach TransUnion Executive Customer Service

If you haven’t been able to solve your TransUnion credit report problems through normal channels, you can escalate your issue to their executive customer service team. Here’s the info.

Estimate Your FICO Score For Free

To creditors, you are a walking, talking, three digit number. Creditors use that number, your FICO score, to judge your credit worthiness. A good FICO score can lead to favorable terms, but unless you pay a fee or sign up for a free trial, your score is cloaked in a shroud of secrecy. Until now.

Correction: Negative Items Are Supposed To Fall Off Credit Reports After 7 Years, No Matter What

Yesterday we erroneously reported that while chargeoffs are supposed to disappear from your report after seven years, you can get that clock reset by making payments or otherwise communicating with the creditor.

Negative Items Fall Off Credit Report After Seven Year Itch, As Long As You Don't Scratch 'Em Creditors Don't Fraudulently "Reage" Them

Under the Fair Credit Reporting Act (FCRA), bad items fall off your credit report after seven years, but did you know that if you contact the creditor in any way during that time you they can use that to illegally reset the clock?

How Banks Flag Ordinary Customers As Terrorists

The Washington Post has an article, “Ordinary Customers Flagged as Terrorists,” describing how the Office of Foreign Asset Control maintains a list of potential terrorist suspects, and how everyday citizens can wind up on it.

Credit Report Nightmare: Damned By Apostrophe, Saved By The Letter M

This is the story of a girl named Corey O’Malley, and a boy named Corey O’Malley, who had their credit reports accidentally merged.

Reach Equifax Executive Customer Service

If you haven’t been able to solve your Equifax credit report problems through normal channels, you can escalate your issue to their executive customer service team. Here’s the info:

Why Equifax Doesn't Seem To Understand Your Letters

Mailing back and forth with Equifax can be like talking to a brick wall, except instead of bricks, the wall is made out of buttocks, and they’re farting all over your credit report.

Credit Report And Score Savvy Roundup

“…stratagems for seeing your FICO score without subscribing to costly services.”

Equifax Refuses To Fix Credit Report, Despite Overwhelming Evidence

Equifax continues to screw up Philip’s credit rating by reporting a late payment on a mortgage that was satisfied in full over a year ago.

Verizon Mars Credit Report, Refuses To Accept Payment

Our anonymous reader could not convince Verizon to take his money after noticing a mark from the telecom on his credit report. Our reader paid his bills in full throughout 2006, yet his credit report showed a collection request in October for $0.00. Verizon usually charges more for everything. Our reader called Verizon.

Apparently when I switched billing plans they canceled my old account and opened a new one, which left a balance on the old account. I never received a bill on the old account, but according to Verizon and Elliott they were mailed out and better yet I paid a mere $50.00 to the $95.08 balance of which I have no record and did not come from me. So low and behold I do have a balance of $45.08 not the $0 balance reported on the credit report. I asked Elliott at the time how this is possible and I would be happy to make good on any money I owed. I did not want my credit wrecked over this incident. Elliot did not want my payment and stated there was nothing he could do to help.

Nobody at Verizon wanted our reader’s money.

Are Minors Responsible For Their Credit Card Debts?

We’ve had a couple of different people ask recently if one is responsible for credit card debts made as a minor. See, people under 18 aren’t supposed to get credit cards (unless an adult cosigns). Now, some of these people lied about their age to get the cards. That’s fraud. Fraud is bad. Don’t do it.

Man Blogs Suing Allied Interstate For Jacking Up His Credit Report

One man is blogging about his suing of Allied Interstate in small claims court for jacking up his credit report.

Get Your FICO Score Without Breaking The Bank

Money, Matter, and More Musings has a roundup of stratagems for seeing your FICO score without subscribing to costly services. In case you don’t know, a FICO score is a 3-digit number lenders used to determine your credit worthiness. It’s based on your credit report info.

How To Fix Your Credit Report When Creditors Won't Admit Their Mistakes

If you find an error on your credit report, fixing it is often a painless process. Notify the credit bureau and if the creditor can’t verify the information, it gets removed. If it doesn’t, here are steps to take towards getting your credit report right, cribbed from the Wall Street Journal.