Since we began writing about credit card companies now allowing merchants to require minimum purchases for credit transactions, we’ve received feedback from readers in both the comments and in the tipline about how credit cards are faster and more efficient than cash. At the same time, there are those who swear by cash when it comes to making purchases of only a few dollars. So which is it? [More]

credit cards

Business Credit Cards Not Protected By CARD Act

Sorry, small businesses, the much ballyhooed protections of the CARD Act do not cover your credit cards. Only consumer credit cards get safeguarded against the most punitive of the old interest rate and fee policies. No wonder credit card solicitations to small business owners have increased 256%, vs 29% for consumer credit cards – they’re more profitable now. [More]

Add Discover To The List Of Credit Cards That Allow Minimum Purchase Requirements

Yesterday, we told you how Visa and AMEX now allow merchants to require customers up to a $10 minimum for credit card payments and how MasterCard will soon be changing their policy to allow for the same. We’d naively hoped that Discover — who hadn’t yet replied to our query — would be the lone holdout, but… not so much. [More]

AMEX, Visa, MasterCard All Give Thumbs Up To $10 Credit Card Minimums

For years, educated credit card holders have been safe in the knowledge that a merchant could not require them to purchase a minimum amount in order to charge something to their cards. But with the recent passing of the finance bill, the door has been opened to allow such minimums — and the card companies are just fine with that. [More]

Cab Driver Locks Doors, Holds Passenger Hostage For Trying To Pay With Credit Card

There’s a driver for Pittsburgh Yellow Cab Company who doesn’t like it when you try to pay with a Discover card, even though the company’s website says they accept it. When Adam tried this, the driver accused him of trying to avoid paying, then locked the doors and initially refused to let him go to an ATM 15 feet away unless he left all of his belongings behind. While Adam called the cab company to complain (he was routed to a voicemail inbox), the driver called the police. Twice. [More]

Thieves Steal $10 Million, Pennies At A Time

These credit card thieves allegedly stole over $10 million by placing bogus charges on customers’ credit cards for amounts between $10 and $.20. Each customer was stolen from only once, spreading the theft out over a million different cardholders. Check your statements, there’s a decent chance you were one of them. [More]

Ohio Woman Indicted For Using Starbucks Job Applications To Commit ID Theft Worth $115K

The last thing anyone needs when they’re out of work is to worry about the safety of the personal information they put on a job application. But the U.S. Attorney in Ohio has indicted a woman on allegations that she used this sensitive info to falsely obtain credit cards and run up a $115,000 tab. [More]

Do Pay-By-Smartphone Systems Put Consumers At Risk?

As smartphones like the iPhone or Droid become more popular and more sophisticated, developers are finding new ways for consumers to use these mobile devices to replace existing items like airplane boarding passes, coupons and now credit cards. Soon, smartphone owners will be able to pay for purchases with a wave of their phones, but they should first be aware of the possible risks involved. [More]

Credit Card Interest Rates Hit 9-Year High. Thanks, CARD Act!

Average interest rates have hit a new 9-year high of 14.7%, and we have credit card reform to thank for that. Por-kay? Unable to keep soaking you on the backend with hidden fees, tricks, and traps, issuers now have to push their profit-taking to the fore. [More]

3 Credit Card Act Protections Went Live Sunday

Three of the provisions of the CARD Act, the legislation passed this year to improve consumer protection in the credit card arena, went into effect yesterday. Here’s what you need to know to sound smart around the water cooler: [More]

Help, Expedia Sold My Chargeback To A Collection Agency!

Ed and his wife successfully filed a chargeback against Expedia for a canceled trip earlier this year. Now he’s being dunned by a collection agency for the amount that Amex refunded him. [More]

New Burst Of 0% APR Credit Cards Boast Higher Balance Transfer Fees

Banks are stuffing mailboxes once again with 0% introductory APR credit card offers, but this time around they’ve got higher fees for doing the initial balance transfer, rising from 3% in ’09 to 4% in ’10. [More]

Your Credit Card APR Might Fall Starting This Sunday

Some Americans might be getting a break on their credit card interest rates very soon. [More]

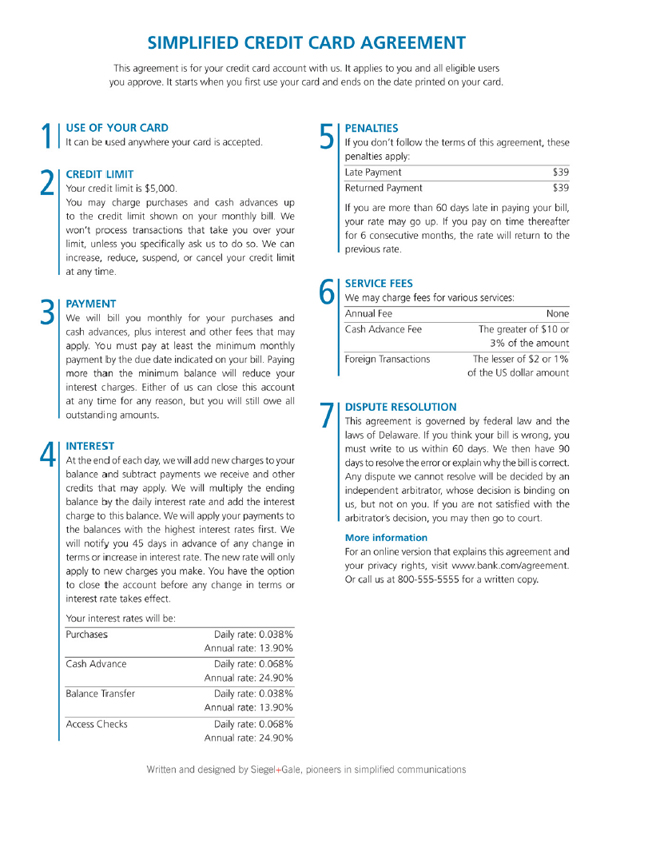

Why Can't All Credit Card Agreements Look Like This One-Page Piece Of Beauty?

Branding expert Alan Siegel has designed a model credit card agreement that is only one page long, is written in English, and communicates everything you need to know about your credit card. It therefore has no chance of coming to life. So let’s gaze upon it and dream about a better tomorrow that will never come: [More]

Look Out For These Fees As Bank Legislation Goes Into Full Effect

This is the first business day financial institutions have been required to give existing checking account customers the choice to opt in to overdraft protection. Since banks are looking for ways to make up for the lost revenue by sticking it to customers in other ways, they’ve dreamed up some new ways to trick you out of your money. [More]

Woman Lends Homeless Man Her AmEx Card, Actually Gets It Back

Here in New York City, most people have become immune to the frequent requests for spare change from panhandlers. And under no circumstances would a sane person hand over their American Express Platinum Card to a homeless person. But not only does a high-powered ad executive do just that, she also got the card back. [More]