So I was in the grocery store this morning buying three rolls of toilet paper and a bottle of seltzer with a credit card, as I am wont to do. (It was on my way back from the gym and I had brought a credit card just for this purpose. I didn’t have any cash, I don’t like to bring my wallet to the gym, and I don’t like to have to futz with lockers).

credit cards

Live Without Credit Cards

The best way to escape from our mindless purchase economy is to ignore your credit cards in favor of pure, reliable cash. Credit cards undoubtedly have value – purchase protection, rewards, convenience – but only for consumers who use credit responsibly. No Credit Needed wrote a useful guide for anyone willing to live the credit-free life.

Credit Card Companies Say TJ Maxx Breach Affected 94 Million Accounts

According to new court papers, Visa and Mastercard are saying that the TJ Maxx security breach actually affected 94 million accounts—more than double the amount that TJ Maxx reported.

BoA Jacks Up Your Rates To 32.24% If You're Late With Two Payments

Bank of America gave Timothy a fun new “change in terms” yesterday that says if he pays late on his Visa at least twice in 12 months, they’re reserving the right to jack his rates up to a higher APR. It could go high as up as an effective APR of 32.24%. Hey, gotta make up for that 32% earnings drop somehow.

5 Expenses You Can't Afford If You Have Credit Card Debt

5) Cable. Your Excuse: “But, but, but I need cable! I get a good deal! It’s only $100 a month! I use it a lot! It’s bundled with my phone and my internet. I’ll only save $30 a month if I cancel it.”

The Mom With $135,000 In Credit Card Debt Who Spends $400 A Month On Starbucks

“I love new clothes. However, I like getting rid of the clothes just as quickly to go buy new ones.”

The Best Credit Cards Ever

The annual Kiplinger’s “Best Of” guide is out and here’s their picks for best credit cards. Best…

Is Your Credit Card Rate Higher Than Average? Switch!

Here are the national averages for credit card interest rates, according to Bankrate. How does yours compare?

Make Changing Credit Cards Across All Your Accounts Easier

If you’ve ever had to change your credit card number across a ton of different accounts, you know it’s a major hassle.

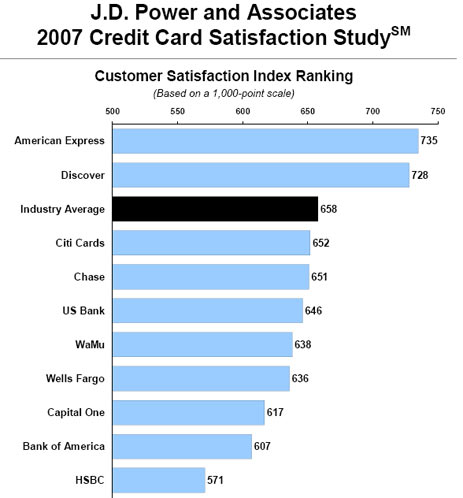

American Express Customers Are Most Satisfied, HSBC, Least

American Express ranks highest in customer satisfaction in the J.D. Power and Associates 2007 Credit Card Satisfaction Study. They said there’s two types of customers. One is transactors, who pay their bill off in full each month and for whom membership benefits are the most important drivers of customer satisfaction. The other is revolvers, who don’t pay their bill off in full each month, and for whom APR and fees are the most important drivers of customer satisfaction. So if we flip this survey over….

It Pays To Discover…. That Your APR Stinks

In this latest edition of Executive Customer Service cures all that ails you, reader Jeremy was able to keep his Discover Card APR from rising by escalating to the top of the customer service ziggurat. However, he doesn’t realize that he shouldn’t be so happy about keeping an 18.24% APR. We let him in on the secret…

Credit Cards Encourage Spending More

A 2001 MIT study published in Marketing Letters found:

In studies involving genuine transactions of potentially high value we show that willingness-to-pay can be increased when customers are instructed to use a credit card rather than cash. The effect may be large (up to 100%) and it appears unlikely that it arises due solely to liquidity constraints.

No wonder Dave Ramsey encourages people trying to get out of debt to cut up their credit cards.

Citing "Market Conditions" Capital One Raises Reader's APR 4.99% to 13.5%.

I have had a Capital One Mastercard for about 10 years. My interest rate has been 4.99% for as long as I can remember. I received my statement for October to find that my interest rate had jumped from 4.99% to 13.5%.

National Arbitration Forum Decides 61 Year Identity Theft Victim Owes $46,000

Yahoo! Finance has a horrible story about a 61 year old lady living on $759 a month Social Security whose credit card was stolen and it ended up with the National Arbitration Forum (NAF) deciding she owed them $46,000. [More]

Counter-Marketing Campus Credit Card Pushers

PIRG volunteers are manning booths in campuses nationwide designed to look like fictional “FEESA” credit card stand, BusinessWeek reports, except passing out lollipops that say “don’t be a sucker” and informational brochures about the dangers of credit card abuse. A worthy counter-marketing campaign, though someone should give them some more money so they can give out free tshirts too, and at least match their opponents’ irresistible offerings.