Four different “credit repair” operations have been ordered to pay a total of more than $2 million in penalties for allegedly tricking people into thinking their bad credit could be easily fixed. [More]

credit reports

Credit Reports Soon Won’t Include Some Tax Lien, Civil Judgment Data

Millions of consumers could soon see their FICO credit scores increase as the three credit reporting agencies — Equifax, Experian, and TransUnion — take another step to overhaul their systems by excluding certain negative information related to tax liens and civil judgments from credit reports. [More]

Equifax, TransUnion To Pay $23M For Misleading Consumers About Credit Monitoring

The nation’s three largest credit reporting agencies — TransUnion, Equifax, and Experian — not only collect consumers’ financial information to assist lenders in gauging whether or not someone is qualified for a loan, fit for a job, or can afford a place to live, they also provide people with credit-related products and resources that are meant to help them keep tabs on or improve their credit. But, according to federal regulators, Equifax and TransUnion haven’t been upfront about the costs and usefulness of these products, and now they’re on the hook for a total $23.1 million in fines and refunds. [More]

Bill Would Overhaul Credit Reporting System, Remove Debt After Four Years

Each year, thousands of consumers file complaints against the nation’s three credit bureaus — Equifax, Experian, and TransUnion. Most of these complaints are related to inaccurate information on a consumers’ credit report and the difficult time they often have in getting this misinformation corrected. That could change with the proposed overhaul of the system. [More]

How Much Investigating Should A Credit Bureau Do When Someone Disputes A Debt?

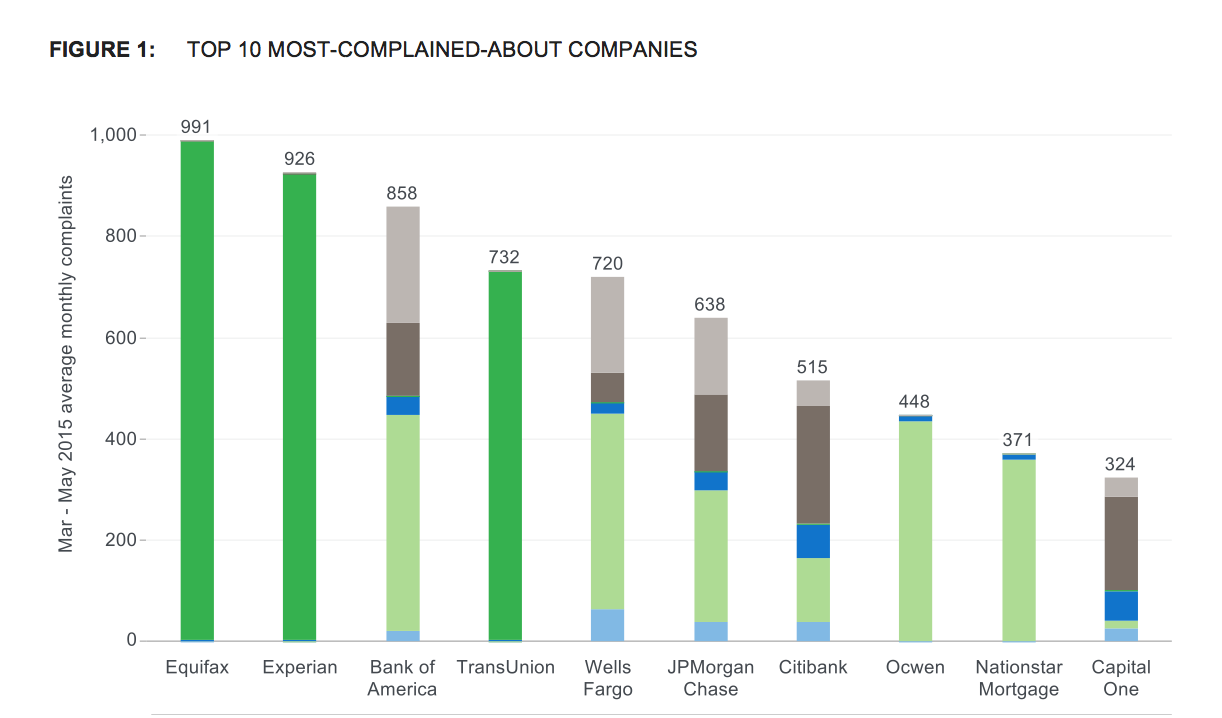

The nation’s three credit bureaus — Equifax, Experian, and TransUnion — are also three of the four most-complained-about companies to the Consumer Financial Protection Bureau, with 77% of those complaints involving incorrect information on consumers’ credit reports. But when a consumer attempts to dispute a debt on their report, what legal obligation do these agencies have to actually investigate? [More]

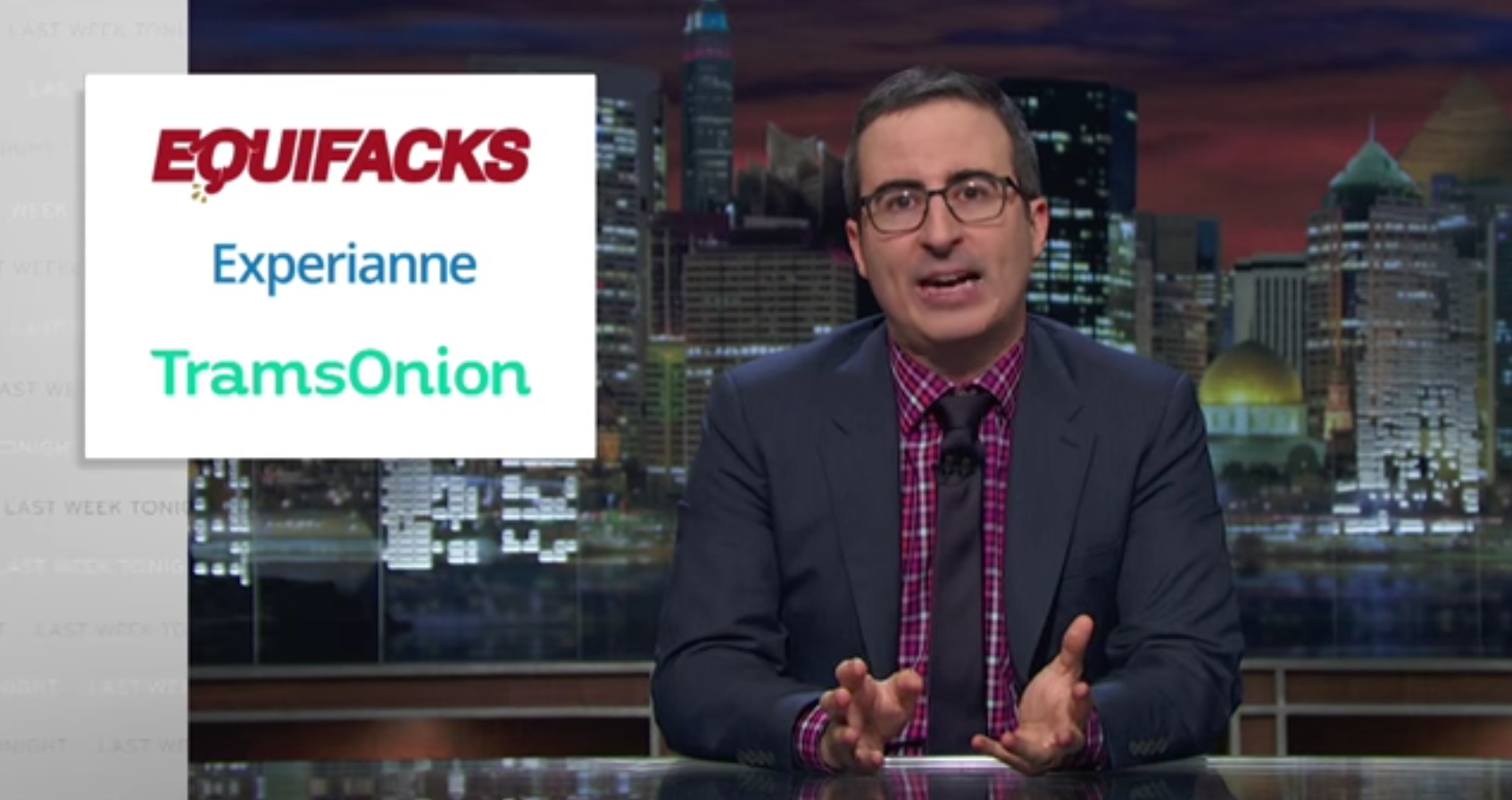

John Oliver Trolls Error-Prone Credit Bureaus With Horrible, Sound-Alike Companies

The three major credit reporting agencies — Equifax, Experian, and TransUnion — receive more complaints from consumers than most banks, primarily because these reports frequently contain errors and they make it incredibly difficult to resolve disputes. The credit industry seems to think its mistakes are within acceptable standards, but will they feel the same way when their brand names are facing similar odds for a disastrous mistake? [More]

Will Costco’s Switch From American Express To Visa Affect My Credit?

In June, Costco will officially change its store-branded credit card from American Express to a Visa card issued by Citi. The wholesale club is promising a seamless transition, but some longtime Costco customers have concerns: Will my credit score or history be dinged? Can I opt-out? [More]

5 Ways To Improve Your Finances With Minimal Effort

Improving your finances doesn’t always require a big investment. Sometimes a single phone call or a small tweak are all you need to improve your financial future or present. Looking for some ideas as you change to your new “366 Kitten Photos” desk calendar? Here are some ideas from our financial friends down the hall at Consumer Reports to get you started. [More]

Comcast Incorrectly Insists Customer Still Owes $400; Her Credit Score Drops By 215 Points

In spite of the fact that Comcast has proven time and again that it’s completely ill-prepared to handle the accounts of more than 20 million customers, credit bureaus still believe it when the cable giant insists that a customer still owes money. [More]

Man Says He Can’t Access His Credit Report After Equifax Sent Him Personal Info For Dozens Of Strangers

Getting an unexpected surprise in the mail can be fun sometimes — a birthday gift from your grandma or some free electronics — but one Washington man was far from happy to find credit reports in his mailbox that were apparently intended for a bunch of strangers. Even worse, he says he can’t get access to his own report to make sure there aren’t unexpected debts attached to his credit history. [More]

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]

![The process for Facebook loan approval. [Click To Enlarge]](../../consumermediallc.files.wordpress.com/2015/08/screen-shot-2015-08-05-at-9-32-15-am.png?w=300&h=225&crop=1)

Facebook Patent Would Allow Lenders To Determine Creditworthiness By Looking At Your ‘Friends’

Earlier this year Facebook announced it would dip its toes into the pool of mobile payments by launching a system that allowed users to send money to friends via the Messenger app. Now it appears the company may take things a bit farther after receiving approval for a patent this week that would allow creditors to determine whether or not someone is worthy of a loan based on their circle of friends on the social networking site. [More]

Operators Of Credit Repair Business Masquerading As The FTC Must Return $2.4M To Consumers

Three months after regulators shut down a credit repair company catering mainly to Spanish-speaking consumers for falsely claiming to have a close relationship with the federal government – calling itself “FTC Credit Solutions” – and bilking thousands of dollars from individual consumers with empty promises of boosting their credit scores, the real Federal Trade Commission announced it has reached a settlement that will result in the return of $2.4 million to victims of the scam. [More]

How Much Is A Company That Knows All About Your Financial Behavior Worth? Turns Out A Lot.

It’s no secret that consumer financial data is valuable: it determines if you get better rates on loans and allows lenders to predict the likelihood you’ll pay back debts. While we can’t necessarily put a price tag on that data (yet), we now know that one of the largest companies to collect that information is worth a bundle – 4 billion bundles, in fact. [More]