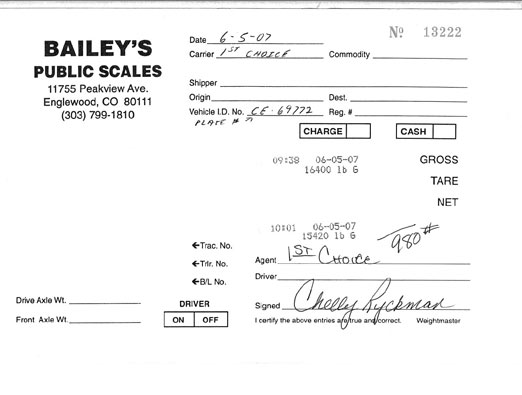

The results of a reweigh yesterday showed that ASAP Van Lines mistakenly overcharged Candace for her shipment.

credit cards

Gas Station "Skimmers" Steal Your Credit Card Info When You Pay At The Pump

In case you weren’t aware, a skimmer is a tiny device that reads your credit card number and delivers it to the bad guys.

Update On That ASAP Van Lines Dispute

The reweigh for the reader in a dispute with ASAP Van Lines over her moving bill has been moved forward to sometime after June 3rd .

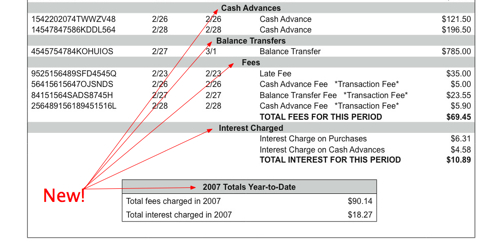

Credit Card Fees, Penalties, On The Rise

A nationwide study by non-prof group Consumer Action found rising trends for credit card rates and fees. Compared to 2005

Every Time I Use My Chase Card, They Try To Raise My Rates

About two years ago when I moved away from home I got a credit card with X limit from Chase whom I bank with. The first year I used the card for some things, made payments on it regularly and all was good until last November, they sent me a letter saying they were going to raise my interest rates. Taking some advice from consumerist.com I called and asked them to lower my rates and they did (afterward I e-mailed consumerist to say you guy’s rock). In February of this year I got a notice from Chase saying they were raising my limit by 50% and in March I paid my balance way down. Just a few weeks ago I used the card again for tires for my wife’s car and immediately after I got a notice saying they were going to double my interest rates again. Naturally I called, answered a question or two and they agreed not to change my rates and send me a letter saying this just like before.

Credit Card Companies Cheer New Regulation?

The Federal Reserve Board wants credit card companies to clean up their act, and the credit card companies couldn’t be happier. The Fed’s proposed regulation would give customers 45 days notice before a change to their card’s terms, require fees and interest to be shown separately on each bill, and would transform default APR into the more menacing-sounding penalty APR. None of this is objectionable to the credit card companies:

“We strongly agree that improved disclosures empower consumers to make better choices in our competitive marketplace,” said Edward Yingling, head of the American Bankers Association, a lobbying group that represents the biggest credit-card issuers.

We tell you why creditors are grinning, after the jump…

It's Easy To Use Google To Find Exposed Credit Card Numbers

When merchants expose your credit card numbers to the internet, there’s an easy tool that ID thieves can use to find them. Google. According to an article on Slashdot, it’s as easy as searching for the most common credit card prefixes. The credit card companies have known about this problem for years, and they’ve yet to fix it. Is it because they can’t? Or is it because the vendors are the ones exposing the numbers? Whose responsibility is it?

Even Reporters Can Not Get Capital One To Act Responsibly

Capital One is so evil that not even media inquiries phase it. Around here we tend to roll our eyes just a little bit at consumer reporters who praise companies for doing the right thing post-media inquiry. After all, what company wouldn’t fix a situation rather than suffer a public shaming by a newspaper? Finally, the answer has been found. That company is Capital One.

Something To Think About The Next Time You Pull Out Your Credit Card

According to Bob Lawless at The Credit Slips Blog, if no one in America spent any of this year’s personal income on “trivial” things like food, shelter, taxes, and medical care,” it would still not be enough to pay off all of our mortgages, credit cards, and other “other personal indebtedness.” In 2003, this wasn’t true.

Mo' Money, Mo' Problems

• What Do You Look For In An Online Bank Account? [Money, Matter, and More Musings] High interest rates, easy synchronization with other bank accounts, absolutely zero fees and seven other factors you should consider when selecting an online bank account.

Support The Credit Card Act Of 2007

The Credit CARD Act Of 2007 is a bill currently before Congress aiming to end some of the credit card industry’s anti-consumer practices. Among H. R. 1461’s proposals:

Chase Switches Me To Paperless Billing, Without My Consent, Then Charges Late Fees

Is Chase enrolling customers in paperless billing without their consent and then charging them late fees when they fail to pay? That’s what seems to have happened to Jack, who writes:

Meet The Credit Card Accountability Responsibility and Disclosure Act of 2007

Remember all of that government debate about the credit card industry? Well, a piece of legislation that addresses the debate has been introduced in the House of Representatives and is currently before the Financial Services Committee. The bill requires several changes, including things like advance notice of interest rate changes.

Microsoft Won't Take Your Credit Card Off Your Ex-Boyfriend's XBOX Live Account

However much you like your man now, don’t let him sign up for XBOX Live using your credit card. Why not? Because after you’ve broken up, Microsoft won’t take your credit card number off of his account. Instead, they’ll tell you to change your credit card number or submit it to you credit card company as fraud. Also, they will be sarcastic to you on the phone. Weird, huh?

Best Credit Cards For Foreign Travel

What credit cards charges the least for overseas purchases?

Watch Out If Your Credit Card Gets Sold To SST Card Services, Cause They're A Total Freakin' Scam

Consumer complaints are mounting against SST Card Services for deceptive and unlawful billing practices.