NPR shows just how easy it is for crooks to buy thousands of stolen credit card numbers and convert them into useable credit cards using a simple desktop setup. [More]

credit cards

Around $2.7 Million Stolen From Citi Accounts After Hack

The fallout continues from the May 10 breach of Citi’s credit card account files by hackers. The bank now says that a total of around $2.7 million was stolen from a relatively small percentage of the 360,000 breached accounts. [More]

U.S. Bank Tests EMV Chip Cards For International Travelers

Good news for Americans who like to go to other countries in the world. U.S. Bank is going to roll out EMV chip cards to 20,000 FlexPerks Visa cardholders this month, adding steam to a small but growing push to get traveling Americans credit cards that can work in the “chip and PIN” systems prevalent in Europe and beyond. [More]

Chase Says No To Credit Increase On One Card But Nearly Doubles Limit On Other Card Without Asking

The inner workings of Chase’s credit card business have Consumerist reader Jon scratching his head. After being turned down for small limit increase on one credit card, the bank goes ahead and nearly doubles the credit limit on a second card with an already higher limit. [More]

AMEX Unveils Low-Cost Prepaid Card Without Hidden Fees

The prepaid card industry is notorious for preying on poorer consumers with hidden fees for just about every thing you use it for. There’s even fees for not using them, in the form of inactivity fees. So it’s an unexpected breath of fresh air that American Express is rolling out a new prepaid card with very few fees and a pretty straightforward approach, at least for consumers. [More]

How Hackers Stole 200,000+ Citi Accounts Just By Changing Numbers In The URL

Details have emerged has to how hackers were able to steal over 200,000 Citi customer accounts, including names, credit card numbers, mailing addresses and email addresses. It turns out quite easily, in fact. All they had to do was log in as a customer and change around a few numbers into the browser’s URL bar, NYT reports. Facepalm. [More]

Report: Citi Knew About Credit Card Hack For Weeks Before Going Public

Last week, Citigroup announced that around 200,000 credit card accounts had been compromised by hackers, but a new report from the Wall Street Journal says the bank knew something was wrong weeks earlier. [More]

Avoid Credit Card Problems When Traveling Overseas

Most credit cards in Europe have an embedded PIN chip in them, called an EMV card. Almost no American credit cards do. This causes big problems for Americans traveling in Europe but there are a few ways to minimize the hassle. [More]

Breach: Citi Says Hackers Stole Hundreds Of Thousands Of Credit Cards

Roughly 200,000 Citi customers’ credit cards were stolen by hackers in a breach the bank just announced today. The data included names, credit card numbers, mailing addresses and email addresses. [More]

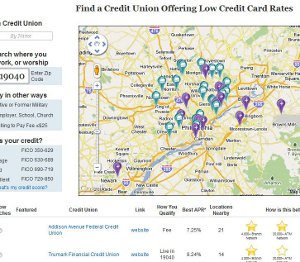

New Search Tool Helps You Find Credit Unions With Decent Credit Cards

As many of the bigger banks have reacted to credit card regulation by nickel-and-diming their customers, a number of people have begun looking to not-for-profit credit unions as a lower-cost alternative. Unfortunately, since most unions don’t advertise and there often isn’t one on every corner, they can be difficult to locate. But a new search tool from the folks at Nerd Wallet can help point you in the right direction. [More]

Anthem Blue Cross To Start Charging $15/Month To Pay Bill By Credit Card

Anthem Blue Cross, along with its parent company, perennial Worst Company In America contender WellPoint, is known for many things — trying to jack up rates on policyholders by upward of 30%, practicing rescission on breast cancer patients, and leaking customers’ credit card information online. Basically everything except for providing quality health insurance. You can soon add another item to Anthem’s long list of qualifications when it stops allowing credit card payments, except for those willing to pay a $15 convenience fee. [More]

Credit Card Reform Worked: Prices Not Increased, Just Clearer

Ignore all the haters. Credit card reform in 2009 did its job, making credit cards less confusing and safer for consumers. According to a new study from the Center for Responsible Lending, contrary to popular misconception, the reforms didn’t increase prices for credit cards, it just made the real costs clearer. Banks couldn’t tuck costs in hidden fees and sneaky practices, they had to put them on the sign out front. [More]

Before Entering Scam, Man Wants To Make Sure He Can Get A Refund…

John is interested in signing up for a currency trading system that says it will turn $10,000 into $100,000 in a year. The service says you have to try it out for 90 days before canceling and he’s worried that that’s just to avoid chargebacks. John should probably be worried about some bigger stuff than just a chargeback. [More]

Best Credit Cards To Get Now

After a nearly apocalyptic pull-back in the credit card market, with credit lines slashed to the quick and new credit being denied, banks have decided to let a trickle flow out again. To entice the cream of the credit score crop, they’re dangling a new batch of incentives. Via the Richmond Times-Dispatch, here’s some of the best deals out there right now on credit cards: [More]

ID Theft: Fix Some Fraudulent Accounts Before Correcting Legit Ones

One of the side effects of someone using your identity to open up a bunch of accounts and leaving you saddled with the bills is that your credit history gets trashed, which means you get victimized a second time over as your real creditors jack up your interest rates and take other adverse action. Your bank account could even get frozen, making you late on some bills. But before you go plead your case to get your credit restored with them, you’ll want to fix some of the fraudulent accounts first. [More]

Best Buy Employee: Pressure To Cram Credit Cards Down Customers’ Throats Now Intensifying

The next time you’re shopping at Best Buy, try not to get too angry when employees attempt to cram store credit cards down your throat. They’re not personally out to scam you, or hawking cards to line their pockets. They’re just trying not to get written up, reprimanded, or fired. A very insightful tipster who works at a Best Buy somewhere in the United States shared with us the impossible credit application quotas now in place. Update: The tipster reports that Best Buy management has backed down on this particular threat. Hurray! [More]

Amex Settles Case Alleging They Advertised BOGO, But Charged Double

How’s this for a bad deal? American Express Publishing Corp. had an offer for a “free” airline ticket when you bought a companion ticket and a subscription to Skyguide magazine. But a lawsuit brought by five Californian counties says that when consumers went to the website to buy their ticket, they were often charged double what the ticket would have cost them if they bought the ticket straight from the airline. Get it? [More]

Here's A Cookie, America, For Paying Your Credit Cards Off And On Time

Good job, America. You are being most excellent at paying your credit card bills and paying them on time. LowCards reports that credit card default and late payment levels fell once again in April to their lowest since 2008. The reasons why are pretty obvious: [More]