As a rule of thumb, if you’re a company and you charge a customer for a service or product, you’re supposed to actually provide that service or product. That apparently wasn’t a practice adhered to by two credit card add-on companies that must now pay millions of dollars in fines and refunds. [More]

credit cards

Visa, MasterCard Cut Ties With Backpage.com After Pressure From Law Enforcement

After pressure from law enforcement, both Visa and MasterCard have announced they will no longer process payments for classified ads on Backpage.com. The site has often been criticized for its “Adult” section, which some say makes it easy for pimps and sex traffickers to solicit customers for sex. [More]

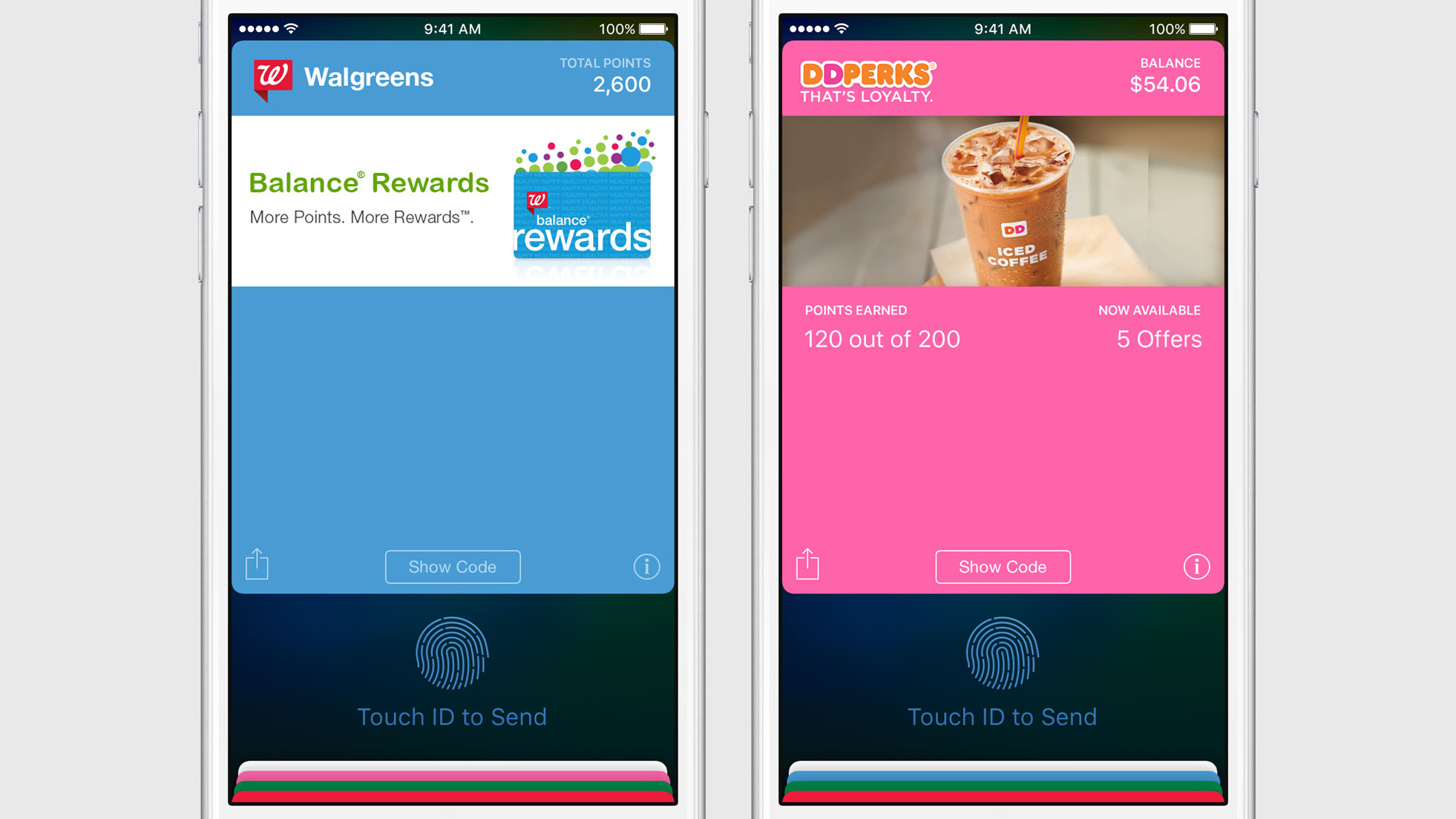

Apple Pay To Include Store Credit, Rewards Cards

Apple Pay is expanding its usability beyond just your bank-issued debit and credit cards. Today, the company announced that the payment platform will soon include the ability to pay with some store-branded credit cards and for users to access certain store rewards cards. [More]

Target Wants To Perfect Chip-and-PIN Before Venturing Into Digital Payment Methods

Consumers and businesses alike are always seeking out ways to streamline the checkout experience, most recently with mobile payment systems like Apple Pay and Android Pay. But there’s one major retailer that won’t be jumping into new payment options just yet. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

Sally Beauty Confirms “Illegal Intrusion” Into Payment Card Systems At Some U.S. Stores

After announcing earlier this month that it was investigating possible security breaches in its credit card payments at some U.S. stores, Sally Beauty has confirmed that there’s evidence of a data breach, its second in a little more than two years. [More]

Legislators Once Again Trying To Delay New Lending Protections For Military Personnel

The Department of Defense is trying to do something good for servicemembers by closing loopholes in the Military Lending Act that can leave military personnel vulnerable to predatory lenders. But these safeguards are now the target of a Congressman who has received substantial campaign contributions from payday lenders. [More]

Chase Says It Will Replace All Debit Cards With Chip-Enabled Cards

After an earlier report that it would do so, JPMorgan Chase says it’ll be reissuing debit cards for all its customers, replacing the old magnetic strip cards with those containing microchips for increased security. [More]

9 Things We’re So Grateful Mom Taught Us About Money

Today is the day we pause to reflect on everything our mothers have given us, from kisses on scraped knees and comfortable laps to sit on, to financial wisdom that has the power to stick with us through adulthood. We asked you to share the personal finance tips your mother imparted to you, because hey, sharing is caring and she’d probably approve. [More]

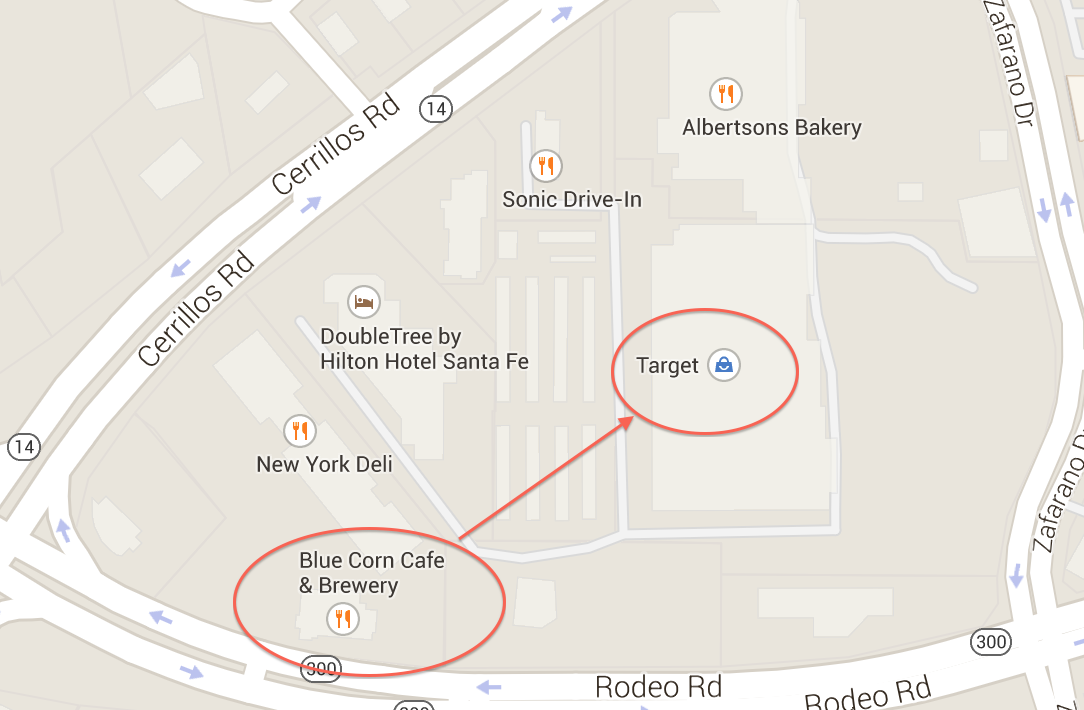

Fake Waitress Steals Diner’s Credit Card, Goes On Spending Spree Next Door At Target

How many times have you put your credit card out to pay for a restaurant meal and had an employee other than your server pick it up? It’s not uncommon, especially in busier eateries, so some diners wouldn’t think twice when it happens. At least until the card hasn’t been returned because the helpful “waitress” who took it is actually at the Target across the parking lot making purchases with it? [More]

Sally Beauty Looking Into “Unusual Activity” On Payment Cards At Some U.S. Stores

In what has become an unfortunately familiar experience, yet another retailer is announcing that it might’ve been the victim of a potential data breach: Sally Beauty confirms that it’s investigating “unusual activity” involving payment cards at some of its U.S. stores. This, a year after a breach that affected tens of thousands of customers. [More]

House Panel Strikes Provision That Would Delay Added Military Lending Act Protections

Yesterday we reported that Congress would make a decision whether or not it would intervene to slow the Department of Defense’s work to create new rules aimed at closing loopholes in the Military Lending Act that often leave military personnel vulnerable to predatory financial operations. Thankfully, legislators saw the need for more protections regarding military lending and determined the rules could go into effect as planned. [More]

How Scammers Trick You Into Giving Up That Security Code On The Back Of Your Credit Card

There are a lot of purchases you can make with the information on the front of a credit card. But ID thieves who have the card number, name, and expiration date will still hit a speedbump if they have to enter that (usually 3-digit) security code on the back of a victim’s card. Notice that we said “speedbump” and not “dead end,” because some scammers have figured out how to get this crucial info from their victims. [More]

Congress May Delay Predatory Lending Protection For Military Personnel

The Military Lending Act prevents military personnel from being caught in revolving debt traps of triple-digit interest loans from predatory financing operations like payday and auto-title lenders, but there are loopholes that allow some lenders to get around the MLA’s 36% APR interest rate cap, resulting in the loss of millions of dollars to servicemembers each year and raising issues of national security. The Dept. of Defense is currently working toward new rules that would add protections for military personnel, but Congress may intervene to slow the DoD from making progress. [More]

Discover To Let You ‘Freeze’ Credit Card When You’re Not Sure If It Needs To Be Canceled

If you’ve ever found yourself without your credit but unsure whether you left it another coat, dropped it on the sidewalk, or had it stolen from your wallet, you’ve really only had one safe option: cancel the card ASAP to prevent anyone else from using it. But Discover is reportedly going to offer its Discover It card customers the option of temporarily shutting the card off without cancellation. [More]

Visa Unveils Plan To Breakdown Airline Fees Separately On Statements

With all the extra fees tacked on by airlines – bag fees, WiFi fees, seat upgrade fees – it can be hard to remember exactly what you paid for each of these add-on charges. Visa customers won’t have to worry about keeping things straight anymore, as the credit card company now plans to breakdown airline charges on monthly statement. [More]

Walmart Executive: Chip-And-Signature Credit Cards Not Enough To Protect Consumers

The long-awaited move from traditional magnetic stripe credit cards to cards equipped with computer chips has been touted as a safer, more secure method of payment for consumers. But a top executives at the country’s largest retailers says all the hype surrounding the new cards will likely be a security letdown without the use of PIN requirements. [More]