Steph says Starbucks violated her credit card’s merchant agreement by forcing her to show her ID while buying $27 worth of coffee. She writes: [More]

credit cards

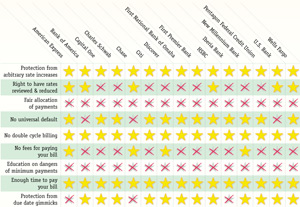

CARD Act: Who's With It, Who's Not

The CARD act is supposed to go into effect next week, Feb 22. As we get close to the deadline, is your credit card complying with the rules? Courtesy of BillShrink, this giant infographic is here to tell you the answers. Teaser: absolutely zero issuers are doing fair allocation of payments. [More]

Chase Doesn't Want Your Paltry $16 Haiti Relief Donation

Chris writes that while closing a Chase credit card, he had to decide what to do with his leftover rewards credit. He tried to donate his rewards to charity, but learned that $16 isn’t enough to be considered a valid donation. Bwuh? [More]

Credit Card Hacker And ID Theft Forum Overlord Sentenced To 13 Years Prison

Max Vision, the security consultant who was first sent to prison in 2001 for messing with the Pentagon, has now been sent to 13 years in prison for “stealing nearly two million credit card numbers from banks, businesses and other hackers,” reports Wired. The FBI took a renewed interest in Vision in 2006 after he successfully made a power grab on several competing black market ID theft websites. “I’ve changed,” Vision wrote in a letter to the court, and although he faced life in prison, he was given the shorter sentence partly because he’d cooperated with the government. With good behavior he’ll be back out in 2018. [More]

Avoid Credit Card Annual Fees: Just Charge $2,400 Per Year

Jesse has a credit card that he doesn’t use, but keeps open to help his credit score. Citibank has foiled his brilliant plan by adding a $60 annual fee. He can avoid the fee by charging at least $2,400 on the card each year. [More]

Starbucks And Chase End Duetto Rewards Credit Card

The Starbucks Duetto Visa card seems like a relic of another time. A time when everyone thought that both coffee-infused sugar bombs and huge amounts of credit card debt were a good idea. Well, Starbucks is still with us, but the Duetto Visa card’s run is over. You can no longer earn Starbucks cards while racking up debt. [More]

Get Up To Speed On What The CARD Act Will Do To Credit Cards

In just a little over a week, the CARD Act will go into effect, and a new set of rules will apply to credit card issuers. Here’s a great summary of what will change and what won’t, so you’ll know what to expect. For instance, did you know that cards issued to business entities rather than individuals are exempt? [More]

Why People Stop Using Credit Cards

In yesterday’s Money section, USA Today talked to some consumers who refuse to carry credit cards, and looked at the hidden costs. One 24-year-old says they make her uncomfortable; a guy working at a gas station to pay for college says he doesn’t want to get accosted by endless junk mailings once his name enters the pool of potential customers. Then there’s the bankruptcy lawyer who canceled his cards on principle 8 years ago, after seeing how lenders behaved when their customers suffered financial setbacks: [More]

Consumerists, How Do I Deal With Credit Card Companies Now That I've Lost My Job?

Newly unemployed, credit card debt-carrying Lilgaladriel wants some advice on how to deal with the credit card companies. He writes: [More]

Disney Store Refuses Small Credit Card Purchase Because You Left Your ID In The Car

UPDATE: This complaint has been resolved. Reader Terry is annoyed because the Disney Store refused to sell his family $8.50 worth of stuff unless he went out and got his wife’s ID from the car. [More]

Judge Censured, Barred For Ordering Lawyer To Be Paid In Gift Certificates

A judicial commission for California judges censured and barred the recently retired judge Brett C. Klein for showing bias, abusing authority, and grandstanding to the press. At issue was his January 2009 alteration of a class action settlement, where he ordered everyone, including the attorneys, to be paid the same way: via $10 gift vouchers from a woman’s clothing store. [More]

Update On Woman Sent To Jail For Using Gift Cards At Best Buy

Last month, New York City’s NY1 news channel produced a news segment on the woman who was arrested for paying with AMEX gift cards at a Best Buy. If you read our earlier post with Ilona’s email, you already know most of the basics, but you can see the problematic gift cards and hear Ilona describe the experience in her own words. It turns out that after she was released, she went back to Best Buy for either a refund or the DVD player, but had to leave without either one–she was told she’d have to contact American Express to resolve the problem. [More]

Best Buy Sends Customer To Jail For Paying With AMEX Gift Card

Update: The news channel New York 1 has prepared a video segment about Ilona’s experience with Best Buy and the NYC police.

*

A shopper just told us that last night last month at a Best Buy in NYC, she was taken to a back room, then cuffed by police officers and taken to a precinct for “further investigation,” because she tried to pay with an American Express gift card her father had bought for her.

Watch Out For These Tricks After The CARD Act Kicks In Next Month

The credit card reform bill will go into effect at the end of February, but that doesn’t mean you should stop paying attention to what your credit card company does with your account. There are lots and lots of loopholes, notes WalletPop. For example, your card issuer can still raise rates on future purchases any time and for any reason. In addition, there’s no limit to the number of fees that can be invented and applied to your account. The only way to make sure you don’t get screwed by a profit-hungry card issuer is to read every single thing that’s mailed to you, and closely review your statement for evidence of any changes that you may have missed. [More]

Experts Answer Credit Questions From Average Americans

Henry Unger at the Atlanta Journal-Constitution has put together a multi-part series of questions and answers from readers. The detailed answers are provided by Consumer Credit Counseling Service of Greater Atlanta, and the questions–which I’ve listed below–cover a broad spectrum of personal finance issues, including credit cards, mortgages, and credit reports. [More]

Paypal Rewards Dollars: Use 'Em In One Go Or Lose 'Em

The PayPal plus rewards card earns points which can be traded for vouchers which can be used like cash to buy stuff. You have to be careful, though, and make sure that the price is the same or greater than the voucher amount. Any unused dollars on the voucher get forfeited after the purchase. Tricky! Reads those terms and conditions close, folks. [More]

Whole Bunch Of Store Credit Cards Add $1 Paper Statement Fee

Last week, I mentioned in passing that World Financial Network National Bank, home of more retail-branded credit cards than you can fit in the average wallet, is adding a “paper statement fee” to all of their credit cards. And if you use store credit cards at all, the odds are pretty good that you have a WFNNB card in your wallet. [More]

Get Ready To Disclose A Lot More Information When Applying For Credit

The downside to responsible lending is that the lenders will need more information about you, says the WSJ. [More]