credit cards

BoA Closes Your Credit Cards If You Ask Why They Increased Your APR

It’s evident the pendulum swung too far in terms of giving away too much credit, but now it seems to be swinging back in the opposite direction just as hard, with banks getting too tightfisted, even when it doesn’t make sense. For instance, the APR on James’s BoA credit card jumped from 9.32% to 13.99%, and shortly after he called to see about getting it back, they closed all three of his credit cards. One was a Gold account with a lifetime APR of 7.99%, the other had a 1.99% APR. Just last month, he received an offer to transfer $15,000 to the 1.99% card. Obviously at least one department in Bank of America thinks he’s a good credit risk. It appears some other expressionless faces of the massive dodecahedron that is the entity called Bank of America disagreed.

The Chargeback Blacklist

The ChargeBackBureau sells merchants a blacklist with names of customers who have done chargebacks. Merchants are supposed to be able to access its lists and deny transactions to customers if they see they’re chargeback-prone. When a consumer is put on the list, they get sent an email warning them they’re “going to have trouble purchasing goods or services on the Internet in the future.” ChargeBackBureua’s headquarters are conveniently located in Panama, which is convenient for its American clients, as such databases are illegal in the US. Chargebacks are an important tool for consumers to fight back against merchants who won’t give you what you paid for. Here’s how to do one. If a merchant won’t do business with you because you stood up for your rights before, then you shouldn’t do business with them either.

Merchant Tries To Forbid Chargebacks

A reader wrote in to ask us if we’ve ever seen anything like the “Chargeback Abuse Policy” that Luxury Car Tuning in Las Vegas includes in their terms—”You agree not to file a credit card or debit card chargeback with regard to any purchase,” and if you do anyway, you have to pay any fees that normally the merchant must pay when dealing with a chargeback. The reader wants to know, “Is this allowed by any merchant agreement that you know of? Sounds pretty ridiculous to me. How likely would it be that they could get away with this?”

Kohls Violates Visa's Merchant Agreement, Refuses To Accept Credit Card Without ID

This afternoon I visited the Kohl’s store in Moline, Illinois. When I was checking out I elected to pay with my Visa card. After sliding my card through the card reader I signed the screen when prompted. My cashier asked to see the card, which I handed over to her. She handed my card back to me and then asked to see my identification, to which I respectfully declined. She said I had to show my ID or I could not leave the store with my purchases…

Wells Fargo Allows Your Data To Be Breached – Twice

Reader Bryan’s Wells Fargo credit/debit card stopped working unexpectedly one day while he was trying to gas up his car. He was confused because he had used the card the night before with no problems. He spoke to a Wells Fargo CSR at a local branch and discovered that the data for 125,000 cards, including his, was “compromised” thus deactivating his card. This had already happened to him once before within the last year and he was not pleased. His letter, inside…

1800flowers Dupes You Into Signing Up For "LiveWell" For $11.99 Per Month

After reader Vikram ordered flowers online from 1800flowers.com, he realized he was receiving a monthly charge from an obscure company called “LiveWell” for $11.99 per month. He did some quick research and found out that many others were being duped into this program. Yet nobody, not even 1800flowers seemed to know what it actually is. What should he do? His letter and our advice, inside…

Government Cracking Down On Anti-Consumer Credit Card Practices

In a surprising departure from the norm, the government is actually cracking down on some of the more egregious credit card practices. Usually they say that including more tiny print is sufficient enough consumer protection. Some things they’re addressing: creating a mandatory minimum payment period, forbidding double-cycle billing, and prohibited APR from being raised on an outstanding balance. The proposals are simply that, proposals, at this point, with finalization expected by year’s end, and we’ll see what happens after all the exceptions and industry lobbying groups get factored in the equation. The specific anti-consumer credit card practices getting attacked, inside…

Credit Card Class Action: Get More Money Back Using Your Digital Camera

If you traveled abroad anytime between February 1, 1996 and November 8, 2006, your credit card company probably owes you money, but how much? Under a class action suing credit card companies for double-dipping on foreign transaction fees, the best bet for getting your the money, if you don’t have detailed records of all your foreign transactions, is making an estimate based on how many days you were out of the country. One good way for shutterbugs to figure this out, says Delicious Baby, is to look through your vacation/travel photos on your computer. Most likely, they have digital timestamps you can use to figure out how long you were away. Now figuring out your refund is as easy and fun as going through your old photos. The due date for filing claims at ccfsettlement.com is May 30th.

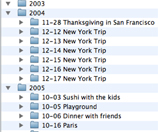

Revenues From Bank Fees Up 41% Over Last 4 Years

LowCards.com points out that fees are a huge source of revenue for credit card companies these days—they’ve gone from $12.8 billion in 2003 to $18.1 billion in 2007, an increase of 41% in 4 years.

Capital One All Hassle Credit Card

How hard should you have to work to pay your bills? No, not to make enough money to pay your bills, but to actually give your money to someone else? Reader Matt has been trying to convince Capital One to take his money for several months now. They’re not taking his money, or his calls, but they are willing to send him to collections! Check out his story, inside.

More Info On The $9.87 Credit Card Scam

MGD at dslreports read our post last night about Prophotosland.com and its fraudulent charge to reader Megan’s credit card. He’s been following the scammers—”an organized crime syndicate operated from Eastern Europe”—for nearly three years now, and has a ton of highly valuable information on them, including their recent targeting of military personnel stationed overseas. Bottom line: cancel your credit card, Megan, because they’ve got access to it now—and report the charge as fraudulent rather than dispute it.

Watch Out For $9.87 Credit Card Scam From Prophotosland.com

A reader named Megan noticed an unfamiliar charge for $9.87 from prophotosland.com on her WaMu credit card statement, so she began to investigate it.

Class Action Against Credit Card Companies Conspiring To Make Us All Accept Mandatory Arbitration Revived

Ross vs Bank of America is a class action suit…