In spite of the “small business” name, there is nothing about most so-called small business credit cards that requires the cardholder to actually own or operate a business. In fact, over a five year period ending last December, credit card companies sent out more than 2.6 billion business card offers to regular Janes and Joes in the U.S. But while these cards are available to the everyday consumer, they do not come with all the protections associated with non-business credit cards. [More]

credit cards

Skimmers Found Installed Inside Gas Pumps. Inside!

If you’re the type of person who already reflexively jiggles every card slot and looks for pinhole cameras whenever you go to swipe your card, despair. There is no 100% foolproof way to protect yourself, as proven by a pair of banditos who stole 3,600 card numbers after installing a credit card skimmer inside several gas pumps, reports the MountainView Voice. [More]

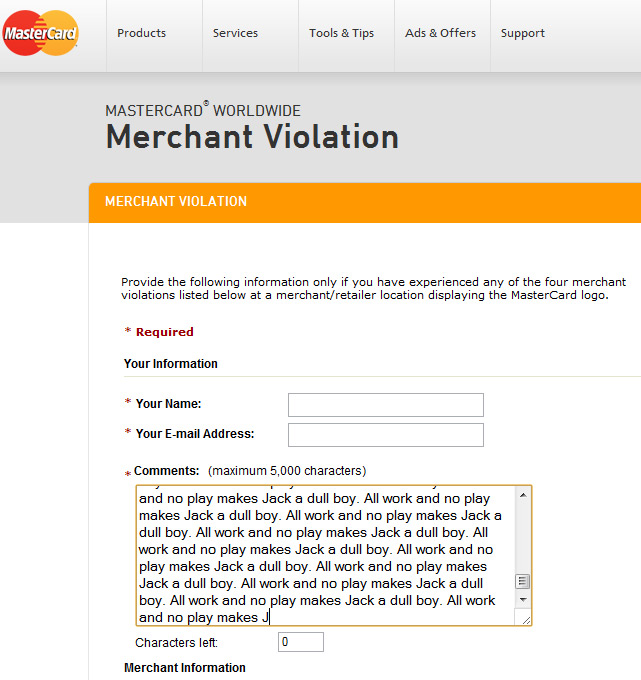

MasterCard Fixes Merchant Violation Form

After a reader noticed that Mastercard’s Merchant Violation report form for consumers only let you put in 100 characters even though it said you had 5,000, we wrote a post about it (in addition to using the form itself to report the error). Now Mastercard has informed us that they fixed it, and indeed it passes our test. Finally, “As a point of reference, consumer questions and issues can be raised on our Twitter page at @MasterCard, as well as the web forms,” the MasterCard rep pointed out via email. That’s right, there’s now at least two ways to talk to MasterCard using over 100 characters. [More]

"Bump The Bonus" And Get More Airline Miles For Free

One way to build up frequent flyer miles quickly is to apply for several of the credit cards that give bonus miles for signing up. You buy stuff you were going to buy anyway and meet the minimum spend requirement, get the miles and move on. But then a while later you notice that the same credit card is offering even more miles for newer applicants. Curses! Instead of despairing, though, The Frugal Travel Guy Rick Ingersoll says you should call the credit card company and ask them to increase the bonus miles they gave you to the new level. [More]

Mastercard's Merchant Violation Form Only Accepts 100 Characters

I guess Mastercard has gotten tired of hearing long-winded consumer complaints about stores breaking their merchant agreement with them. The form on their website where you’re supposed to make complaints says that you can use a max of 5,000 characters, but when you actually go to type something in, it won’t let you enter in more than 100. Perhaps they would rather consumers tweet their complaints? [More]

Credit Cards Pitches Return To Campus

Despite being largely banned by the CARD act, credit card issuers have figured out how to get around its provisions and still reach college kids, reports WSJ. Here’s what they’re doing: [More]

Sony: No Evidence That Credit Card Info Was Stolen By PlayStation Network Hackers

Sony’s PlayStation Network has been down for more than three weeks, during which the company hasn’t been able to definitively state whether or not users’ credit card information was compromised. But in a letter sent to game publishers, Sony writes that it’s seen no proof that such data was hacked. [More]

Visa Developing "One-Click" Payment System

Visa announced that they’re working on a “one-click” payment system that would make it easier for consumers to shop online without having to enter their credit card and billing information over and over again. [More]

Hotel Digs Out Old-School Carbon Credit Card Machine, Forgets To Actually Charge Customer

What do you do when you’ve received a product or service, but were never charged for it? Legally, in most cases you’re not required to do anything, but what about those pesky ethics? Rebecca was traveling to Europe for business, and the hotel had trouble processing the transaction on either her business or personal credit cards. The hotel clerk hauled an old-school carbon copy device out of, we assume, some kind of Museum of Antiquated But Still Functional Financial Devices and took an impression of Rebecca’s personal credit card. The bill was settled. Rebecca’s company reimbursed her for the hotel stay. But six weeks later, the hotel still hasn’t charged her card, and she isn’t sure what to do. [More]

A Tearful Breakup Letter To The Credit Card Company

Jon Acuff cut up all his credit cards and cancelled all his accounts. He thought was enough to end his relationship with his credit card company. But one of them wasn’t quite ready to move on. They sent him a letter that was oddly close to something a spurned lover begging for another chance might send. “They hadn’t heard from us in a while and just wanted to see how we were doing, writes Jon. “They promised that they’d change if we took them back. Things would be different this time.” That got Jon thinking that he should write a letter back in the same vein to give their relationship total closure. [More]

Sony Breach Could Flood Market With Millions Of Cheap Stolen Credit Cards

Some fun (no, not really) potential aftershocks of the Sony Playstation Network breach: The price of buying a stolen credit card number could drop from $5-$10 per to $1-$2 if the hackers flood the market with the 2.2 million credit cards they claim to have access to… [More]

Michaels Warns Customers Of Possible Data Breach

If you’ve shopped at a Michaels big-box craft store recently and used a credit or debit card, keep an eye on your statements, especially if you shopped in the greater Chicago area. The chain notified customers on its e-mail list earlier today about a possible PIN pad breach in Chicago that may apply to other stores as well. [More]

Trying To Ruin Your Ex's Credit Score Is Not A Good Way Of Getting Revenge

When a romance goes south, it’s not unheard of for at least one of the parties involved to begin dreaming up clever ways to continue making the other person’s life hell. And one thing you definitely don’t want to do is try to screw with your ex’s credit score. [More]

Swiping Your Debit Card At The Pump Could Put A Huge Hold On Your Checking Account

When customers pay by debit card, it’s a common practice in the hotel and restaurant business to put a hold on their account for an estimated amount of the purchase. That way, there is still flexibility for you to write in a tip or to cover any other ancillary costs. Now, more and more gas stations are taking this approach for debit card customers who swipe at the pump, putting holds in the range of $50 to $100 that can linger on your account for days. [More]

Capital One Gives Platinum Card To 5-Year-Old

A mom in Connecticut was concerned about the credit card applications her 5-year-old son kept receiving from Capital One, so she contacted the credit bureaus to make sure someone wasn’t stealing her kid’s personal info. She says she was told that a good way to get those applications to stop would be to actually fill one out. The boy would be rejected, obviously, and the mailings would end. But that isn’t exactly how things panned out. [More]

Why Are Financial Companies Forcing Us To Have Weak Passwords?

Your bank or credit card company is probably the last entity you would want forcing you to set an incredibly weak Web password. But it’s not just American Express that wants their customers to use really crappy, easily crackable passwords. Charlie recently discovered that Capital One and, to a lesser extent, Bank of America have limits on their customers’ passwords that force them to choose crappy ones. [More]

Bank Of America To Charge Penalty Rates To Customers With Late Credit Card Payments

Starting June 25, Bank of America will begin charging penalty interest rates of nearly 30% on new purchases by customers who miss payments. [More]

Sony: PlayStation Network Users' Credit Card Info May Have Been Leaked

Sony’s early bid for a high seed in next year’s Worst Company tournament continues, as does the mass outage of its PlayStation Network. Yesterday, the company admitted that it wasn’t sure if users’ credit card info was compromised by whatever evil forces hacked the system, but now Sony has slightly upgraded that uncertainty by saying that credit card info may have been leaked. [More]