Security firm Pandalabs investigated the online underworld’s menu of services and has surveyed the going rates for various kinds of fraud. Stolen credit card numbers can be had for as little as $2, but these are like buying a mystery bag. Crooks don’t know the cardholder’s info and there’s no assurance that it will actually work. So for $80 thieves will sell a debit card with a guaranteed (small) balance. To get access to a big balance of $82,000, that will run ya $700. [More]

credit cards

Kardashians Sued For Fee-Drenched Debit Card, By The Card's Makers

The Kardashians have been sued over their Kardashian Card, a pre-loaded debit card they agreed to put their faces and names on and help promote. The card was slammed by critics and an AG almost as soon as it came out for the high hidden fees it hoped to extract from the teen audience it was targeting. But the plaintiff isn’t a government body or members of a class action, it’s the Kardashian’s former business partners. [More]

Ex-Credit Card Thief Recommends Making Up Fake Answers To Security Questions

In an interview, a former credit card thief talks about some of the scams he used to run on unwary consumers. It’s got some good takeaways for protecting yourself, like the one where you make up fake answers to security questions. With all the info that can be found online now some of these security questions aren’t that hard to figure out. So instead of putting down the real answer to “What’s your mother’s maiden name?” put down “unicorn princess.” [More]

American Express Offers Credit Card To 3-Year-Old

If you needed any more evidence that credit card offers are on the rise, you need look no further than this story over at CNNMoney, in which the writer’s 3-year-old daughter received a credit card application from American Express. [More]

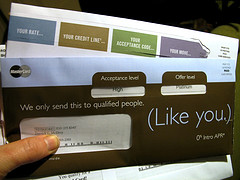

Subprime Credit Cards Are Back, Now With Extra Interest!

After a couple years of hiding in the shadows, credit cards targeted at consumers with less-than-stellar credit ratings are once again making a push to gain new customers. [More]

Chase Took My 89 Cents, Says It Wasn't A Big Deal (Updated)

Mark says he was nickel and dimed — as well as quartered and penneyed — by Chase. He had an 89 cent positive balance on his credit card, but the bank debited the same amount so it wouldn’t owe him anything on his statement. Mark acknowledged that the amount of the transaction was insignificant, but was alarmed that Chase made an unauthorized charge on his account. He twisted the bank’s arm to get it to send him the 89 cents. [More]

I Call For A New Credit Card, Am Told My Account Is Canceled

Andrew thought everything was fine with his Bank of America credit card account, save for the physical card itself, which was frayed and needed to be replaced. Then he called customer service and was told not only would he not receive a new card, but his account would be killed because of delinquency. [More]

Thief Tries To Buy $3K Worth Of Chicken Sandwiches With Stolen Credit Card

You’re a thief who has just exercised your criminal genius to swipe two credit cards from an unsuspecting victim. You know you probably have only a few hours to use your golden tickets to fulfill your dreams before the cards are rendered worthless. What do you do? Try and buy as many chicken sandwiches as possible, of course. [More]

Citi Testing Card With Button That Lets You Choose To Pay With Reward Points

A credit card with a button? Yep. That exists. Citi is testing a card with an actual button on it that, when pressed, switches the card from regular credit to reward points. [More]

What's My State's Statute Of Limitations On Debts?

One of the first thing you’ll want to check when you get a debt collection notice is the expiration date. No, it won’t be written on the top like a milk carton. But you can check to see when the debt is from. If it’s longer than your state’s statue of limitations on debt collections, they’re unlikely to successfully sue you. Those dates vary by state, so here’s a handy list that gets routinely updated. [More]

First Step To Reducing Credit Card Debt Is To Stop Using Your Card

It sounds obvious but judging how many people (ab)use their credit cards they seem to forget it: to get out of debt you need to stop getting into more debt. That means putting your credit card on lockdown. [More]

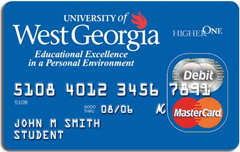

Put That Beer On My Student Loan

A card called “Higher One” lets college kids take their student loan and turn it into a debit card they can use to buy pizza, beer, and other learning essentials with. [More]

Best Buy Virtually Cuts Up My Credit Card, Won't Let Me Pay By Other Means

Allison’s experience of having her credit card purchase denied by Best Buy online may not be as embarrassing as a head-shaking waiter returning your card after a meal, but it’s every bit as frustrating. Best Buy sent her an email informing her that her credit card wouldn’t go through, but every time she calls to rectify the situation, she’s gets lost in voice mail hell. [More]

Transcripts Of Discover Card Allegedly Tricking Customers

The Minnesota AG is suing Discover Card for allegedly duping customers into thinking they were just getting a courtesy call about their card but then actually signing them for a payment protection plan. The AG gave copies of the audio files of the customer calls to the New York Times. Here is a salient selection of one of the transcripts. [More]

Lawsuit: Capital One Sent Me Letter Demanding $286 Million

A woman in Pennsylvania has filed a lawsuit against Capital One after a dispute over a few thousand in credit card debt spiraled out of control until, she alleges, it culminated in the credit card company sending her a letter demanding the immediate payment of more than $286 million. [More]

New Line Of Prepaid Debit Cards Target Teens With Cartoon Designs

Just days after the Kardashian Kard got cut, a new line of “Myplash” prepaid debit cards targeting teen consumers is here, bedecked with cutesy cartoon characters and Twilight stars. [More]

Overcome Personal Finance Procrastination

The number one cause of personal finance ruin is procrastination, and the number one cause of procrastination is fear of failure. So if you find yourself watching Brideplasty instead of balancing your checkbook, deciding which expenses to cut, or updating your retirement savings plan, here are some tips for making those tasks less daunting. [More]

Kardashians Terminate Krap Kard

After just 3 weeks, the Kardashian Kard is canceled. Lawyers for the K sisters sent a termination letter to the bank that had licensed their likenesses and slapped them on its hidden fee-laden debit card targeted at children. Seems they don’t want to be associated with a card that was almost immediately after it launched the source of an AG investigation. See the full letter, after the jump. [More]