Balance chasing is a practice credit card companies are using to reduce their risk, find out what it is and what you can do about it.

credit cards

Hit With A Credit Card Rate Hike? Try Freezing The Account

Rosemary writes that Bank of America just increased the interest rates on her two credit cards by 12% and 15% because the balances were too high, after slashing the credit limits on both cards a month before. She’s frustrated, of course, but like everyone else who’s been hit with these increasing fees, she’s sort of stuck with their decision. But Mary Schwager at Examiner.com suggests you try placing your account on hold for six months or so, at which point your creditor may be less terrified of the economy and willing to work with you.

Tennessee Pushes Back Against Late Fees By Credit Card Companies

Although it has yet to pass into law, the Tennessee Senate Commerce Committee has approved a bill that requires creditors to count the postmark date of a payment as the payment date, not the day they say they receive it.

Chase Stops Charging $120 Annual Fee For Balance Transfer Customers

We wrote in January about a new $10 per month fee that Chase was arbitrarily imposing on customers who had transferred balances to their Chase cards. Well after having a little chat with New York Attorney General Andrew Cuomo, Chase announced that they’ll stop charging this ridiculous fee and they’ll be refunding customers’ previous payments.

Best Buy Taking Over Circuit City Credit Cards

“Good news about your credit card account,” proclaims the letter Wilman recently received from Chase. Starting in May, you’ll be able to use that Circuit City card to make purchases at Best Buy. We think this is more like “mixed feelings” news, but on the plus side you won’t have an otherwise good credit card account closed (assuming you care about your FICO score). See the Chase letter below.

FICO Confirms: Reduced Credit Lines For Good Borrowers

A study from Fair Isaac confirms that even the best borrowers are seeing their credit lines slashed as banks move to boost profitability during the recession. 16% of Americans have seen their credit lines reduced by an average of $2,200, and of them, 11% had no late payments or negative marks on their credit report.

Make Sure Your Replacement AmEx Gets Overnighted

Traditionally, AmEx will send you a replacement credit card via overnight, but an insider tells us that as a cost-saving move, they’ve been trying to cut back on this. If you have low-balance, low-usage or are not an annual fee payer, they might not offer the overnight right off the bat, or may even deny it. Our tipster says there are some key phrases you can use to make sure you get your card lickity-split:

Blog Gets Some Stupid Capcom Credit Card Fees Removed

It turns out that Chun-Li, of Street Fighter fame, does not want to charge you so many onerous fees on your Capcom credit card that attack over and over on your neck like that stupid bitch, Blanka. Just some of them.

15 American Express Executives' Email Addresses

Here are the email addresses for 13 American Express execs, in case you need to send them an eecb.kenneth.I.Chenault@aexp.com, kenneth.Chenault@aexp.com, daniel.t.henry@aexp.com, alfred.kelly@aexp.com, l.kevin.cox@aexp.com, ashwini.gupta@aexp.com, john.d.hayes@aexp.com, judson.c.linville@aexp.com, louise.m.parent@aexp.com, louise.parent@aexp.com, thomas.schick@aexp.com, steve.squeri@aexp.com, douglas.e.buckminster@aexp.com, douglas.buckminster@aexp.com, william.h.glenn@aexp.com [More]

GEICO Mastercard Slashing Everyone's Credit Limit To $500?

Dan wrote in to let us know his $8,800 GEICO Mastercard now has a $500 line of credit. “It’s not you, it’s us,” is basically what GEICO told him in their letter on March 12th. They also say they’re doing this to every one of their Mastercard holders. Dan notes, “Interestingly enough, this new limit is less than the 6 month rate GEICO was charging me for my two cars, meaning that I couldn’t even use their preferred card to pay their premiums.” You can read their letter below.

10 Self-Lies That Screw You Into Debt

10 lies we tell ourselves that get us into and keep us stuck in credit card debt:

Suze Orman Says Build Up Emergency Cash As Much As Possible

In Suze Orman‘s most recent book, “2009 Action Plan,” she urges people with credit card debt to pay off their balances as quickly as possible using the high interest first method. “The fact that you pay just the minimum is a huge warning signal to your credit card company,” she writes, “that you may already be on shaky ground.” Now she’s changed her mind and says you should just pay the monthly minimum and put the rest of your money toward building an emergency cash stash. Based on the way credit card companies have been behaving, we think she has a point.

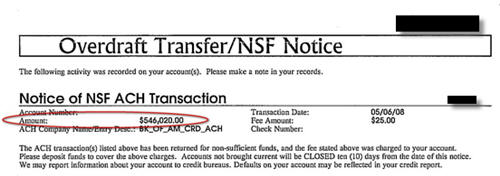

Whoops: Typo Causes You To Overdraft $546,020

Reader Thomas was celebrating the birthday of his 1 year old when a letter arrived from his credit union. It was a notice informing him that he had overdrafted his account. By $546,020. Whoops.

Get The Best Cash Back Credit Card

Tired of using a two credit card system to maximize his cash back returns, I did an analysis to determine the single best cash back credit card. Here’s what I found:

Visa Covers Butt By 'Delisting' Breached Credit Card Payment Processors

Visa has removed Heartland Payment Systems and RBS WorldPay, the two huge payment processors that suffered recent data breaches, from its list of companies that are in compliance with Payment Card Industry (PCI) rules. It says they can get back on the list when they recertify that they have proper security in place. While this may sound like a significant change in the status of the companies, in reality it does little to change how the three companies do business with each other or with merchants. It’s just a way for Visa to protect itself from any upcoming lawsuits by banks and credit unions against the payment processors.

My Home Depot Credit Card Now Has A 25.99% APR

Reader Warren says that Home Depot raised his APR to 25.99% — causing him to cancel his account. Yikes.